These 33 FinTech funding rounds from last week highlight the rise of Scandi challenger banks, the importance of cybersecurity and how competition in the buy now, pay later space is heating up.

Another week, another 33 FinTech funding rounds reported on. And let us tell you, they give us plenty of things to reflect upon in terms of where the industry is heading.

From the rise of Nordic FinTech to the growing need form businesses to up their digital defences, there’s a plethora of things to get into. But first, let’s talk about how one raise highlights the growing number of rivals aiming to take a slice out of the most valuable FinTech in Europe’s market share, shall we.

Jon Snow may have been the King of the North in Games of Thrones, but when it comes to FinTech, Klarna is the true champion of the Nordics. In fact, the buy now, pay later company can claim the title of being Europe’s most valuable privately owned FinTech company after it secured a $10.65bn valuation last month.

However, one of the rounds over the past seven days highlights that Klarna may have some competition for the crown coming along. Danish neobank Lunar raised a €40m Series C round last week, part of which will be used to fund the challenger bank’s new instalments offering.

The new service is designed to help customers split their payments across several instalments without needing merchant agreements. The new buy now, pay later service is said to be working across both the retail and e-commerce space.

What makes this move particularly interesting is that Lunar is not the only company to have launched new instalments services or raised funding. In other words, it seems as if the instalments industry is heating up.

In the past few months, PayPal has launched its iteration of the service in the US and in the UK and Curve has announced that it had teamed up with Thought Machine to have it power its aforementioned instalments startup Curve Credit, both of which are said to be competing with Klarna and Australian AfterPay. Moreover Split and Tabby, two other companies in the sector, secured fresh cash injections over the summer.

Lunar’s raise is also interesting for another reason – it highlights the rise of the challenger banking sector in the Nordics. The region has been slightly slower to dive into the sector than the UK, which has heavyweights like Revolut and Starling Bank, or the Netherlands that has bunq. But this is changing. Not only is Lunar growing tremendously, but are its counterparts in Iceland and Sweden. Iceland has indó and Sweden has Northmill.

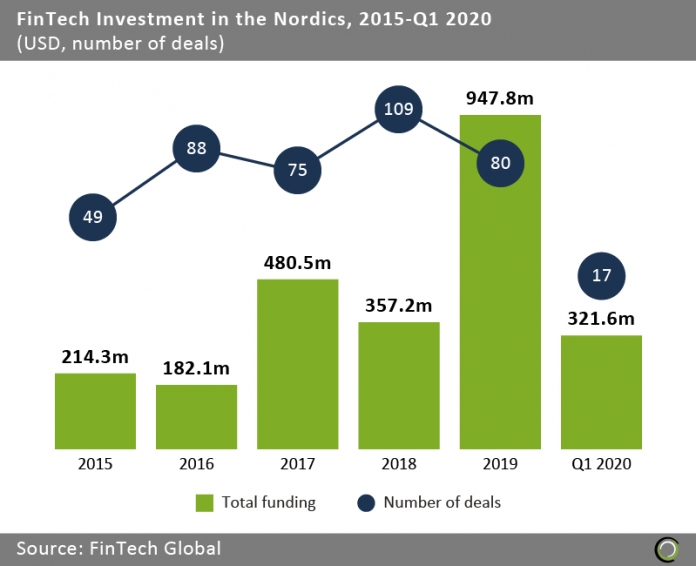

Looking at the FinTech in the Nordics in general, one can note that the rise of neobanks have conicided with a spike in funding into the industry over the past few years. In 2015 the industry in the Nordics raised $214.3m across 49 deals, according to FinTech Global’s research. That number skyrocketed over the next four years. In 2019, the region’s FinTech companies had secured $947.8m in funding across 80 rounds.

Until the coronavirus caused chaos in the markets, it seemed as if the region would continue to enjoy this upward trajectory. In the first quarter of 2020, Nordic FinTechs raised $321.6m across 17 deals. How exactly the Covid-19 crisis will continue to impact the sector is anyone’s guess. But given Lunar’s raise as well as Swedish FinTech Lendify’s $115m cash injection last week, there may cause to be optimistic.

Until the coronavirus caused chaos in the markets, it seemed as if the region would continue to enjoy this upward trajectory. In the first quarter of 2020, Nordic FinTechs raised $321.6m across 17 deals. How exactly the Covid-19 crisis will continue to impact the sector is anyone’s guess. But given Lunar’s raise as well as Swedish FinTech Lendify’s $115m cash injection last week, there may cause to be optimistic.

