Challenger banks and InsurTech ventures stood out among the 23 FinTech companies that successfully raised money last week.

FinTech firms continue to raise funds to accelerate their growth. As we have reported in the past, concerns have been levied that the industry would be unable to keep up its momentum. But some businesses seem to determined to prove the detractors wrong and to weather the pandemic, potentially even coming out stronger on the other side. And by the looks of some of the trends we’ve picked up from the past seven days, neobanks and InsurTech companies seem to be doing reasonably well.

Let’s start by taking a look at the challenger bank industry. No matter how you look at it, the past seven days have been big for this sector. In the UK, Revolut CEO Nikolay Storonsky becoming the UK’s first tech billionaire and Anne Boden, founder of competing venture Starling Bank, launched her autobiography where she laid out her side of the story of how the Monzo founding team broke from her startup to launch their own.

But those are not the only ventures in the sector to have broken the news this week. For instance, child-focused neobank Strive launched its waitlist last week as it hopes to tap into the family-friendly FinTech trend we have reported on in the past.

Elsewhere, Afro-American-focused neobank Tenth caused a few headlines by announcing its mission to close the financial gap between black and white US citizens.

On top of that, we also reported last week that Vivid Money, Automata and Lucy had closed funding rounds.

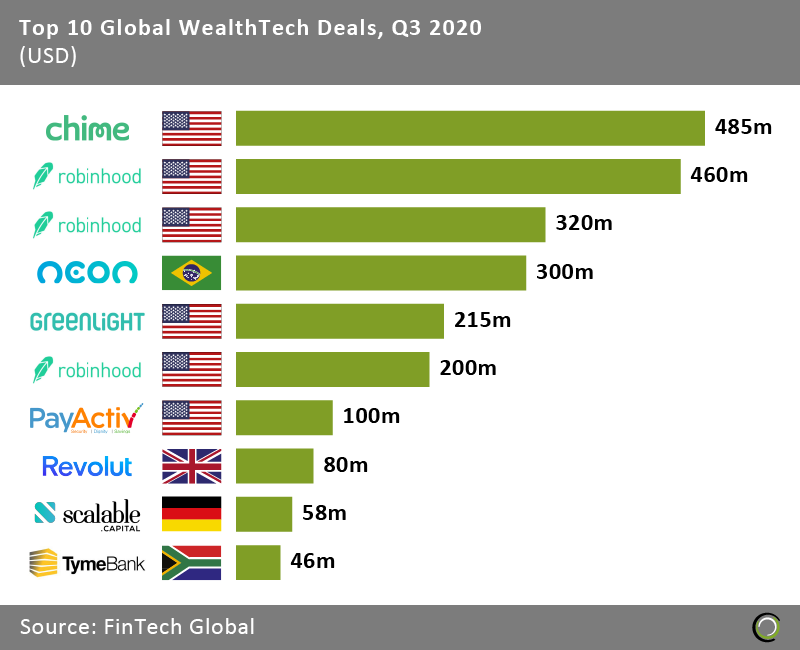

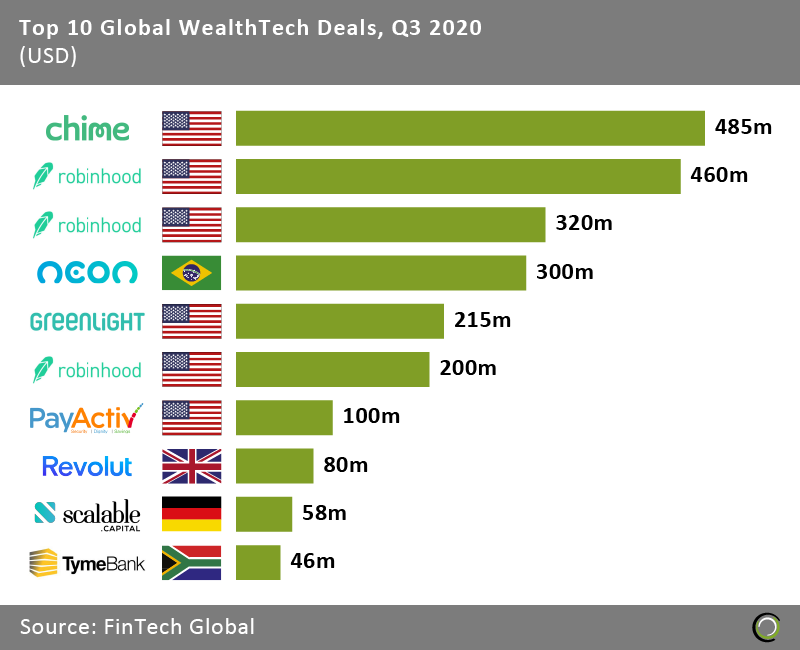

The stories above highlights how challenger banks keep driving the growth of the WealthTech space. Indeed, as we reported in our recent research, neobanks have been behind several of the top ten rounds recorded in the sector this year.

