German neobank N26’s new research suggests that people in the US saved on average $2,102 because of Covid-19.

Having polled 3,000 adults across the States, the challenger bank revealed that 2020 was set to be a big spending year for people across the nation.

In fact, 61% said that they had plans to spend money on big-ticket items such as buying a new car, paying off debt, going on a vacation abroad, or buying a new house.

Then the pandemic hit, causing 63% of respondents to cancel or postpone such spending.

Even though 39% of respondents lost money due to their cancelled plans, with the average losses amounting to $759, 71% actually saved money as a result. Moreover, those who held onto their money managed to save an average of $2,102.

“The pandemic has forced us to become more cautious with our money,” said Alex Weber, chief growth officer of N26. “We are seeing that people are developing new digital habits, especially with their finances, as our plans and lives have entirely changed.”

“Now more than ever, consumers need trust, flexibility and a safer experience as they adapt to these new financial changes. At N26, we’re dedicated to helping consumers become more financially confident and we are proud to offer a product that empowers people to live and bank their way.”

The news comes on the back of N26 being engaged in a conflict with some of its German employees. Several staff members have rebelled against the neobank’s leadership after saying that confidence in the top brass was at an all time low.

The employees has moved to form a works council, which they are entitled to under German law but that the leadership has opposed.

The co-founders Valentin Stalf and Maximilian Tayenthal sent an email to its staff saying that the works council would stand “against almost all values that we believe in at N26.”

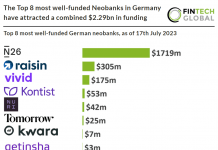

N26 has become one of Europe’s most valuable FinTech startups since its launch in 2013. The German challenger bank was valued at $3.5bn earlier this year after extending its Series D round with another $100m, with the raise now totalling $570m.

Copyright © 2020 FinTech Global