Speaking of the coronavirus impact on different segments of the market, one part of the RegTech industry has seemingly benefited from it – cybersecurity. Last week’s biggest round was raised by Arctic Wolf, a cybersecurity company. It added an impressive $200m to its coffers via a Series E round. Cybersecurity companies 4iQ and Security On-Demand also raised capital last week.

This is hardly surprising given how the pandemic has raised the demand for digital defences. Part of the reason for this is that cyber criminals have tried to leverage the health crisis to their benefit. Ever since the pandemic broke out, they’ve been busy unleashing waves of ransomware attacks, phishing schemes, financial frauds and other scams. No wonder that the cost of security breaches has also gone up since the coronavirus outbreak.

Given the rise in hack attacks and a huge number of employees still working from their kitchen tables, it’s hardly surprising that the pandemic has pushed companies and governments to rethink their cybersecurity strategies.

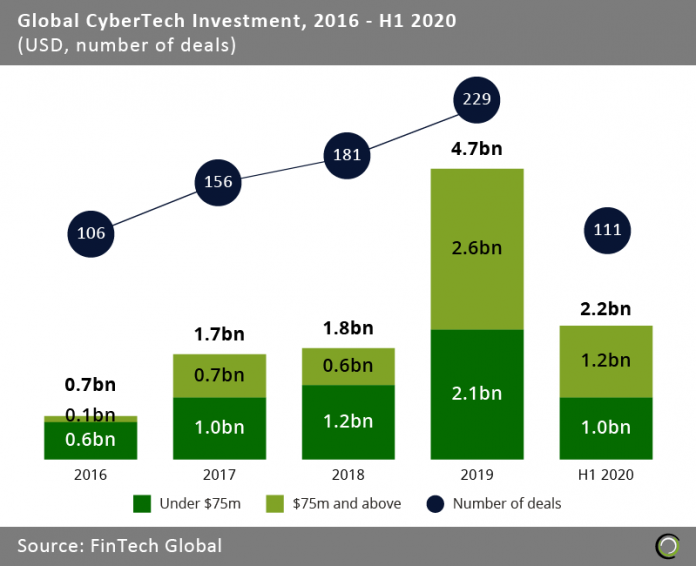

However, investment into CyberTechs cooled down in the first half of 2020. In that period the sector only raised $2.2bn, not even half of the $4.7bn raised in 2019. Although, it is still more than the $1.8bn raised in 2018, according to FinTech Global’s research.

With that in mind, let’s take a closer look at the 33 investment rounds raised last week.

With that in mind, let’s take a closer look at the 33 investment rounds raised last week.

Arctic Wolf joins the unicorn club after closing $200m Series E

Cybersecurity company Arctic Wolf joined the unicorn club last week after raising 200m in a Series E round. The invest put its valuation at $1.3bn. Viking Global Investors acted as the lead investor for the round, with additional support coming from DTCP. Other unnamed investors also participated in the raise. Arctic Wolf will use the capital to accelerate the introduction of a new security operations offering, enter new markets and boost its position in the market. Arctic Wolf offers security operations as a concierge service. Its platform acts as an extension of a client’s internal security team and supplies them with tailored threat detection and response, as well as ongoing risk management.

Lendify closes $115m deal

Digital lending platform Lendify has reportedly closed a $115m investment to fuel its European expansion. Global asset management firm Insight Investment supplied the capital, having pushed $170m into Lendify’s coffers in 2019. Sweden-based Lendify is a P2P lender providing digital loans from $2,278 to $56,966. Those wishing to increase their savings can use Lendify to invest into loans, with the FinTech automatically allocating the user’s capital across several loans.

Possible receives $91m in a mixture of debt and equity

Possible has secured $91m in funding. The mobile platform is set up with the stated goal of boosting financial fairness and netted the significant funding in two stages. First it closed an $11m Series B round led by Union Square Ventures. Other backers, such as Canvas Ventures, Unlock Venture Partners, Columbia Pacific Advisors, Union Bay Partners, Tom Williams and FJ Labs also participated in the raise. The second part of the meaty investment consisted of $80m in debt financing from Park City Advisors. Both those two money streams will reportedly be put to the same goals: expanding the company’s team and reaching more customer feeling the burn of the Covid-19 pandemic.

