Stripe launched a new tax compliance tool called Stripe Tax to help businesses automate the calculation and collection of sales tax, value-added tax (VAT), and goods and services tax (GST).

Stripe Tax, which is available in more than 30 countries and every US state, tells businesses where they need to collect taxes and creates comprehensive reports that make it easier for businesses to file taxes.

Customers can implement Stripe Tax with a single line of code or by updating a single setting in their Stripe Dashboard. Stripe will keep expanding the tools it offers to help internet businesses with sales tax. Specifically, the company is planning a suite of tax tools that other platforms can offer their own customers.

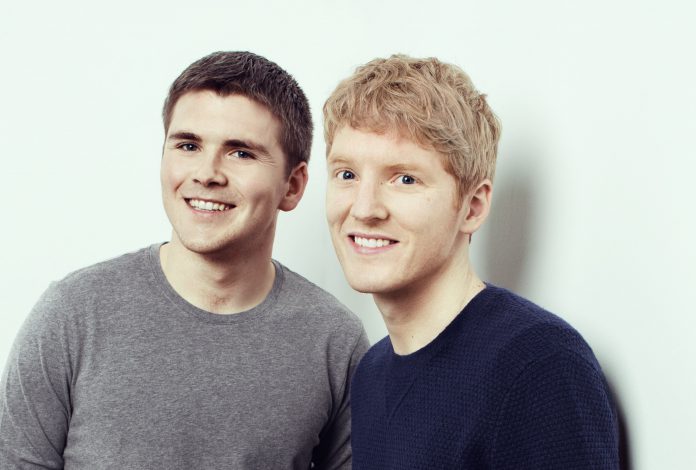

Stripe, which was founded by Patrick and John Collison, was recently valued at $95bn, making it the most valuable privately-owned company in Silicon Valley. Stripe Tax was engineered in Stripe’s Dublin HQ and has been in pilot mode over the last six months.

Customers have long sought more assistance with tax compliance and understandably so. The task has become increasingly complex. With growing numbers of businesses having an online e-commerce operation, it’s critical for proprietors to be able to generate accurate sales tax calculations. Nearly every US state now collects sales taxes from online merchants. Adding local online sales taxes into the mix, there are more than 11,000 different sales tax jurisdictions in the US alone, Stripe said.

Non-compliant businesses face legal and financial exposure as national governments around the world increase penalties for late or inaccurate filings. In the US, businesses face an average 30% interest charged on past-due sales tax.

According to a survey the company published last year, two-thirds of European businesses polled said managing tax compliance holds back their growth. A majority said they would launch more products and expand into more countries if relieved of the burden.

Commenting on the new launch, Stripe founder John Collison said, “No one leaps out of bed in the morning excited to deal with taxes. For most businesses, managing tax compliance is a painful distraction. We simplify everything about calculating and collecting sales taxes, VAT, and GST, so our users can focus on building their businesses.”

The full country list where Stripe Tax is launching includes Australia, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, New Zealand, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the United States and the UK.

Businesses like NewsUK, as well as startups like Tuple and Routetitan, are using Stripe Tax to simplify their tax compliance across multiple products and geographies.

And, NewsUK Head of Subscriptions Platform Ruan Odendaal said, “Directly integrating Stripe Tax into our subscriptions platform will save us countless hours—time that can be better spent elsewhere.”

In addition, Tuple co-founder Ben Orenstein added, “As a small company, we want to spend as little time thinking about tax collection as we can legally get away with. We’re thrilled to let Stripe Tax handle the heavy lifting for us.”

The product launch comes on the heels of Stripe’s acquisition of TaxJar, a provider of sales tax software for internet businesses.

Copyright © 2021 FinTech Global