Last week proved to be good week in terms of FinTech investment, with the rounds revealing the state of CyberTech and InsurTech.

In a week that saw crowdfunding platforms Crowdcube and Seedrs announce their upcoming merger, Revolut and Starling Bank announce new products, and Root Insurance follow in Lemonade’s footsteps and filing for an IPO, it would be easy to forget that we also recorded the close of 34 deals in the FinTech space.

However, neglecting to take a closer look at these deals would be a mistake as they offer insights about the FinTech sector. For instance, the £7m investment enjoyed by Hometree and DeadHappy’s £2.4m crowdfunding round may not look like much unless you take a step back.

These companies celebrated their cash injections during an eventful week for the sector. Not only did Root Insurance file to go public, but The Zebra also announced that it has become profitable after achieving a run rate of $100m. These news combined with Hippo joining the unicorn club and Lemonade’s IPO this summer all account for the good news in the InsurTech sector.

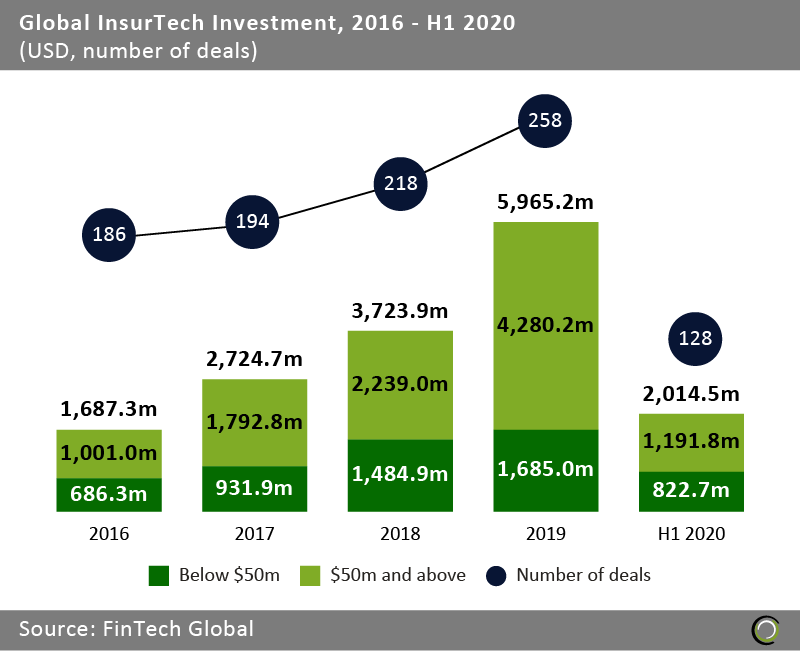

Yet, the Covid-19 pandemic has taken its toll on this segment of the FinTech sector as well. Looking at the investment injected into the InsurTech industry, FinTech Global’s research shows that investment dropped by 13.3% in the first half of 2020 compared to the same period in 2019. Although, at the same time there was a 5.4% increase in the number of deals compared to the same period last year. The InsurTech industry raised $2.01bn across 128 deals in the first six months of 2020. Comparitively, there were 258 deals totalling $5.96bn in 2019.

Last week was also a big week for the cybersecurity sector. Onapsis, LogPoint, Illusive Networks, Eclypsium, NormShield, IriusRisk and Cyvatar all raised rounds last week.

Last week was also a big week for the cybersecurity sector. Onapsis, LogPoint, Illusive Networks, Eclypsium, NormShield, IriusRisk and Cyvatar all raised rounds last week.