Hyperscience raises $80m in Series D round

Automation software developer Hyperscience has closed a massive $80m Series D round. Tiger Global led the round. BOND, Bessemer Venture Partners and all of Hyperscience’s existing major investors also made considerable cash injections into the venture. The investment comes hot off the heels of the FinTech’s Series C round, which closed on $60m in June 2020. This funding surge has been supported by a three-times year-over-year revenue growth. Just like most other FinTech firms frequently featured on these weekly lists, Hyperscience will use the cash injection to fund further developments of its technology. It will also empower the FinTech to advance its partner and channel ecosystem.

Snapdocs collects $60m in its Series C

Digital mortgage solution Snapdocs has closed its Series C round on $60m to continue its strong growth period. The investment was led by YC Continuity, with previous backers Sequoia Capital, F-Prime Capital and Founders Fund also joined to the round. First time investors Lachy Groom and DocuSign also backed the FinTech startup.

Funds from this round will be used to capitalise on the growth momentum of the company by driving innovation and scaling operations. The company offers a cloud-based suite of products that enables people to simplify the closing of the mortgage process. Its solution allows lenders, settlement agents, title companies, borrowers, notaries and others to connect online and close deals.

Fivestars closes $52.5m Series D round

Last week we reported that payment processing platform Fivestars had netted $52.5m in its Series D round. The round comprised of both debt and equity. Salt Partners led the round. Lightspeed Venture Partners, DCM Partners, Menlo Ventures and HarbourVest Partners also chipped in on the raise. Having topped up its treasure chest, Fivestars hopes to accelerate the development of its technology and strengthen its marketing endeavours.

FundThrough bags $50m investment from private equity firm

Cash flow optimisation company FundThrough is bullish about its ability to support more customers in North America after it secured a $50m cash injection from private equity firm Northleaf Capital Partners. FundThrough will also use the funds to solve cash flow challenges that will be created after government funding programmes come to an end, it said.

Lunar raises €40m Series C round

As noted above, Danish challenger bank Lunar added another €40m to its coffers on the back of a Series C round last week. Having already discussed how it will use the money to take a bite out of the buy now, pay later market earlier, lets just give you a quick overview of the Danish lender’s funding so far. Lunar’s latest cash injection comes just months after Lunar extended its Series B round by another €20m. The FinTech originally raised €26m in its Series B round in August 2019. Last year also saw it getting a European banking licence from the Danish Financial Supervisory Authority, cementing its pivot from being a financial management app to joining the ranks of digital banks. Lunar had previously raised €4.2m in 2016.

4iQ closes $30m Series C round

Cyber intelligence startup 4iQ has bagged $30m in its Series C round and named its new CEO to support its growth plans. The investment was led by ForgePoint Capital and Benhamou Global Ventures, with additional support coming from C5 Capital, Adara Ventures and TheVentureCity.

In tandem with the fund close, 4iQ has named Kailash Ambwani, the former CEO of data cataloguing solution Waterline Data, as its new CEO. Ambwani will help 4iQ to increase its go-to-market strategies and bolster the innovation of the product.

Matic scores $24m investment

Digital insurance agency Matic has closed its latest investment round on $24m to support a wave of partnerships and integrations with carriers and distribution partners in emerging channels and verticals. This investment was led by IA Capital, a New York-based venture capital firm. Other backers include Cultivation Capital, Clocktower Technology Ventures, MTech Capital, The K Fund, Protection America, Nationwide Ventures, Anthemis Group, ManchesterStory, Franklin Madison and Fenway Summer.

ShopUp collects $22.5m in new funding

Dhaka-headquartered ShopUp has raised $22.5m in what could be the biggest Series A funding round ever in India. Sequoia Capital India and Flourish Ventures co-led the raise that also enjoyed participation from Veon Ventures, Speedinvest and Lonsdale Capital. ShopUp will use the new cash injection to fund its vision of digitising the country’s mum-and-pop stores with the help of its business-to-business commerce platform.

Finlocker bags $20m in Series A-1

Credit score company TransUnion has made a $20m Series A-1 investment into personal finance app FinLocker, alongside the establishment of a new commercial partnership agreement. The deal will enable consumers to collect and permission their financial information needed to secure a mortgage or other loans. Consumers can receive a loan decision much quicker and easier. Users can explore educational resources on the platform to help them prepare for the mortgage application process as well as use a personalised financial health dashboard.

