Retirement planning company Lendtable recently announced it was looking to build a solution that improves savings and investment and after just three months, it has witnessed strong growth.

The FinTech has also secured $3.5m in a seed funding round to support its continued development.

In the past three months, it has helped clients save more than $100,000 for their retirement, graduated from the Summer 2020 Class of Y Combinator, identified key products it will begin adding to the platform and launched its blog.

It also built its first web servicing experience that lets it collect customer information from the start to finish without having to call them.

Lendtable chose to raise a seed round so that it can continue this momentum and create more products for its platform.

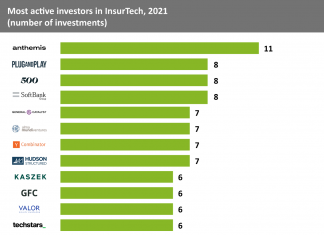

The seed capital was supplied by investment firms Y Combinator, Valor Equity Partners, SoftBank Group, Streamlined Ventures, Valia Ventures, Socii Capital, Partech Ventures and Green Visor Capital. A list of angel investors also contributed to the round, including Impossible Foods president Dennis Woodside, former Venmo COO Michael Vaughan, DoNotPay founder and CEO Joshua Browder, and others.

With their support, the FinTech is hoping to bolster its marketing, branding, operations and product efforts.

The core focus with this extra cash is growing the user base, building partnerships with employers, advisors and businesses, as well as increasing the size of the team.

Lendtable founder Mitchell Jones said, “While there is a ton more product work required to make Lendtable’s vision a reality, we have set up a strong foundation by removing the barriers for users to sign up and diversifying customer payment channels to create a seamless experience.”

Lendtable is aimed at helping employees increase the amount of money they can put in their 401(k). The FinTech claims that each year around $25bn in employer 401(k) matches are left on the table, typically because employees cannot afford to save and pay daily expenses.

This is where Lendtable helps, by supplying them with funds to receive their full 401(k) match from their employer.

Lendtable Cash provides employees with cash advances so they can pay for daily expenses and save money each month.

Copyright © 2020 FinTech Global