Still, it is important to recognise that everything is not just hunkydory among challenger banks. Indeed, some argue that the huge losses suffered by leading challenger banks such as Monzo, Revolut and Starling have deterred investors from being as bullish as they could’ve have been this year.

Still, it is important to recognise that everything is not just hunkydory among challenger banks. Indeed, some argue that the huge losses suffered by leading challenger banks such as Monzo, Revolut and Starling have deterred investors from being as bullish as they could’ve have been this year.

Indeed, those losses and the raging pandemic could have been behind the fact that the global WealthTech funding had a slow start to 2020. Only $3.3bn was invested in the first six months of 2020, representing a 41% decline compared to the capital raised in the preceding two quarters.

Although, the WealthTech sector seemingly bounced back ever so slightly in the third quarter of 2020. The sector as a whole raised $2.8bn across 111 rounds in that period, up from the $1.9bn raised in the second quarter. Still, while this represented a 12-month high, it is still some ways below the $3.4bn collected in the third quarter in 2019.

Last week was also big for the InsurTech sector. For one thing, FinTech Global unveiled the 100 most innovative companies in the sector around the world by announcing the ventures named on this year’s InsurTech100 list. You can find the full third annual list here.

Last week was also big for the InsurTech sector. For one thing, FinTech Global unveiled the 100 most innovative companies in the sector around the world by announcing the ventures named on this year’s InsurTech100 list. You can find the full third annual list here.

It was also a big week in terms of InsurTech investment with Marshmallow, Ushur, Kover and Assurely all grabbing the headlines last week for achieving cash injections.

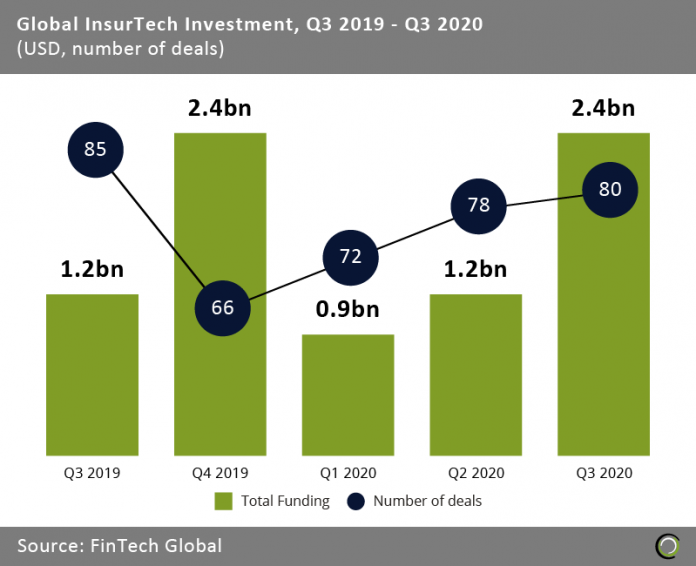

At the beginning of the Covid-19 crisis, several industry experts argues that the sector could come out of the troubling times stronger than before. The argument went that insurers had up until recently been slow to adopt digital solutions to the same extent seen in other industries.

The investment trends over the past year seem to give that idea some credence, with sector having attracted $4.5bn across the first nine months of the year, according to FinTech Global’s research.

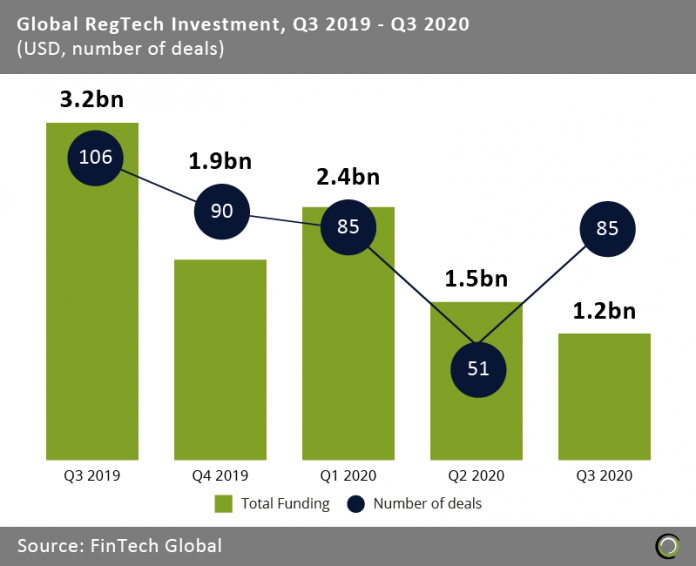

One sector that has noted a significant drop in investment over the course of the crisis is the RegTech industry. It recorded a five-quarter low in terms of investment funding between July and September this year. RegTech companies raised $1.2bn across 85 deals during that period, according to FinTech Global’s research. That’s down from the $3.2bn raised across 106 rounds in the same quarter last year.

