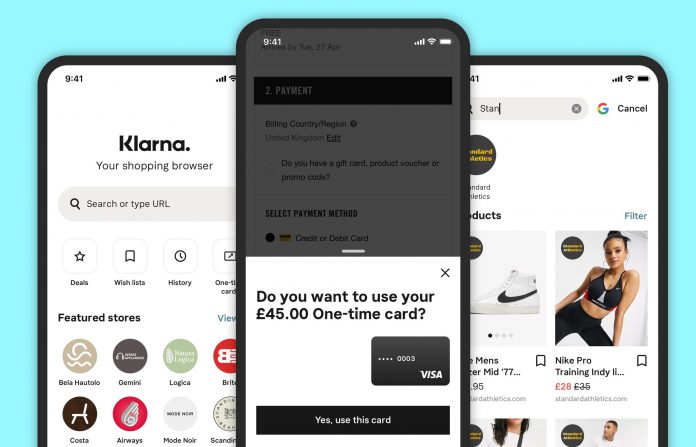

Banking, payments and shopping service Klarna launched its Shopping app, enabling users to pay in any online shop directly through the Klarna app, eliminating the need to use a credit card.

This new Shopping feature will allow UK Klarna users to shop at any online retailer – regardless of whether they are partnered with Klarna or not and split the payment into three interest-free instalments. It will also integrate monthly budgets and personal spending limit functionalities for users to set and remain in control of their spending.

The feature is already live in other markets including the US, Australia and Sweden. The app is available to download for iOS and Android mobile devices.

CEO Sebastian Siemiatkowski said, “At Klarna, we believe that no one should ever have to pay credit card fees or high-interest rates and now, thanks to our new in-app shopping feature, they don’t have to.

“Shoppers now can interact with their favourite retailers without having to leave the Klarna app, to create a smooth, safe and frictionless shopping experience.”

Other features include personalised wish lists and curated content based on consumers’ interests and favourite stores. In addition, customers will receive price drop notifications, deals updates, as well as a list of retailers for users to decide where to buy a certain product, at the “best” price.

“Our one-stop shop app is the future of shopping, it creates a truly personalised and bespoke service for every user and liberates consumers from ever paying more than the price of the product,” Siemiatkowski added.

The launch of Klarna’s new shopping feature comes during Klarna’s prominent #WhyPayInterest advertising campaign. The campaign highlights the difference between buy now pay later products and credit cards, challenging the outdated credit model that saw Brits pay £5.7bn in credit card interest and fees in 2020 alone.

Mobile wallets are becoming increasingly popular. According to Klarna, 72% of e-commerce will take place on a mobile device by the end of the year.

Furthermore, the move follows recent criticisms of the BNPL sector, which is currently unregulated. Critics of the sector say services, such as paying in instalments, encourage consumers to spend money they do not have and that those who fail to pay may see it reflected in their credit score.

Addressing these claims, Klarna launched an interactive campaign, in May, designed to enable customers to “discover the truth”.

Copyright © 2021 FinTech Global