With the year coming to an end, it is time to look ahead into 2021 and predict where the market is headed.

It is safe to say that no one will ever forget 2020 and how it kicked off the decade. Besides the seismic shift the coronavirus has caused on how people live and work, there have been numerous other major events this year. The world has gone through a lot these 12 months, with elections, protests and the announcements of aliens, it has been a mixed year.

Insurance, like many other industries, has noticed one key trend during 2020 and that was the race for digitalisation. Firms have been updating their systems for the past decade. While the benefits of online platforms have been no secret, legacy systems and stubborn mindsets in firms have stalled its rapid implementation, but the pandemic made them rethink this and digital products are coming out fast.

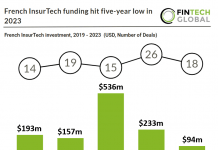

Funding into InsurTech has been steadily increasing each year. In 2016, global investment into the sector reached $1.6bn across 186. In 2019, the total funding in InsurTech companies reached a sizable $5.9bn, across 258 transactions. Even though 2020 has been a turbulent year, it could continue the rise in funding. The total capital invested during the first three quarters of 2020 has reached $4.5bn through 230 deals.

A recent survey from Information Services Group outlined just how important technology will be playing in insurance in the coming months. Its survey, which comprised responses from 300 senior insurance executives, found that 86% companies expect customer behaviour to change due to the pandemic. Further to this 90% are accelerating their digitalisation strategies to keep up with the new demands.

The report states that 61.5% of firms will invest in digital customer experiences, 51.3% will spend budget on cloud transformation and 46.2% will allocate funds to data, machine learning and AI technologies.

As 2020 has proved, you can never accurately predict the future. However, these are the trends that are likely to happen.

Push towards AI

Artificial intelligence has been a major buzzword over the past few years. Whilst it dominates discussions, there is still much more potential for the technology. However, with the world being forced to accelerate digitalisation, Akur8 is confident pricing is one area of insurance that will be impacted by AI next year. A recent study from MunichRE Consulting stated that 78% of the surveyed insurance firms felt they needed to improve pricing sophistication. This could pave the way for AI to help.

Akur8 corporate development lead Astrid Noël said, “The pressure on insurance carriers has strongly increased over the past few years: rising competitive pressure from direct insurers and new entrants like InsurTechs or tech giants like the GAFAs, with lower interest rates putting a drain on their profitability. These trends have only been accentuated by the Covid-19 crisis, increasing the urge for best-in-class rate making capabilities.

“Insurers that will create the most value are those that strongly and sustainably commit to rate making and underwriting excellence, in order to build a self-perpetuating competitive advantage. For insurers, rate making excellence, in terms of strategy and capabilities, is more critical than ever to generate value.” By implementing AI technology, insurers can improve their risk assessment and pricing capabilities, Noël claimed. The technology can automate risk modelling to increase predictive powers and accelerate process times.

While AI has been lurking for a number of years, due to the pandemic affecting the global economy, Noël believes more pressure will be put on P&C insurers’ revenues. This pandemic has made predicting consumer behaviours and risk assessments very tough and firms need new tools to be able to assess the full picture and ensure they can continue to price accurately.

“At Akur8, we believe that we are at a genuine pivotal time for non-life insurance. The winners of the next decade will be the ones making bold and future-looking choices today.” This is down to the fact the current environment is forcing firms to offer more speed, agility and relevance. Without technology, firms might struggle to keep up with the needs of their customers.

This drive for AI-powered pricing capabilities is a welcome one, with Noël seeing it as a “win-win” for both the insurance carriers and their customers. “On the one hand, better risks assessment capabilities allow for more speed, efficiency and accuracy, accelerating time-to-market and reducing loss ratio for insurers. On the other hand, they allow for more targeted and more personalized policies at fair and transparent prices for customers.”

There are a number of InsurTech platforms out there which can help insurers make the most of AI-powered pricing. Akur8 is one of them. Its tools enable insurers to automate the rate making process through its transparent AI. The solution captures insights from customer data and quickly assesses the correct pricing for a policy. By being transparent, the service is fully auditable, unlike other blackbox solutions, helping insurers understand the results, as well as meet compliance.