The deals from last week also highlights the continuing importance of cybersecurity companies during the coronavirus health crisis. As we have reported in the past,

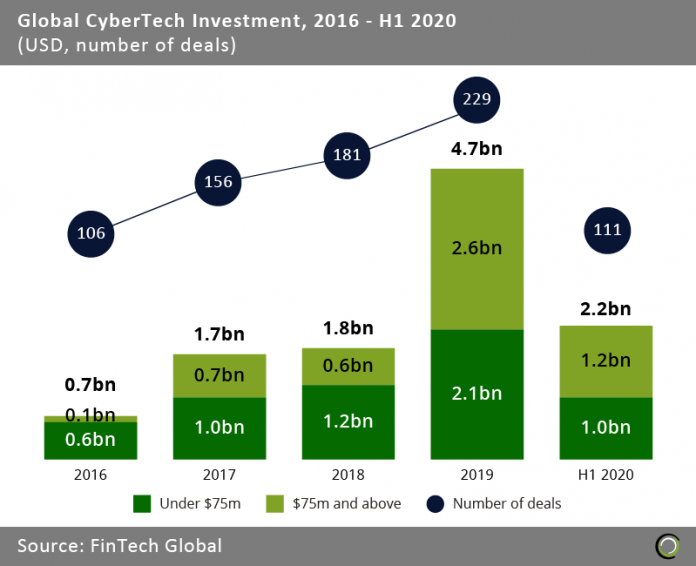

However, investment into CyberTech ventures cooled down in the first half of 2020, according to FinTech Global’s research. In total, the ventures in the sector raised $2.2bn between January and June, which is not even half of the $4.7bn injected into the industry in 2019. Moreover, we saw the sector only raise $700m in the second quarter, representing a 60% decline from the first three months of 2020.

Curious about why that was the case, despite the pandemic having shown the importance of cybersecurity, we asked experts in the market why that was.

Curious about why that was the case, despite the pandemic having shown the importance of cybersecurity, we asked experts in the market why that was.

For instance, E.J. Yerzak, director of cyber IT services at at Compliance Solutions Strategies (CSS), the RegTech company, suggested that the slowdown was natural given that companies are tightening their budgets and that they have already invested in cost-efficient solutions. He did, however, warn that businesses should not grow complacent as the cybersecurity risks have been growing.

Miles Busby, CRO at IDmission, the biometric and authentication software company, also suggested that “the investment world, particularly private equity, is looking at a more long term impact a vendor can have on an industry and not what is clearly going to be a short term issue.”

“In addition to their outlook they are also going to take into consideration how crowded the space [is],” he said. “As an example there are hundred of players in the identity space that have a hug head start in this market and the investment community may not see enough of a market mover to invest.”

If you’re interested in learning more about the state of the cybersecurity industry, make sure you pick up a free ticket for our CyberTech Forum on December 1 and 2.

With all that taken care of, let’s take a closer look at the 34 rounds we reported on last week.

Tipalti has raised $280m in a new funding round

Global payables automation company Tipalti accounted for the biggest raise last week, which saw it achieve a $2bn valuation. The new capital injection saw Tipalti add $280m to its coffers. Durable Capital Partners led the investment. Greenoaks Capital and 01 Advisors also contributed to the raise.

With the fresh capital secured, Tipalti is focused on accelerating its growth plans and bolster its international presence. Funds will also be used to increase the penetration of its services around the world. To support these growth plans, the company is hiring more staff across its developer, product management, customer operations, sales and business development teams.

October raises €258m in funding

Business loan provider October has successfully raised €258m. It will use the money to strengthen its capacity to provide financing options and to improve three of its lending products.

The first will see it offer an additional €20m for its classic loans to SMEs across Europe.

The second will see October put €38m aside to support French companies operating within the tourism sector. Through these differed repayment loans, October hopes to support the reopening of the hotel and catering industry as well as other tourism companies.

The third will see €200m used for state guaranteed loans for Italian SMEs. The capital for these loans were supplied by Gruppo Intesa Sanpaolo.

Unqork increases its valuation to $2bn after the close of $207m Series C

Unqork has added its name to the ever-growing list of unicorns by closing a $207m Series C round that increased its valuation to $2bn. The round was led by BlackRock. Additional support came from Eldridge, Fin Venture Capital, Hewlett Packard Enterprise, Schonfeld Strategic Advisors and Sunley House Capital Management.