Accelerated Payments said to receive €20m

Invoice financing solution Accelerated Payments has reportedly finalised a €20m debt line, which will more than double its lending capabilities. The capital was supplied by Chanel Equity Partners, a technology-focused debt and equity investor.

With this fresh funds, Accelerated Payments plans to provide more businesses with invoice financing, as well as help the FinTech grow across Europe. Accelerated also plans to provide additional funding to startups in Ireland and the UK, which are still struggling due to the Covid-19 pandemic.

Silent Eight doubles its valuation after the close of a $15m investment

Money laundering-fighting company Silent Eight has closed a funding round on $15m. The investment was led by OTB Ventures, with contributions also coming from Altara Ventures chairman and general partner Koh Boon Hwee and SC Ventures. Silent Eight did not disclose its valuation, but it claims it has doubled since its previous round which closed last year. The former round was a $6.2m investment from Wavemaker Partners, OTB Ventures and SC Ventures.

Zest AI closes $15m round

Credit underwriting software developer Zest AI has closed a $15m investment from Insight Partners. The capital was raised to support the adoption of Zest’s Model Management System for creating and deploying powerful, explainable and compliant AI-powered credit models. Zest AI also plans to use the funds to drive rigorous technology and standards around algorithmic fairness, with the aim of de-biasing the lending market.

Klar scores $15m in its Series A round

Mexico-based challenger bank Klar secured $15m on the back of a Series A funding round led by Prosus Ventures. Contributions also came from International Finance Corporation, Mouro Capital, aCrew and Quona Capital, which led the FinTech’s seed round, according to a report from Crowdfund Insider.

The FinTech hopes the funds will grow its engineering capabilities in its Berlin and Mexico offices, which will help it expand its product suite. Klar is a mobile banking platform that does not charge commissions and comes with a debit card that offers rewards when used. Users can earn up to 4% cashback when using their card and they can also access up to $5,000 in credit.

Lili nets $15m in a new investment round

Mobile banking platform for freelance workers Lili has secured a $15m investment, coming just a matter of months after its seed round. The fresh investment was led by Group 11, with participation also coming from Foundation Capital, AltaIR Capital, Primary Venture Partners, Torch Capital and Zeev Ventures.

Funds from this round will be used to support the expansion of the company, which includes expanding its product suite, hiring more engineers and accelerating customer adoption. The FinTech claims the freelance economy has seen a 700% increase in transaction volume sine the start of the coronavirus pandemic.

Unit21 closes its funding round on $13m

No-code risk and compliance solution Unit21 has closed a funding round on $13m to support the growth of its product. A.Capital Ventures led the round, with contributions also coming from Gradient Ventures, Core VC, South Park Commons, VMWare founder Diane Greene, Plaid founder William Hockey, Chime founders Chris Britt and Ryan King, Shape Security founder Sumit Agarwal, and former Venmo COO Michael Vaughan.

Funds from the investment will also enable Unit21 to grow its management team, bolster sales and marketing efforts and launch into new industries.

Alpaca closes $10m Series A round

Stock trading API company Alpaca has reportedly closed a $10m Series A round as it seeks to reach more enterprise customers. The investment was led by Portag3, with support also coming from Social Leverage, Spark Capital, Fathom Capital and Abstract Ventures. With the close of the round, Alpaca is looking to reach more customers and build more features for its suite of APIs.

Pulley nets $10m in Series A round

Employee financing company Pulley has bagged $10m in a Series A round led by FinTech giant Stripe. Many startup offer their employees equity to attract talent that they would otherwise not be able to afford. The idea is that these staff members would be motivated to work even harder to realise the value of their stake in the business.

Mine closes $9.5m Series A

Personal data management company Mine has netted $9.5m in its Series A round. Google’s Gradient Ventures led the round, with participation from e.ventures and MassMutual Ventures, according to a report from TechCrunch. Previous Mine backers Battery Ventures and Saban Ventures also contributed. Capital from the round will be used to support Mine’s launch in the US.

Signzy secures $5.4m in new investment

Digital onboarding solution Signzy has reportedly received a $5.4m investment to bolster its research into AI technology. The investment was led by MasterCard and Arkam Ventures, with support also coming from previous Signzy backers Kalaari Capital and Stellaris Ventures. With the funds, the RegTech startup hopes to increase its research and development and boost global sales after increased demand, it said.