Akur8 offered some advice to insurance firms for 2021, Noël said, “Do not miss out on the opportunity to enhance your rate making capabilities! AI-based solutions like Akur8, by automating the data-driven part of the rate making process, empower pricing teams by allowing them to focus on the expertise-driven part of the rate making process, to deliver better value to customers and insurers. This will be key to deliver retention, acquisition as well as loss ratio performance in the years to come!”

Remote working

Before 2020, remote working was rare. If it was to be used, employees would typically have the odd working from home day if they had something urgent to do at home, like having a boiler being fixed. Data from Business Comparison claims that at the start of 2020, just 5.2% of people in the financial and insurance industries mainly worked from home. Furthermore, it stated that just 38.9% of employees had ever had experience working remotely.

When governments issued the lockdown and forced businesses to abandon their offices, it left many scrambling to establish remote working capabilities. Worryingly, financial services were largely unprepared for this and there have been a number of challenges to get things working. One study from Netwrix even claimed 85% of CISOs sacrificed their cybersecurity protocols just to get staff working from their houses.

However, the pandemic is still in full swing and it does not look likely that offices will be opening their doors to the masses any time soon. Tractable president Adrien Cohen said, “Even if the impact of Covid decreases in 2021, the direction of change will remain the same: insurers now realise that a smoother claims process with fewer points of potential friction can result in substantial gains in terms of efficiency and customer satisfaction.”

Cohen offered some advice to insurance firms planning for the next year, he said, “For insurers, I would be very clear: change in the claims process isn’t on the horizon – it’s already here. Some of the world’s largest companies have already deployed cutting-edge technology across their claims processes, and this is being used today on hundreds of thousands of live claims. If you’re thinking about whether you should think about change, then you’re being left behind by the other players in the sector – you need to evaluate the solutions that are available, and you need to do it today. Test the technology – it’s here, it’s real and it’s making a difference now.”

Tractable is preparing itself for the shift in workforce mentality. During 2020, demand for the InsurTech’s AI-powered remote vehicle damage assessment technology has surged in demand. The pandemic has increased the interest in these types of tools and how insurance firms can improve their claims processes without needing human interaction. To help cope with this shift in demand, Tractable has been rapidly hiring staff so it can continue to help insurers with their remote working.

An ongoing hard market

It is safe to say most people will be happy to see the back of 2020. It has been a tough year for many businesses around the world. However, just because we have started a new year, does not mean the challenges will simply disappear. CyberCube head of client success Oliver Brew sees an ongoing hard market for insurance throughout 2021. The insurance industry is reacting from losses from the pandemic and the accumulation of several major natural and man-made events over the past few years, as well as liability losses. These are likely to still have impacts through the new year.

He said, “Changes to market conditions are always noteworthy, particularly as there has been a prolonged soft market for the last several years, and I think it will continue to dominate industry conversations for much of the year. Whenever rates increase, the focus for buyers is to ensure they are getting value from their brokers and carrier partners. In many cases, this extends beyond the insurance policy alone, and includes support for risk mitigation and post-loss services as well as indemnity for claims.”

This hard market is going to make insurance even more competitive and there will be a drive from firms to improve efficiency and reduce friction in transactions to offer more value to clients. However, there are silver linings and in the tough times, it will support more innovation in the market.

Brew added, “The insurance industry has had periods of rapid innovation, and I think we are in one currently. The need to provide stability and enable companies to bounce back after knock-backs is higher than ever. Rapid adoption of technology to improve outcomes for clients is critical, and while a hardening market is not welcome to clients, it is already attracting new capital and investment to build improvements in service delivery and transaction processing to benefit clients.”

InsurTechs like CyberCube are helping insurance industry clients with cyber risks by supporting better and faster decisions through data and analytics. Its technology is enabling brokers to help their clients make informed choices about the extent of cyber risks. The technology also ensures insurers improve their understanding of cyber accumulation risks and bolster capital management efficiency.

Brew offered advice to insurers looking ahead to 2021. He said, “Innovation will always be important, but the pace of change has increased with the hardening market, so to thrive companies need to adapt and drive the change, rather than be a passenger.”

Copyright © 2020 FinTech Global