Neon Pagamentos, a Brazilian neobank, has closed its Series C round on $300m as it looks to build new features.

The investment was led by growth equity firm General Atlantic, with commitments also coming from accounts managed by BlackRock, Vulcan Capital, PayPal Ventures, Endeavor Catalyst and existing shareholders Monashees and Flourish Ventures.

BBVA also contributed to the round, participating via existing shareholder Propel Venture Partners.

This funding round is being split into two tranches if $150m.

Capital is earmarked for increasing hiring efforts, growing the Neon user base and enhancing the technology’s capabilities. Neon also plans to launch new products and features and pursue mergers and acquisitions.

Neon founder Pedro Conrade said, “Neon was born with a clear purpose: to provide an accessible bank account to any Brazilian, placing user experience at the centre of everything we do. Unlike banking incumbents in Brazil, we do not transfer the cost of inefficiency to our customers.”

The company believes the current pandemic has accelerated its growth trajectory, with more people looking to alternatives to in-person banking solutions. It has seen a 26% increase in new customers since March.

Founded in 2016, provides consumers with a digital savings account, credit cards, investment products and more.

Neon president Jean Sigrist said, “Brazilian banking penetration is relatively high for Latin America but still lags developed market peers, with a significant under-banked population that traditional banks have generally overlooked. Neon is focused specifically on providing access to this group and bringing them into the financial world.”

The FinTech previously raised $92m in its Series B last year from General Atlantic and Banco Votorantim. Its Series A closed in 2018 on $22m.

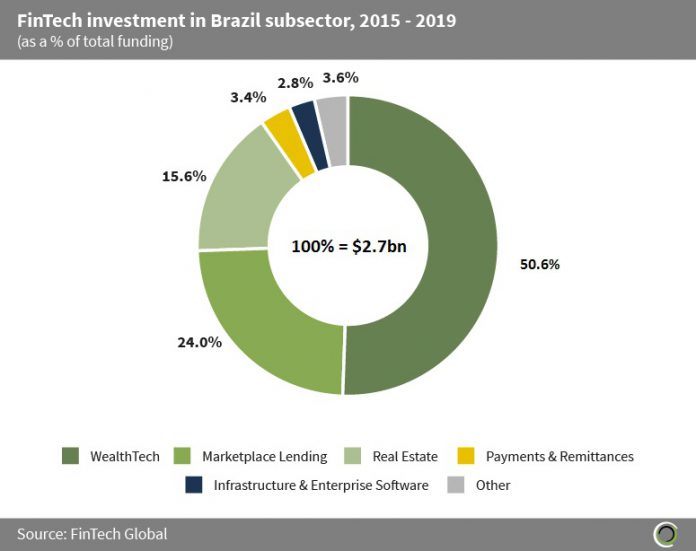

Between 2015 and 2019 a total of $2.7bn has been invested into Brazil’s FinTech sector, of which, 50.6% has gone to the WealthTech sector. The country’s WealthTech includes fellow challenger bank NuBank, which became a decacorn last year.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global