A number of existing Unqork backers Alphabet’s independent growth fund CapitalG, Goldman Sachs, Broadridge Financial Solutions, Aquiline Technology Growth and World Innovation Lab also joined the round.

Onapsis nets $55m in Series D to support its product development

Having already mentioned Onapsis above, let’s dig down a bit more in the details of its raise.

The mission-critical application cybersecurity and compliance platform netted $55m in its Series D round. Canadian pension plan firm Caisse de dépôt et placement du Québec and fellow cybersecurity platform NightDragon served as the lead investor. Existing backers .406 Ventures, LLR Partners and Arsenal Venture Partners also contributed to the round.

Onapsis earmarked some of the money to fuel the expansion of the digital defence platform and to keep developing its protection and compliance tools for Salesforce and SuccessFactors applications.

Chargebee nets $55m in its Series F

Chargebee, a subscription billing and revenue solution, has scored $55m in its Series F round. The investment was led by Insight Partners, with commitments coming from previous backers. It did not name the return investors. This funding round comes off the back of a surge in usage for its platform, which has been caused by startups and enterprises increasing their usage of subscription services.

Fligoo said to close $40m in its funding round

Data and analytics platform for banks Fligoo has reportedly secured $40m in a funding round. 4P Investments and Suquet Capital Partners backed Fligoo in the raise. Based in Argentina, the Latin American FinTech is using the capital injection to help it to enter the Brazilian market and scale its operations.

PayCargo secures $35m in funding round

Payments network for the global supply chain industry PayCargo has netted $35m in funding to capitalise on the growing demand of digital payments cause by the pandemic. Private equity firm Insight Partners served as the lead investor of the round. Capital from the investment will support the global adoption of its payments network and increase the development of its capabilities.

LogPoint closes a $30m Series B round

Danish cybersecurity startup LogPoint has reportedly collected $30m for its Series B, which will support the company’s next growth phase. Digital + Partners acted as the lead investors. Previous LogPoint backers Evolution Equity Partners and Dico also supported the round. LogPoint will use the cash to enter new markets and further the development of its platform.

Illusive Networks bags $24m Series B1 round

Cybersecurity company Illusive Networks has closed a new $24m Series B1 round. Investment capital was supplied by Spring Lake Equity Partners, Marker, New Enterprise Associates, Bessemer Venture Partners, Innovation Endeavors, Cisco, Microsoft, Citi and other unnamed backers. Capital from the round will be used to accelerate the company’s next growth phase, which includes an aggressive go-to-market strategy that focuses on sales and marketing. Funds will also be used for product enhancements.

ClickSWITCH secures $21m in its Series B-2 round

FinTech ClickSWITCH has secured $21m in a Series B-2 funding round. The money will enable the company to grow its team and to further the development of its technology. ClicksSWITCH is set up to help financial institutions to onboard customers quickly by letting customers switch their direct deposits and automatic payments to new accounts through a simple click process. The capital was supplied by a subsidiary of USAA, a provider of insurance, banking and retirement services for military members and their families.

Knoma raises £21m to help more people access education

While Seedrs’ upcoming merger stole a lot of the headlines this week, the crowdfunding platform also contributed to Knoma’s £21m raise. The UK-based education loan platform also enjoyed a capital boost from Global Founders Capital, Rocket Internet and Fasanara Capital. Contributions also came from angel backers including LendInvest’s chairman Christian Faes.

AccessFintech secures $20m in its funding round

Data and analytics platform AccessFintech has closed a $20m funding round. The investment was led by Dawn Capital. J.P. Morgan, Citi, Goldman Sachs and Deutsche Bank also contributed to the raise. AccessFintech will use the money to accelerate its product innovation, continue market expansion and extend its partner network.

