Marco Financial, the financing platform built for small and medium-sized Latin American exporters, has bagged $26m in funding and credit.

The company will use the new cash influx to address the $1.5trn global trade finance gap that disproportionately impacts SMEs businesses.

The funding includes an equity round led by Struck Capital and Antler as well as a credit facility underwritten by Arcadia Funds.

“As a former owner of a small business in Latin America, I saw first-hand how SMEs in this region struggle to access trade financing that will let them export their goods while retaining enough capital to keep their business running,” said Peter D. Spradling, COO and co-founder of Marco.

“Access to trade finance is one of the greatest hurdles in business operations. The traditional system, dominated by banks, simply is not working any more. It disproportionately hurts SMEs, restricts economic mobility and stifles job creation in emerging markets.

“With equity funding and a material credit facility we can serve this disadvantaged market in Latin America and help build a healthier, more equitable trade ecosystem reflective of an increasingly borderless global economy.”

While SMEs account for 80% of the employment in developing countries, Marco said these exporters face massive financial hurdles due to long payment cycles. The gap between when goods are shipped by the exporter and when the buyer submits payment can last two to four months.

The FinTech has positioned itself to address this financing gap by providing fast and easy financing to Latin American SME exporters selling to US buyers with an innovative due diligence process that leverages real-time data to dynamically assess risk and mitigate capital loss.

The company boasts that its platform shortens the loan origination timeline from months to one-two weeks and provides funding to approved exporters within 24 hours.

“We look for companies that not only target massive, sleepy industries but also for ones that are led by management teams with fresh perspectives and asymmetric information that position them to upend incumbents,” said Yida Gao, partner at Struck Capital.

“In short order, Marco has assembled a world-class team to tackle the multi trillion-dollar trade finance market in a post-Covid time when SMEs around the world need, more than ever, reliable capital to fund operations and growth. We are excited to be part of Marco’s journey to support the suppliers that are the backbone of global trade.”

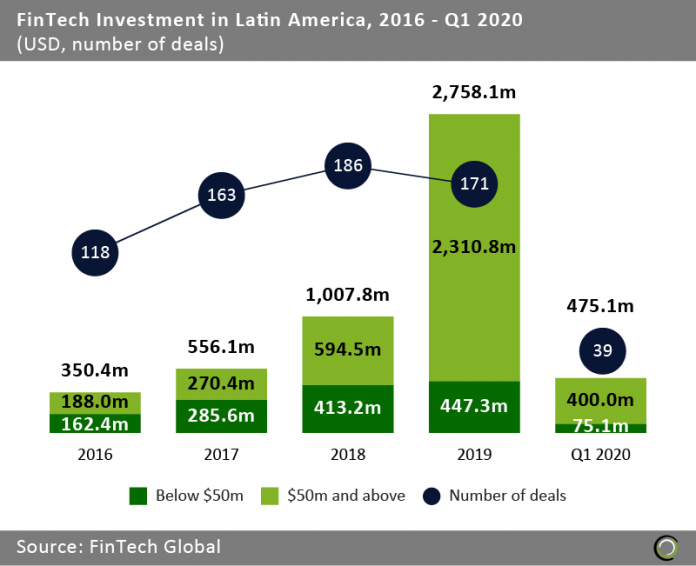

The news comes after a period of massive growth for the Latin American FinTech space. The ecosystem in the region experienced a massive jump, investment-wise, between 2016 and 2019, according to FinTech Global’s research.

Between those years, the total capital invested grew at a compound annual growth rate of 98.9% from $350.4m in 2016 to over $2.7bn at the end of last year.

At the start of 2020 the Latin American region’s FinTech companies raised a total of $475.1m between January and March.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global