Egyptian digital banking startup Telda raised $5m in a fundraise led by VC giant Sequoia Capital, marking the region’s largest pre-seed funding round.

Global Founders Capital and Class 5 Global also joined the round.

Telda, which was founded just last month by former Uber engineer Youssef Sholqamy and Ahmed Sabbah, who co-founded Cairo-based ride-sharing firm Swvl, has already become the first company to receive a license from the Central Bank of Egypt under the new Banking Agents regulations, allowing it to issue cards and onboard customers to its app.

Users can set up an account through the app with their phone number and national IDs and get an Iban and Mastercard-powered card. Telda’s account comes with a Mastercard-powered card that can be requested from the app and used for online payments, in-store purchases, and cash withdrawals.

In its first month of operation, the startup has acquired over 30,000 sign-ups. Given that only 40% of people in the MENA region have access to a bank account, digital banking services provided by startups such as Telda makes it more accessible.

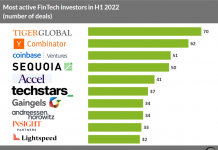

The investment also marks Sequoia’s first investment in the Mena region and the first Egyptian investment from Global Founders Capital and Class 5 Global.

Telda’s growth has prompted comparison to Brazil’s $25bn Nubank from Sequoia’s partner George Robson, who said that Egypt’s tech-savvy population has parallels in Brazil. But the tough regulatory landscape in the Middle East has so far made it difficult for the region’s standalone digital banks to gain a license and compete with legacy players.

In fact, GFC partner Roel Janssen believes that Egypt has the potential to become an “important hub in the global tech ecosystem.”

Commenting on the round, Sabbah remarked, “We refer to Telda as The Money App. It is the first digital banking experience in Egypt, enabling customers to create a free account in seconds, receive a free Telda card to use online, in stores and withdraw cash from any ATM worldwide and pay bills all directly from their phone. Telda customers will also be able to send and receive money instantly and for free from friends, family and anyone with a mobile phone, as easy as sending a Whatsapp message.”

Highlighting some of the benefits provided by Telda, Class 5 Global managing partner Youcef Oudjidane said, “Money has become a medium of self-expression – a form of identity – not solely a store of value. Telda has done a remarkable job of embedding their culture and values in the product, in both functionality and design. No hidden fees, no maintenance charges, no paperwork nor stress, coupled with an elegant design to enable a self-service experience.”

Digital banking has been gaining popularity amid a broader FinTech boom in the region. Silicon Valley’s Stripe entered the UAE last month after an escalation in online payments. Dutch payments company Adyen too inaugurated a Dubai office last year citing plans to expand across the region.

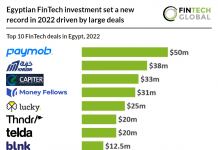

Additionally, the sector has continued to attract fresh capital. Last month, Egypt’s Paymob completed $18.5m in a Series A round led by the UAE-based Global Ventures. Meanwhile, the Riyadh-based buy now, pay later startup Tamara raised $110m from investors including European payments giant Checkout.com, in one of the region’s largest funding rounds.

Copyright © 2021 FinTech Global