Zeller, which offers an alternative to business banking, has reportedly revealed that it collected $25m in its Series A last year.

The round was led by Addition, with commitments also coming from Square Peg and Apex Capital, according to a report from TechCrunch.

Proceeds from the round will be used to accelerate its product development and engineering capabilities. Furthermore, capital will increase its marketing and sales, and its customer support teams.

Zeller is hoping to launch its services in the near future.

The FinTech claims to be a better alternative to business banking and supplies everything a client needs to accept payments, manage finances and pay recipients.

Zeller co-founder and CEO Ben Pfisterer said, “We don’t underestimate the challenges that come with scaling a new brand in an area dominated by entrenched banking incumbents, yet the opportunity is incredibly exciting.

“The industry experience our team has built up over the years means that we are well aware of the pain points business owners face when getting set up with a new banking or financial services provider.”

Prior to the Series A, the FinTech raised a $6.3m investment in June 2020.

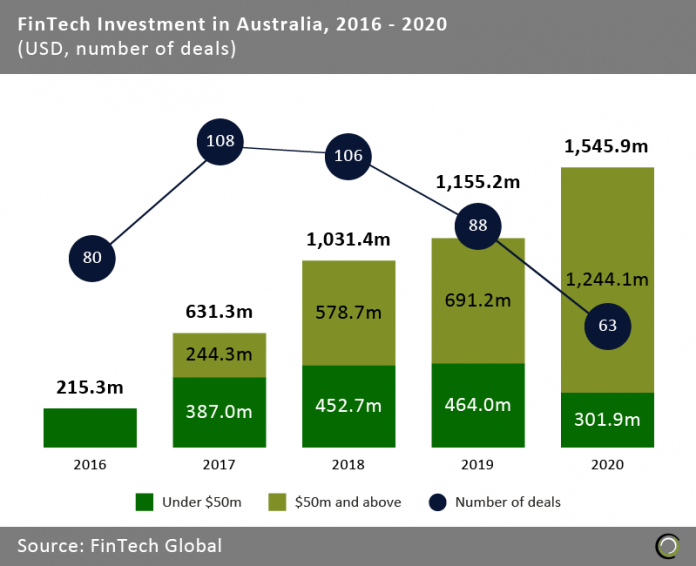

Australian FinTech hit another record year for investment funding, according to FinTech Global’s data. In 2020, Australian FinTech companies raised a combined total of $1.5bn in funding – the sector hit $1.1bn in funding in 2019.

Copyright © 2021 FinTech Global

Copyright © 2021 FinTech Global