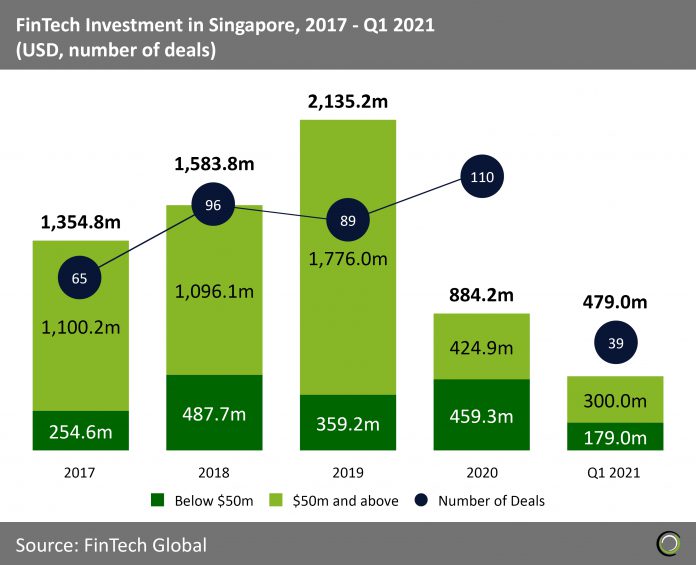

FinTech companies in the country raised $479m in the first quarter of the year across 39 deals

- On the back of a record 2019, the FinTech sector in Singapore experienced a sharp decline in funding last year registering its worst year since 2017. The decline in funding was brought on by a lack of deals over $50m as foreign investors focused on domestic markets amid the pandemic. As a result, the Monetary Authority of Singapore has announced a $125m support package for the FinTech sector to deal with immediate challenges from Covid-19 and position strongly for the recovery and future growth.

- FinTech companies raised over $884m last year, a decline of 58.6% year-on-year compared to 2019. The decline in funding was brought on by a lack of large deals. At the same time deal activity increased during the period with 110 deals completed compared to 89 transactions in 2019.

- However, Investment in the country had a strong start to 2021 with $479m worth of funding, a big increase on the $138m invested in Q1 2020. Deal activity also recovered YoY from 24 transactions last year to 39 deals in the first three months of 2021.

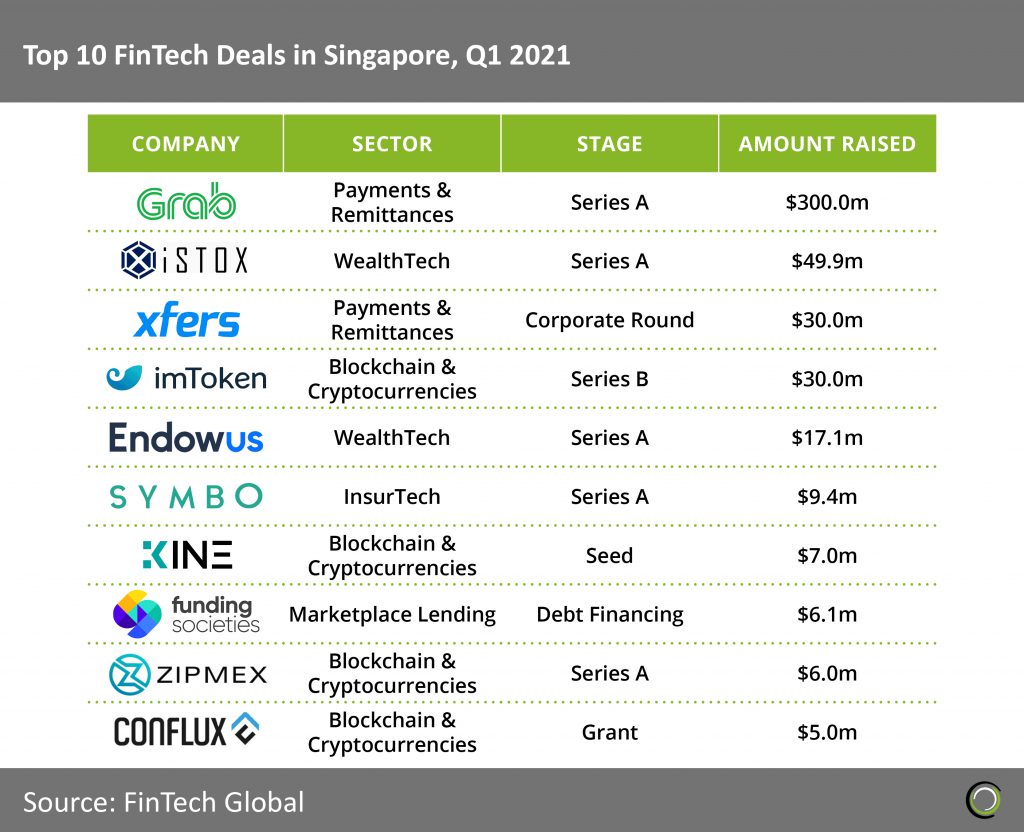

Large deals return in Singapore as the country recorded four funding rounds at $30m or above

- Last year’s decline in funding was driven by the lack of large deals – only six transactions at $30m or above were recorded. The opening quarter of 2021 bodes well of the FinTech sector in Singapore as already four transactions in that size bracket were recorded.

- The top ten deals in Q1 2021 raised in aggregate $460.5m, which equals to 96.1% of the overall investment in Singapore during that period. The high levels of concentration of capital in large deals is normal given that the biggest deal during the quarter was responsible for nearly two-thirds of the total funding in the country.

- Grab Financial Group, a subsidiary of the car sharing and delivery giant which provides financial services across payments, rewards, lending and insurance, raised the largest deal of the quarter after collecting $300m Series A funding led by Hanwha Asset Management. The company will use the new funds to continue helping more individuals and SMEs access the benefits of financial services. It will do so by further investing in talent, and expanding its offerings in SEA with more affordable, convenient and transparent financial solutions.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2021 FinTech Global