One sector that has noted a significant drop in investment over the course of the crisis is the RegTech industry. It recorded a five-quarter low in terms of investment funding between July and September this year. RegTech companies raised $1.2bn across 85 deals during that period, according to FinTech Global’s research. That’s down from the $3.2bn raised across 106 rounds in the same quarter last year.

Nevertheless, the sector did see some investment in the last week and several of the RegTech experts we have spoken with have been bullish about their ability to keep thriving past the pandemic. Moreover, the third quarter results did also represent a slight rise in terms of the number of deals compared to the 51 deals raised in the second quarter of 2020.

Nevertheless, the sector did see some investment in the last week and several of the RegTech experts we have spoken with have been bullish about their ability to keep thriving past the pandemic. Moreover, the third quarter results did also represent a slight rise in terms of the number of deals compared to the 51 deals raised in the second quarter of 2020.

With all that out of the way, let’s take a closer look at the rounds from last week.

Marketlend raises over $140m

Buy now pay later company Marketlend has secured more than $140m via a series of credit facilities from a consortium of investors, including banks, credit funds and other institutional investors. The startup will use the money to fund its instalments product named Unlock for Australian SME borrowers and Asian trade credit transactions.

Tomo Networks secures $40m in seed capital

Last week the PropTech startup Tomo Networks picked up $40m in seed capital. The Seattle-based venture said it would use the cash injection to grow its digital mortgage solution. The startup is founded by former executives at Zillow, the online real estate database company.

Marshmallow bags $30m in new Series A funding

InsurTech startup Marshmallow has collected $30m in a new round to better determine risk for car insurance policies. However, the investors behind the Series A raise remained anonymous. The startup, founded in 2018, will use the money to scale the venture, focusing particularly on diversity and inclusion, with the plan being to launch in further countries, and more types of insurance, in the next 18 months. The company is now apparently worth $310m.

Assetz Capital bags £25m

Peer-to-peer lender Assetz Capital has been given £25m from the British Business Bank for the UK Coronavirus Business Interruption Loan Scheme (CBILS). This adds to the £15m the British Business Bank injected into the venture in March.

Ushur closes its Series B on $25m

InsurTech Ushur has closed a $25m Series B round to support its sales and marketing efforts. The investment was led by Third Point Ventures, with support also coming from previous Usher backer 8VC. Funds from the round will be used to accelerate the company’s sales and marketing efforts. Ushur has built a cloud-native automation platform that enables insurers to transform their customer communications with digital-first experiences.

Human API bags $20m in its Series C round

Human API, which is helping consumers to connect and share electronic health data with companies, has bagged $20m in its Series C. The investment saw contributions from Samsung Ventures, CNO Financial Group, Allianz Life Ventures and Moneta VC. Several existing Human API backers also joined the round, including BlueRun Ventures, SCOR Life and Health Ventures, and Guardian Life Insurance Company.

Vivid Money bags $17.6m in Series A

Vivid Money has raised $17.6m in a Series A round led by Ribbit Capital and aimed at boosting the challenger bank’s growth. The new round gives the German FinTech venture a valuation of $117m. The news comes on the back of the neobank starting to accept customers in June. The Berlin-based startup is also collaborating the banking licence-holding company solarisBank and Visa in Germany.

EarlySalary said to raise $10m Series C

India-based EarlySalary, which gives consumers instant access to credit, has reportedly bagged $10m in its Series C round. The capital was co-led by existing investors Chiratae Ventures and Eight Road Ventures. The FinTech’s valuation has not increased since its former round and is still estimated to be around $41.8m.

Kover raises $5m

Kover, which offers income protection to gig workers, has secured $5m in a new funding round. The capital was supplied by Afore Capital, West Loop Ventures and Foundation Capital. Members of Kover can get paid time off, sick leave, 24/7 health service, legal protection and automatic mileage tracking. The policy starts at $7 per month. The InsurTech’s seed round closed on $1.5m in 2019, with West Loop Ventures serving as the lead investor. Other backers to the round included Afore Capital and Techstars Ventures.