Uni netted $18.5m in funding round

Credit company Uni has reportedly raised $18.5m in a funding round. The company, which was created by PayU India founder Nitin Gupta, received the investment funds from Lightspeed India Partners and Accel. Once it comes out of stealth, the company will be targeting the under-penetrated credit cards market in India by making them more accessible across India.

Eclypsium has secured $13m in a new funding round

Device security company Eclypsium has received $13m in an oversubscribed funding round, coming after a 2,000% increase to its annual recurring revenue. The round was supported by first time Eclypsium backers AV8 Ventures, TransLink Capital, Mindset Ventures, Alumni Ventures Group, and Ridgeline Partners. Previous investors Intel Capital, Madrona Venture Group, Andreessen Horowitz and Ubiquity Ventures also joined the round.

Bloom Credit has raised a $13m Series A round

FinTech Bloom Credit has bagged $13m in a Series A funding round led by Allegis NL. The round was also supported by Resolute Ventures, Slow Ventures and Commerce Ventures. Of the money raised, $3m was part of a previously undisclosed angel round. Bloom Credit will use the money to hire more people and to strengthen its leadership team.

Capify closes a £8m round

Capify, an SME lending platform, has closed an equity round on £8m from Goldman Sachs Merchant Banking through existing credit facilities. Founded in 2008, the UK-based company offers a variety of business loans starting from £5,000.

NormShield ends Series A round on $7.5m

NormShield, a cyber risk rating company, has finalised its Series A round on $7.5m to bolster its go-to-market strategy. Moore Strategic Ventures, a New York-based investment firm, served as the lead investor to the round. Previous NormShield backers Glasswing Ventures and Data Point Capital also contributed to the round.

The capital will be used to extend the RegTech’s go-to-market capabilities and accelerate the development of its technology platform.

Hometree bags £7m in round led by Anthemis

London-based InsurTech startup Hometree has collected £7m in a funding round designed to allow it to capitalise on skyrocketing demand amid Covid-19. Investment firm Anthemis led the round that also enjoyed cash injections from existing investors DN Capital and Literacy Capital. Gumtree founder Michael Pennington, several unnamed existing shareholders and Silicon Valley Bank also participated in the round.

IriusRisk scores $6.7m in funding

Threat modelling platform IriusRisk has bagged $6.7m in a Series A round led by Paladin Capital Group, a global cybersecurity-focused investor. Additional support coming from 360 Capital Partners and previous IriusRisk backers Swanlaab, JME Ventures and Sonae Investment Management. IrusRisk will use the money to support its product roadmap and nurture the RegTech’s global growth by deepening its sales and marketing teams.

CreditWise Capital bags $6m in funding round

Online lending platform CreditWise Capital has reportedly netted $6m in a funding round from angel investors and family offices. Investors included Venture Catalysts founder Anuj Golecha, M J Shah Group chairman Mayank Shah and Shanti Group director Anup Agarwal.

Funds from the round will be used to increase the company’s dealer network, increase geographical expansion and improve its collection and underwriting models.

Strike Graph scores $3.9m in its funding

Compliance automation startup Strike Graph has netted $3.9m in its seed round. Madrona Venture Group led the investment, with contributions also coming from Amplify.LA, Revolution’s Rise of the Rest Seed Fund and Green D Ventures. The RegTech company was founded by Justin Beals and Brian Bero in partnership with Madrona Venture Labs to help eliminate confusion around cybersecurity audit and certification processes.

Lendtable closes $3.5m seed round

Lendtable has secured $3.5m in a seed funding round to support its continued development. In the past three months, the FinTech has helped clients save more than $100,000 for their retirement, graduated from the Summer 2020 Class of Y Combinator and identified key products it will begin adding to the platform.

Covalent said to raise $3.1m in funding

Blockchain startup Covalent has reportedly raised $3.1m in its latest funding round. The company aims to bring transparency to blockchain. Woodstock Fund, 1kx Capital and Mechanism Capital all co-led the investment, according to a report from The Block. Other backers to the round included CoinGecko, Alameda Research and other unnamed backers. With the support of the funding, Covalent hopes to expand its reach to support other industries where data is being locked away.