Secureframe bags $4.5m seed round

Secureframe, which offers automated compliance software for SOC 2 and ISO 27001, has netted $4.5m in its seed round. The investment was co-led by Base10 Partners and Gradient Ventures. Additional support came from BoxGroup, Village Global, Soma Capital, Liquid2, Chapter One, Worklife Ventures, and Backend Capital. Proceeds from the round will enable the RegTech startup to support the launch of its technology.

Sym bags $9m in a Series A

Security workflow management company Sym has netted $9m in its Series A funding round, which was led by Amplify Partners. The investment also received support from angel investors including former Google CISO Gerhard Eschelbeck, Atlassian CTO Sri Viswanath and GitHub CTO Jason Warner. With the close of the round, the RegTech startup plans to increase the size of its engineering team and reinforce its sales and marketing efforts.

Click2Sure raises funding from SixThirty

South Africa-based InsurTech startup Click2Sure has reportedly raised a multi-million investment from SixThirty. With the fresh equity injection, the InsurTech plans to further the development of its technology and reach more customers, according to a report from IT Web.

Silverflow bags €3m round

Global payments technology developer Silverflow has closed a €3m investment to support its launch in 2021. UK-based venture capital firm Crane Venture Partners, with additional contributions coming from Inkef Capital, several angel investors and industry leaders from Pay.On, First Data, Booking.com and Adyen. Alongside launching its platform, Silverflow will use the funds to double the size of its team by the end of the year. This includes hiring new developers and a commercial director.

Neobank insha bags €2.5m in seed funding

insha, the Islamic challenger bank that boasts about offering an “account with principles”, has secured €2.5m in a new investment round. Turkish payment service provider Param led the seed round. Berlin-based insha will use the money to fund its European expansion, further develop its ethical banking product and strengthen the team at its headquarters in Berlin and Istanbul. The thing that makes it argue for for its higher ethics is that it guarantees that it follows sustainable banking and guarantees that deposits won’t be reinvested in morally questionable companies such as arms, tobacco, alcohol or betting.

Lawmatics picks up $2.5m investment

San Diego-based RegTech Lawmatics has added $2.5m to its coffers on the back of a seed funding round. The company specialises in building marketing and CRM software for lawyers, according to TechCrunch. Eniac Ventures and Forefront Venture Partners led the round, which also enjoyed participation from Revel Ventures and Bridge Venture Partners.

Security On-Demand secures $2.16m to fund the launch

Cybersecurity company Security On-Demand has secured a $2.16m grant from the National Center for Research and Development. This extra cash will help the company bolster the development of its big data analytics technology and support the deployment of its services in the industry. The RegTech company also plans to create new managed threat detection and response capabilities.

Vitable Health nets $1.6m in new round

Health insurance startup Vitable Health has collected $1.6m in a funding round, which was led by SoftBank Group. With the burst of funds, the InsurTech hopes to scale is operations, provide customers with more services and attract more clients. It will also be used to expand its services to residents of New Jersey and Delaware. Other backers to the round included Combinator, DNA Capital, Commerce Ventures, MSA Capital and Coughdrop Capital. Several angel investors contributed including, Mercury Bank CEO Immad Akhund and ex-Gainsight COO Allison Pickens.

Fundall closes its pre-seed on $150,000

Nigeria-based mobile banking platform Fundall has closed a $150,000 pre-seed funding round to support its launch. The capital injection was led by Black Knight Capital. Equity from the round will also be used to support the acquisition of a microfinance bank, form partnerships with financial institutions and double the size of the team.

Fundall founder Kolapo Joseph said, “We started Fundall to be a financial partner that helps everyone build generational wealth & grow their businesses through sound financial decisions & finance tools powered by Behavioural Economics and customized to their lifestyles.”

Total Network Services already plans second token sale after Series A one

San Diego-based blockchain business Total Network Services has closed of a Series A round with a security token round structured by city native venture Deal Box, a capital advisory and financial technology firm. Total Network Services is already planning on follow-on Series B security token offering for up to $25m, which will begin in November.

Global Processing Services gets investment from Visa

Payment giant Visa has made a strategic investment into Global Processing Services, a payments issuer processor. UK growth equity firm Dunedin backed the deal ,which will fuel the venture’s continuous global expansion plants and builds on the FinTech company’s previous partnership with Visa.

Copyright © 2020 FinTech Global