InsurTech startup Getsafe has secured $30m in funding through a Series B round led by Swiss Re’s digital platform iptiQ.

The investment, which brings the total capital injected into Getsafe to $53m, was also backed by existing investors Earlybird, CommerzVentures, btov Partners and Capnamic Ventures.

“We are thrilled to have iptiQ as our new lead investor and partner,” said Christian Wiens, founder and CEO of Getsafe. “Together with them and our existing investors, we want to build on our position as the leading insurer for a new generation of customers.

“The latest funding will allow us to significantly accelerate our growth, to consolidate our position as market leader among millennials in Germany and to expand into other European markets.”

Getsafe and iptiQ have previously publicly announced their partnership, which has already seen the two companies collaborate to launch the first digital car insurance optimised for smartphones in Germany.

With just a few clicks, users can purchase insurance with the Getsafe app, file a claim and manage their policy in real time.

“Getsafe has established itself as a very promising InsurTech brand and we are pleased to lead this funding round,” said Andreas Schertzinger, CEO at iptiQ EMEA P&C. “As their partner, we will support future growth by combining iptiQ’s digital platform and insurance expertise with their mobile-first distribution model. Together, we will develop digital insurance products that are appealing, relevant and affordable for their growing customer base.”

Getsafe is also gearing up to increase its offering and is awaiting the results of an application for a property and casualty insurance licence sent to the Federal Financial Supervisory Authority (BaFin) earlier this year.

Ahead of getting the green light from the regulator, Getsafe plans to use the cash injection to extend its funding with a second tranche to be closed in the first half of 2021.

“We want to inspire and positively surprise people with a digital customer experience,” said Wiens. “What we have seen so far in terms of innovation in the insurance market is just the tip of the iceberg.”

Getsafe entered the UK in January 2020 and has since grown its customerbase to include more than 150,000 users.

And while many businesses have faltered during the pandemic, Getsafe has managed to increase its staff numbers to over 120 employees.

“In the middle of one of the biggest economic crises in history, we have undergone rapid development and established ourselves as an insurance company for consumers with a preference for digital channels,” Wiens.

“However, we are still at the beginning of our journey and have plenty to do to make insurance more digital throughout Europe.”

The deal comes as the InsurTech space is seemingly going from strength to strength. Just the other week, Hippo Insurance raised a massive £350m round, just months after it secured its unicorn status, and Conduit secured London’s third biggest public listing in 2020 with its value exceeding £826m.

Over the summer, US-based InsurTech Lemonade went public and Root Insurance followed with an initial public listing of its own in October.

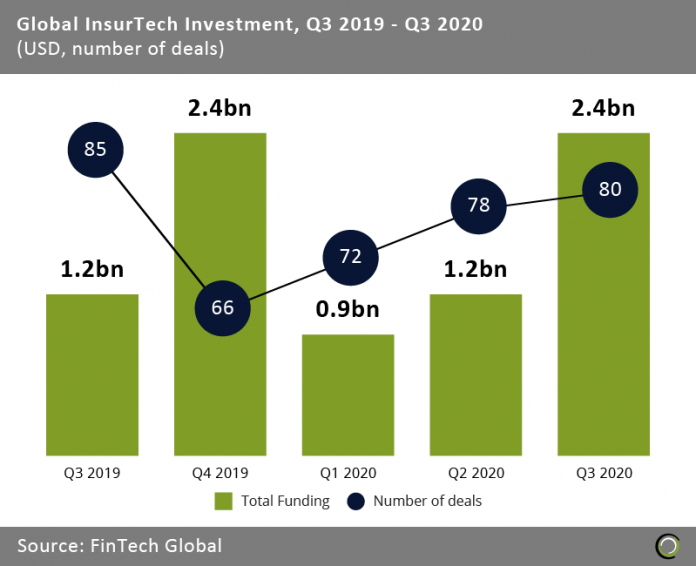

Looking at investment into the InsurTech industry as a whole, the sector had a reasonably slow start to 2020. The industry only raised about $900m between January and March, according to FinTech Global’s research.

Investment was initially affected by the coronavirus, with investors becoming more conscious with their money in the face of the market uncertainty.

Investment was initially affected by the coronavirus, with investors becoming more conscious with their money in the face of the market uncertainty.

Nevertheless, investment has picked up in the last two quarters. The sector raised $1.2bn in the second quarter and a whooping $2.4bn in the third, according to FinTech Global’s research.

All of this combined suggest that the argument made earlier this year by several market stakeholders that InsurTech startups would be the big winners from the coronavirus crisis may hold some water.

Their argument was that the pandemic would demonstrate, with almost painful clarity, how much the insurance industry is in dire need of innovation.

There is some credence to that argument. For instance, recent Scanbot research backs that up, suggesting that only 42% of health insurers in Europe have a consumer facing app, despite the rising importance of digitalisation.

Now, with both Getsafe closing its $30m round and French startup Luko securing €50m this week, it seems as if InsurTech is still going strong.

Copyright © 2020 FinTech Global