FinTech companies in the region raised over $1.1bn in the first quarter of the year with Loft and Nubank closing large investments.

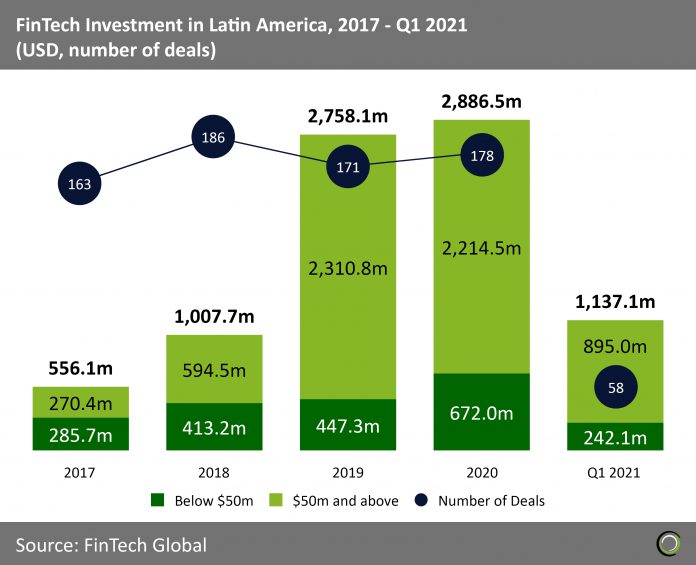

- The FinTech industry in Latin America experienced huge growth in funding between 2017 and 2019 as investors backed innovative startups making financial services more accessible for the large unbanked population in the region. Total capital invested grew from just $556.1m to over $2.7bn during the period.

- FinTech investment growth in the region continued unabated in 2020 despite the coronavirus-caused economic uncertainty. Companies in the region raised more than $2.8bn last year, a growth of 4.65% year-on-year compared to 2019. The momentum in funding and deal activity was maintained by the increased demand for digital services especially in the WealthTech and Payments & Remittances sectors amid a surge for contactless payments and digital banking services due to the pandemic.

- Investment in Latina America had a strong start to 2021 with $1.14bn capital invested, a more than two-fold increase compared to Q1 2020. That being said, 72.6% of that funding came from two deals completed by Loft, a marketplace for residential real estate, and Nubank, a challenger bank, which raised $425m and $400m, respectively.

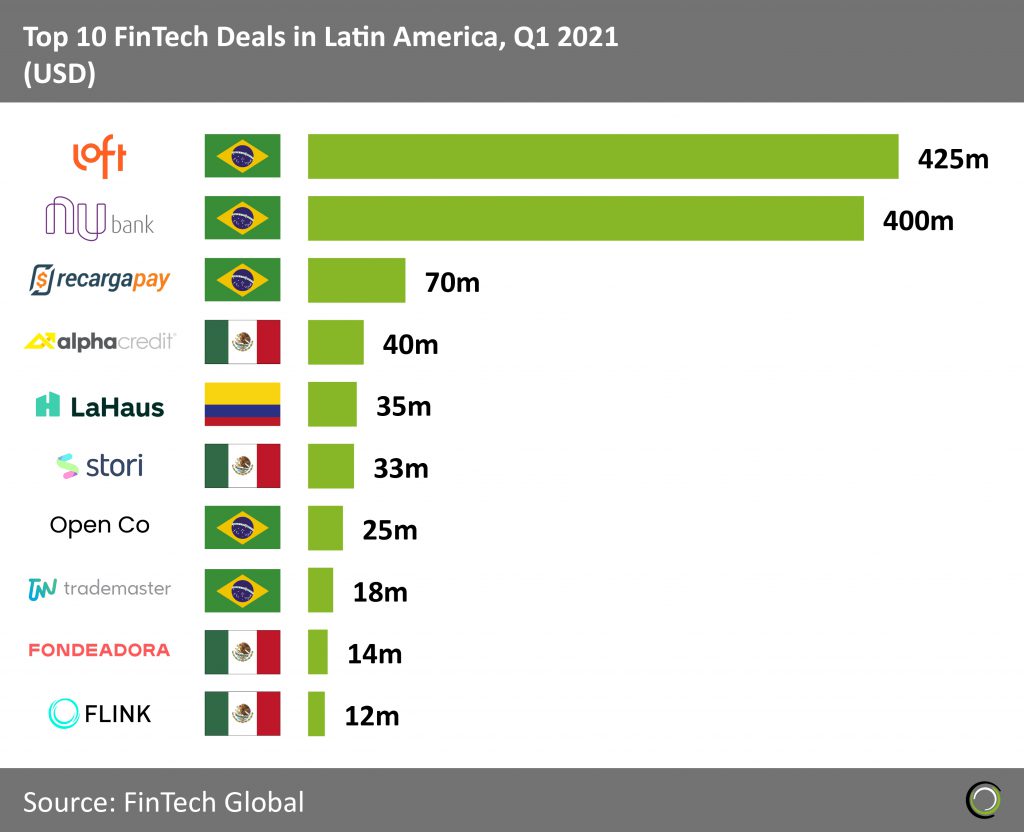

Brzilian companies raised the three largest FinTech deals in Latin America in Q1 2021

- The top ten FinTech deals in Latin America completed in the first three months of 2021 raised in aggregate $1,072m, making up 94.3% of the overall investment in the region during the quarter. The high concentration of capital in large deals can be explained by the huge disparity in deal size distribution with two deals recorded over $400m and all remaining funding rounds under $70m.

- Brazilian companies took five spots on the list including the three largest deals in the region during the opening quarter. The largest deal in the country was completed by Loft, a Brazilian real estate platform to buy, sell and rent residential and commercial properties, which raised $425m in a Series D round led by D1 Capital Partners. The round values Loft at $2.2 billion, a big jump from its near unicorn status in January 2020, when it raised a $175 million Series C. Loft plans to use the new capital in part to expand across Brazil and Latin America as well as explore M&A opportunities.

- The largest round outside of Brazi was completed by AlphaCredit, a Mexican lending platform for individuals and SMEs, which completed a $40m debt financing from IDB Invest. The resources will support the expansion of AlphaCredit’s lending portfolio targeting retirees and pensioners, independent workers, and micro, small and medium-sized enterprises (MSME) through digital platforms

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2021 FinTech Global