Cybersecurity platform Cyvatar closes $3m seed round

Cybersecurity company Cyvatar has closed a $3m seed round, which will be used to support t he launch of its all-in-one cybersecurity-as-a-service platform. Bill Wood Ventures, an investment firm focused on the technology space, led the investment.

DeadHappy closes £2.4m crowdfunding round

DeadHappy, a digital-first life insurance platform, has exceeded the £1.5m target for its crowdfunding campaign by raising £2.4m from 1,014 investors on the Seedrs platform. The DeathTech company is set up to transform attitudes towards death by getting people to think, talk and plan for when someone inevitably dies. Consumers can access a pay-as-you-go life insurance policy with a rolling ten-year guarantee.

a55 has raised $2m

Latin American financial management platform a55 has closed a $2m investment from E3 Negócios to grow the size of its team. The company will use the funds to grow its team from 60 to 100 by the end of the year. a55 provides businesses in Mexico and Brazil with a financial management platform that helps them grow their sales. Its platform leverages data to track receivables, generate insights on customer behaviour and access credit.

RootAnt closed $1.46m seed round

Last week we reported that Singapore-based RootAnt had closed a $1.46m seed round. The FinTech is a developer of banking-as-a-service technology. Linear Capital led the round, which was supported by KZM & Company. Funds from this investment will be used to support the expansion of the platform in Singapore, as well as other parts of Southeast Asia and Japan. The company also plans to increase the research and development of its technology stack and its multi-tier financing service.

goPeer picks up $25,000 in prize money

FinTech goPeer has added $25,000 to its coffers after winning the top prize in York University’s LaunchYU Accelerator programme this year. The company provides non-traditional loans available through a peer-to-peer network. The starup claims to be Canada’s first consumer peer-to-peer lending platform, which connects creditworthy individuals looking to invest with those in need of a loan.

Macy’s invests in European FinTech decacorn Klarna

Just a few weeks after Klarna was named Europe’s most valuable FinTech company on the back of a $650m round, the Swedish decacorn has now received new investment from Macy’s. While neither of the parties divulged just how much the American department store would inject into Klarna, the deal will enable Macy’s to tap into the company’s buy now, pay later technology. The partnership will last for five years.

Payrix has extended its Series A round

Payrix has closed an extension of its Series A round to support the growth of its team. The round was led by Blue Star Innovation Partners and Providence Strategic Growth. Payrix enables SaaS companies to embed payments.

IQvestment taps B. Riley Financial for new investment

E-commerce FinTech IQvestment Holdings has picked up an investment from B. Riley Financial, a financial services company. IQvestment Holdings has developed a business-to-business e-commerce platform solution. It is also an SEC-registered investment advisor for sub-advised accounts and retail investors.

DeFiner has raised a new investment round

Decentralised finance network DeFiner has received an investment from SNZ Holding, a crypto fund created by a group of blockchain evangelists. The deal will see DeFiner leverage the SNZ expertise and support to refine its protocols on its non-custodial digital asset platform.

BanQu closes funding round

Fresh out of Highline Beta’s inaugural 100+ Sustainability Accelerator, BanQu has now picked up investment from AB InBev. BanQu is a software company leveraging non-cryptocurrency blockchain technology to help unbanked populations in developing countries build financial identities. The startup is said to provide complete supply chain transparency to global brands, with a focus on the people traditionally cut off from banking systems, like small-scale farmers, which AB InBev works with across the globe.

Origin raises Series A round

London-based FinTech Origin has raised a Series A round from Deutsche Börse Group’s post-trade services provider Clearstream and the Luxembourg Stock Exchange. The Luxembourg Stock Exchange had previously acquired an initial stake in the company in 2019.

Copyright © 2020 FinTech Global