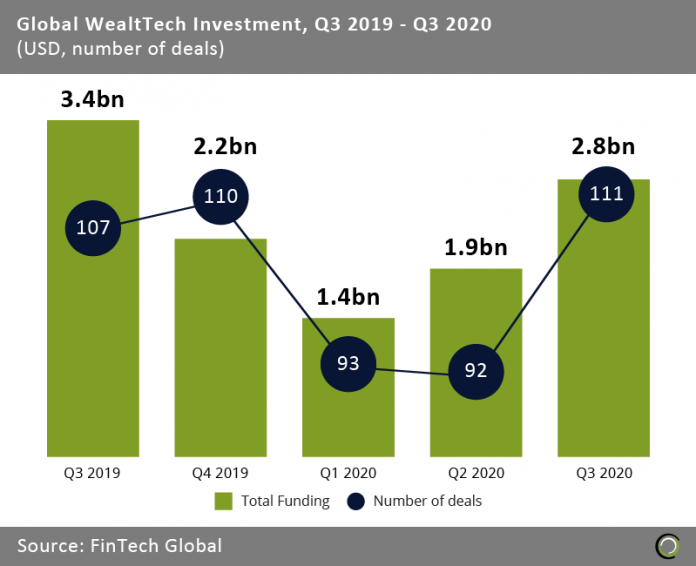

WealthTech companies raised $2.8bn in the third quarter of 2020 across 111 transactions, a five-quarter high for deal activity

- Global WealthTech funding had a slow start to 2020 as rising concerns about the economy caused by Covid-19 and huge losses at leading challenger banks such as Monzo, Revolut and Starling deterred investors. Only $3.3bn was invested in H1 2020, a 41% decline compared to the capital raised in the preceding two quarters.

- However, the sector rebounded strongly in the third quarter with $2.8bn invested. The funding was driven by seven large deals over $100m, including three rounds totalling $980m raised by Robinhood, a commission-free investing platform.

- While funding levels were driven by a small number of extremely large deals, the healthy recovery was supported by strong deal activity levels which increased over 20% QoQ to reach 111 transaction

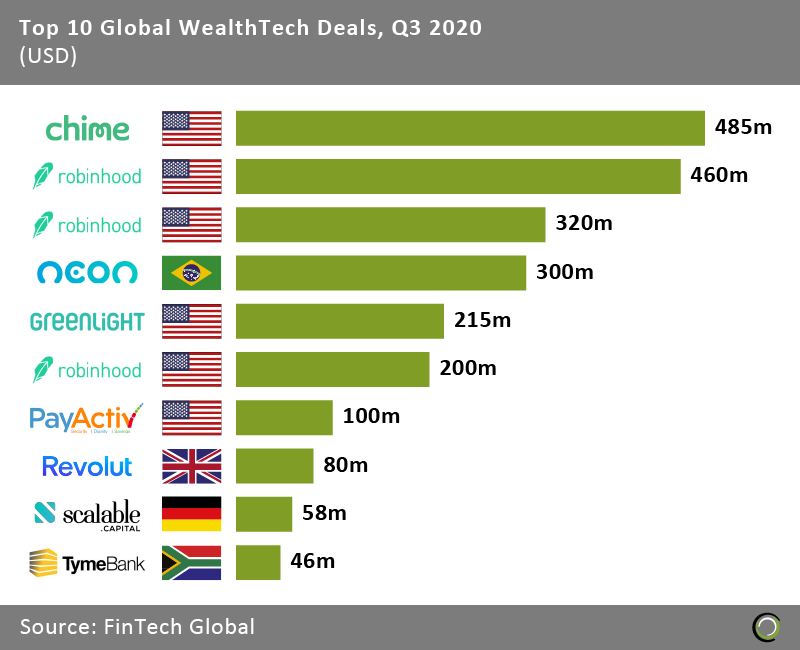

The top 10 WealthTech deals in Q3 2020 raised nearly $2.3bn

- The top ten WealthTech deals in the third quarter of the year collectively raised $2.26bn, making up 80.4% of the overall investment in the sector during the period. As mentioned previously Robinhood completed three deals on the list with the company closing a $320m extension of its Series F round in July, before raising a combined $660m Series G across two rounds in August and September. The company has seen an influx of new users given the market volatility earlier this year with average unique daily visits on its learning tools up by more than 250% since January.

- The largest round of the quarter was completed by Chime, a US-based challenger bank, which raised a $485m Series F round which saw the company become the US’ most valuable consumer-focused FinTech with a valuation of $14.5bn. The company has seen strong growth of its platform, which has seen it triple its transaction volume and revenue this year as coronavirus has pushed consumers to look for digital banking solutions.

- Two challenger banks in developing countries also made the list with Brazil-based Neon and South African TymeBank raising large rounds. TymeBank received $46m cash injection from African Rainbow Capital as it experienced a drop in footfall to its kiosks under national lockdown. With restrictions easing the bank is now signing up between 3,000 and 3,500 customers per day, with about half of the customers actively using its bank accounts

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global