Statrys secures $5m from angels

Hong Kong-based digital payments platform Statrys has apparently added $5m to its coffers in an angel investment round. The venture will use the new cash injection to fund its global expansion plans, starting in Asia. The company provides payment services for SMEs.

Stairwell raises $4.5m

Cybersecurity company Stairwell has bagged $4.5m in a seed round led by Accel. Sequoia Capital, Gradient Ventures, Allen & Company and a smattering of angel investors also supported the raise. The company will use the money to better protect businesses against breaches. The founder of Google’s Threat Analysis Group Mike Wiacek serves as the founder and CEO of Stairwell.

Keyrock collects €4.3m in funding

FinTech startup Keyrock has secured €4.3m in a funding round co-led by SIX Fintech Ventures and MiddleGame Ventures. Existing backers Volta Ventures, Seeder Fund and TNN Patrimony returned for this round too. The Brussels-based venture will use the cash injection to fund its ongoing efforts to build efficient markets for digital assets.

Osome has secured $3m in investment

RegTech and accounting app Osome has netted $3m in a new funding round. It will use the new capital, invested by XA Network and AltaIR Capital, to leverage the growing digitalisation brought on by the Covid-19 pandemic.

Cado Security closes its seed round on $1.5m

Cado Security, a cloud-native cyber forensics and response platform, has closed its seed round on $1.5m. Cybersecurity-focused venture capital firm Ten Eleven Ventures served as the lead investor. The capital will enable Cado to expand its development team in the UK.

Cooler Future picks up €1.4m

Green-focused investment app developer Cooler Future has picked up €1.4m of funding from venture capital house Lifeline Ventures and a string of angel investors. Nordic Makers, Gary Lin from Purple Orange Ventures and Global Fashion Group CEO Patrick Schmidt have committed capital through the funding round, which aims to let users track the carbon dioxide-equivalent impact of their investments in its green fund.

Automata bags £1.35m in its Series A funding round

UK and France-based neobank startup Automata has has bagged £1.35m in its ongoing Series A round. The round takes the total amount raised by the FinTech to £1.8m. The round was raised through an equity token offering. The startup is the the umbrella company behind wealth-centred challenger bank akt.io.

Interlapse Technologies collects CAD735,632

Canada-based Interlapse Technologies has completed its non-brokered private placement raising a total of CAD735,632. The FinTech issued 4.9 million units at the price of CAD0.15 apiece, with each unit containing one common share and one non-transferable warrant. A warrant entitles the holder to purchase an additional share at the price of CAD0.20.

Lucy raises $360,000

Lucy is a neobank aimed at helping female founders find the tools they need to manage their finances. Last week it raised $360,000 in a pre-seed funding round entirely backed by women investors based in the UK, US, Singapore, Somalia, Mexico, India, Indonesia, Hong Kong, the Netherlands, Australia, New Zealand, Vietnam and Germany. The Singapore-based business is said to officially launch in early 2021.

Stikcredit collects €156,496 in crowdfunding campaign

Bulgaria-based lending platform Stikcredit has raised €156,496 in a crowdfunding campaign being raised on Seedrs. Stikcredit has beaten the initial crowdfunding target and with another 26 days still on the campaign, it could still raise more capital. The FinTech is raising the capital at a pre-money valuation of €19.8m and has offered 0.78% of its equity to investors. According to the funding page, there have been 117 investors on the campaign.

Assurely secures seed capital

Assurely, an insurance firm for innovators, has reportedly closed its seed round, which was led by ATX Ventures. The value of the investment was not disclosed; however, the funds bring the company’s total equity raised to $3.7m. Contributions to the investment also came from unnamed strategic investors with deep insurance and technology expertise.

MioTech adds more money to its coffers

MioTech, an alternative data and insights platform, has received a minority investment from Moody’s Corporation, a global risk assessment firm. The FinTech platform leverages AI technology to track and scan alternative data sources related to environmental, social, and governance (ESG) and know your customer (KYC), supply chain and financial information in China. It scans data from more than 800,000 public and private companies in the country.

FinTech the Hydrogen Technology Corporation bags more cash

The Hydrogen Technology Corporation, which builds embedded finance and international payments software, has received an investment from EML Payments. EML made the investment through its incubator FINLAB, but it is unclear how much capital it deployed.

Arcus secures cash injection

Arcus, which stylises itself as a FinTech-as-a-service platform, has collected an undisclosed investment from Citi Ventures. The deal marks Citi Ventures’ first investment into a FinTech company based in Mexico. Funds from the round will enable Arcus to extend its biller network, facilitate consumer payments in Latin America, and further its growth in Mexico.

Copyright © 2020 FinTech Global