The UK Supreme Court has ruled that policyholders should have their coronavirus losses covered by insurers and the InsurTech industry is welcoming the decision.

The Financial Conduct Authority (FCA) spearheaded the case on behalf of policyholders in order to get more clarity about whether business interruption insurance polices that included clauses about infectious and notifiable diseases meant insurers had to accept liability when it came to Covid-19.

Prior to the Supreme Court case and the preceding High Court case in September, some insurers had elected to pay out and some had not.

The Supreme Court’s 112-page ruling offers some clarity about how to move forward, saying that insurers are liable for partial closure of premises as well as for full closures and for mandatory closure orders that were not legally binding.

It stated that valid claims should not be reduced because the loss would have resulted in any event from the pandemic.

The FCA calculates that the case will affect roughly 370,000 policyholders in the UK.

“Coronavirus is causing substantial loss and distress to businesses and many are under immense financial strain to stay afloat,” Sheldon Mills, executive director of consumers and competition at the FCA.

“This test case involved complex legal issues. Our aim throughout this test case has been to get clarity for as wide a range of parties as possible, as quickly as possible, and today’s judgment decisively removes many of the roadblocks to claims by policyholders.

“We will be working with insurers to ensure that they now move quickly to pay claims that the judgment says should be paid, making interim payments wherever possible. Insurers should also communicate directly and quickly with policyholders who have made claims affected by the judgment to explain next steps.

“As we have recognised from the start of this case, tens of thousands of small firms and potentially hundreds of thousands of jobs are relying on this. We are grateful to the Supreme Court for delivering the judgment quickly. The speed with which it was reached reflects well on all parties.”

Tim Hardcastle, CEO and founder of INSTANDA, was one of the people who welcomed the Supreme Court ruling.

“The measures announced by the Supreme Court today are a positive ruling for SMEs,” he said. “The government has had to finely balance the economic support it offers out to businesses so this can only come as huge lift for those who will benefit.

“It brings to light a broader issue that the industry has been grappling with for some time: how to ensure clarity in policy wording and avoid ambiguity or misinterpretation. Clear and simple communication around policies should not just be a nice to have, it should be a given.”

The news comes on the back of many InsurTech industry stakeholders suggesting that the pandemic will mean a boon for the sector as more insurers are being forced to digitalise their offerings.

“The Covid-19 pandemic more generally has brought to light the desperate need for digital transformation of the insurance sector,” said Hardcastle. “Insurers must embrace modern agile technology and digitise their business as they seek to adapt to changing customer demands not just now, but also in the future.”

There are several indication why that may be the case. In 2020, US-based InsurTech Lemonade successfully went public, Hippo secured its unicorn status on top of hundreds of millions in new cash injections, and Root also went public.

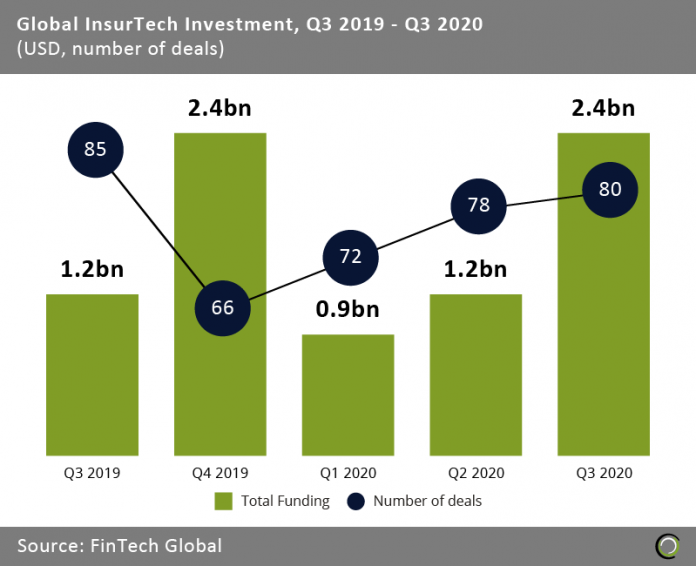

Investment into the InsurTech industry had a slow start to 2020. The industry only raised about $900m between January and March, according to FinTech Global’s research.

The perceived trepidation from investors was hardly surprising given the financial turmoil brought on by the coronavirus pandemic. Uncertainty tends to discourage investors from opening their pocketbooks.

Nevertheless, investment picked up speed in the second and third quarters of the year. The global sector raised $1.2bn in the second quarter and a whooping $2.4bn in the third.

Copyright © 2021 FinTech Global

Copyright © 2021 FinTech Global