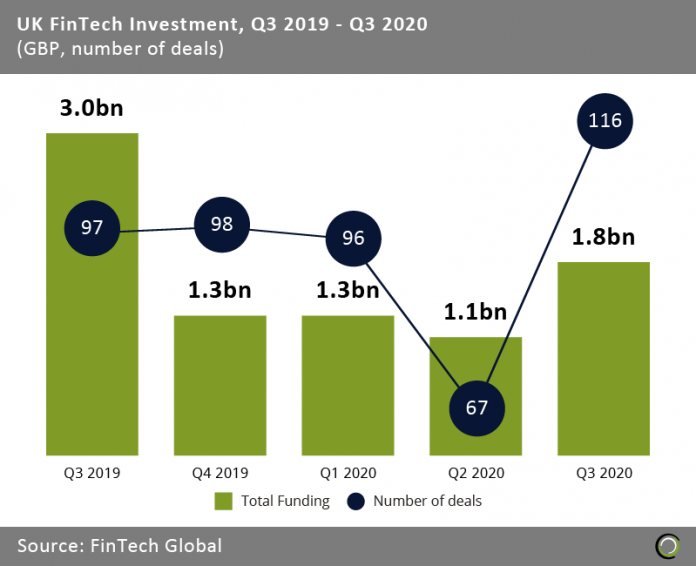

Companies in the UK completed 116 deals in the third quarter raising £1.8bn, the highest level in 12 months.

- UK FinTech investment declined sharply during the second quarter of 2020 as rising concerns about the economy caused by Covid-19 coupled with huge losses at several high profile FinTech scaleups such as Monzo and Revolut deterred investors. Only £1.1bn was invested in Q2 2020 across just 67 transactions, a 30% decline compared to the opening quarter of the year.

- However, the sector rebounded strongly in the third quarter with £1.8bn invested. The funding was driven by several large deals, as three of the five largest FinTech rounds this year took place in Q3.

- Deal activity also recovered after a poor second quarter where only 67 transactions were completed. As the strict lockdown measures in the country were relaxed investors renewed their interest in FinTech companies offering services around remote work and digital operations in financial services.

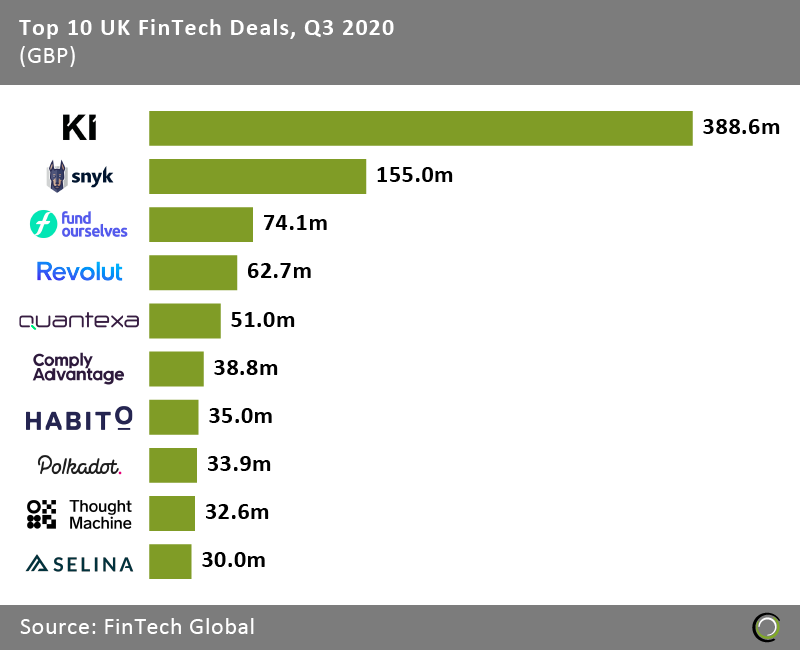

The top 10 UK FinTech deals in Q3 2020 raised over £900m

- The top ten UK FinTech deals in the third quarter of the year collectively raised £901.7m, making up 49.7% of the overall investment in the sector during the period. The ratio is lower compared to the first half of the year when the top ten transactions brought in 61.6% of the overall capital raised. Given the structural shifts due to Covid-19 have altered the outlook for the sector, new earlier stage companies are being backed due to improved prospects.

- The largest round of the quarter was completed by Ki Insurance, the first fully digital and algorithmically-driven Lloyd’s syndicate, which raised a $500m round from Blackstone Tactical Opportunities and Fairfax Financial Holdings. The company is launching in Q4 2020 and is going to underwrite using an algorithm-driven approach and offer instant follow capacity through its proprietary digital platform.

- Three RegTech companies made the list with Snyk, Quantexa and ComplyAdvantage all raising large rounds. Snyk, a company that builds security into the application development process, closed the largest round. The company raised a $200m Series D round led by Addition on the back of a $150m Series C round completed in January which saw the company attain a unicorn status. The latest investment round comes after a year that has seen Snyk grow its revenue by 275% and increased its headcount by 100%. The company currently has 375 employees with plans to add 100 more in the next year.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global