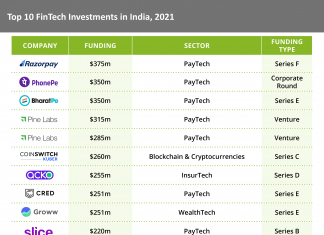

India-based FinTech unicorn Pine Labs raised $285m in a new round of funding which valued the firm at $3bn.

This round of fundraising saw investors including Baron Capital Group, Duro Capital, Marshall Wace, Moore Strategic Ventures and Ward Ferry Management. Existing investors Temasek, Lone Pine Capital and Sunley House Capital also participated in this funding round.

The merchant commerce solutions provider, which is preparing for its initial public offering (IPO) for early next year, said it was an oversubscribed round which also enabled secondary transactions for its founder, employees and early shareholders.

The company almost tripled its valuation since January last year when it was valued at $1.4bn after it raised an undisclosed amount from New York-based financial services major Mastercard.

The funding will be used to scale its merchant network and make investments into its technology product stack.

Pine Labs provides a range of financial services which include merchants payments terminals, invoicing tools and working capital and point of sale devices. Currently, it has its presence in India, South East Asia and the Middle East.

With more than 150,000 merchants across Asia and the Middle East, its Pay Later product saw $3bn in annualised equated monthly instalment transactions, it claimed.

On the fresh round of funding, Pine Labs CEO Amrish Rau said, “[The company] now wants to scale new frontiers in the online space as well, at the same time continue to power the credit and commerce needs of our offline merchant partners.”

With the aim to offer consumer payments to users in India and Southeast Asia, the firm acquired Fave, a consumer FinTech platform based out of South East Asia for $45m last month. It also launched its popular Buy Now Pay Later proposition in Malaysia.

Also commenting on the round, Sequoia Capital managing director Shailendra Singh said, “Pine Labs has rapidly transformed from a single product company offering retail acceptance of payments to a broader payments platform. The company now serves hundreds of thousands of merchants for payments through cards and UPI, processing tens of billions of payment volume.”

Copyright © 2021 FinTech Global