Klarna may soon arguably be named Europe’s most valuable privately held FinTech after news broke that the payment firm is in talks with investors to raise new funding that would push its valuation across the $10bn mark.

Reuters was first to break the story, having spoken to three sources, and said that the funds would be used to fuel its expansion plans across the US.

If true, the new valuation would see Klarna almost double the $5.5bn valuation it achieved on the back of it raising a $460m round in August 2019.

Impressive as it might be, Klarna would still be worth less than its Australian rival Afterpay that has a market capitalisation of roughly $15bn.

The Swedish buy now, pay later company is said to be looking to raise about $500m from both new and old investors in a deal that could be officially announced as early as within the next few days.

The news could also put more weight behind the bullishness Sebastian Siemiatkowski (pictured), CEO and co-founder of Klarna, expressed in August when the unicorn revealed that the company’s losses had increased sevenfold in the first six months of 2020 compared to the same period last year.

Yet, despite the losses and the ongoing pandemic, Siemiatkowski said that the company was not only in a “strong” position but even hinted that the company may be planning to go public within the next “one or two years”.

Looking at the proposed aim of the new funds, to further expand into the States, it is clear that the venture has already made some ways to reach the goal.

In August, Klarna announced that its US branch had added one million new consumers to its books over the summer.

David Sykes, head of US at Klarna, said, “Our US network has grown to more than nine million consumers, we see an average of 20,000 new app downloads a day and thousands of retailers are partnering with us to implement forward-thinking strategies that will help them compete effectively, build lasting connections with consumers and provide the payment flexibility their consumers need during this time.”

Moreover, Klarna has been on a bit of shopping spree of late, having acquired UK-based e-commerce company Nuji in May and Italian payment company Moneymour in February to improve its underwriting capabilities.

Still, before the new funding round is made official, Klarna is still sharing the title of Europe’s most valuable FinTech with UK challenger bank Revolut and Checkout.com who both have secured $5.5bn valuations in the last year.

Klarna is part of the slow but steady FinTech awakening happening across the Nordics. Over the past few years we have reported about it becoming a breeding ground for challenger banks such as Lunar and indó, contactless payment solutions, and FinTech unicorns such as Bambora and iZettle.

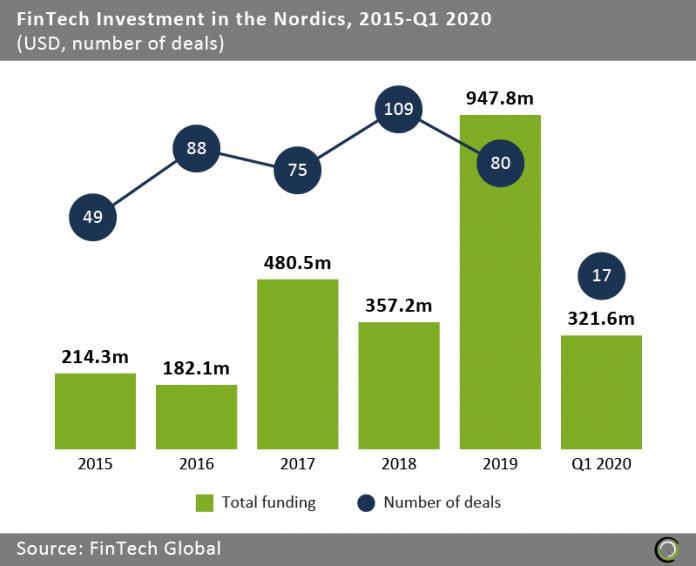

The region experienced remarkable growth in terms of investment between 2015 and the first quarter of 2019, often powered by innovation in Sweden. In 2015, the region’s FinTech ventures raised $214.3m across 49 rounds, according to FinTech Global’s data. By 2019, that number had risen to $947.8m across 80 deals.

The sector was seemingly on track for another record year in the first quarter of 2020, with the sector raising $321.6m across 17 deals. Like everything else in the industry, the future of the sector has been put in doubt due to the coronavirus.

However, if the rumours of Klarna’s potential new funding are true, then the Nordics could be heading for another record year.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global