Funding to the sector reached a five-quarter high in Q2 with nearly half of all transactions over $25m

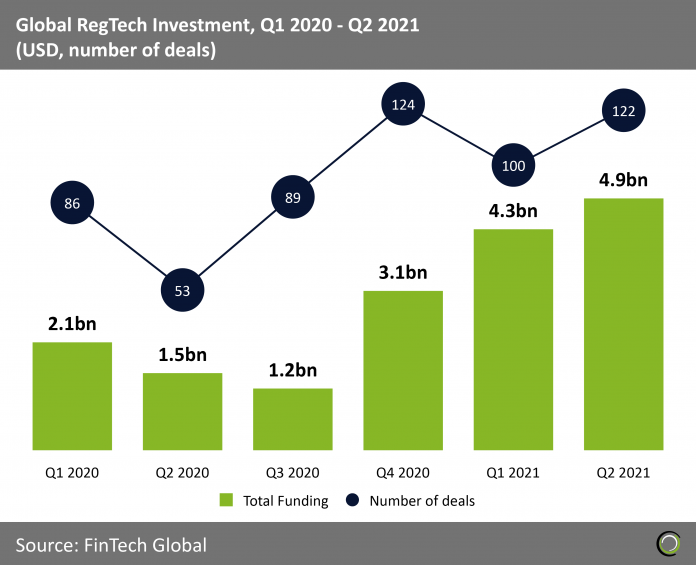

- The last quarter of 2020 witnessed the highest rebound in the number of deals and total funding raised by RegTech companies worldwide. The RegTech sector saw a 39% increase in the number of deals and $1.9bn increase in total funding compared to Q3 2020. Following a short COVID-19 driven pause in the first three quarters of 2020, RegTech investments bounced back strongly in Q4 2020 almost tripling from Q3 2020 ($1.2bn) to Q4 2020 ($3.1bn).

- Despite the decline in RegTech investments in the first three quarters of 2020, total deals and funding exceeded 2019’s figures. This trend continued in 2021 with companies raising $4.3bn across 100 deals in Q1 followed by a blistering second quarter which $4.9bn raised across 122 deals.

- Pandemic driven need for digital transformation alongside regulators’ demand for transparency and accountability continues to push for greater RegTech adoption in financial services. Pressure for digital transformation has caused financial service companies to adapt to virtual regulatory clarification services, digital identity initiatives, and electronic customer onboarding. This coupled with the risk of fraudsters taking advantage of financial systems digital integration led to investors investing money into RegTech companies solving these issues.

- After the dip in Q3 2020, RegTech Investments are trending upward. Total funding for H1 2021 is at 9.2bn exceeding investments that have been raised in the RegTech sector in the past 5 years. Changing regulations and the complexity associated with compliance along with the pressure faced by financial service companies to offer digital business solutions is driving interest in regulatory compliance without increasing structural costs. As jurisdictions around the world continue to evolve regulations related to financial services, such as privacy rules and open banking regimes, RegTech is only expected to become more important.

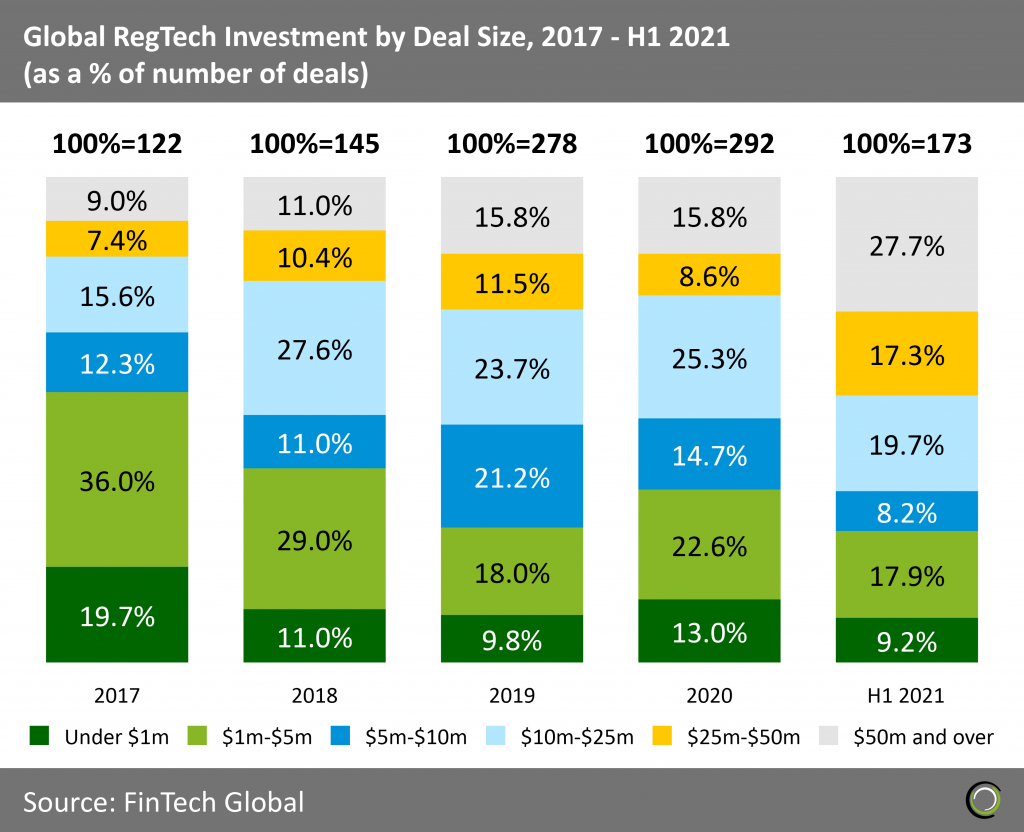

The share of deals $25m and over hit 45% in H1, signaling investors readiness to write big cheques post pandemic

- The share of deals $50m and over reached 27.7% in the first half of 2021, the highest percentage among deal size brackets. This can be attributed to the fact that there is a general trend in the RegTech industry towards maturity. Larger funds coupled with retreat in seed-stage funding, point toward development and consolidation of the sector.

- H1 2021 saw a tremendous increase in larger deals with 45% of all deals being $25m and over. New technologies such as cyber defense and artificial intelligence that fueled innovation in the RegTech arena are also maturing further contributing to the maturing of the RegTech sector. Investors are attempting to double-down investments backing established companies who require large funds to expand their business into new markets and locations and fund key global verticals to grow the organization.

- Deals in the $25-$50m range in H1 2021 have doubled in comparison to 2020. This surge in funding can be owed to the fact that seed-stage RegTech companies that received funding over the years are now advancing into the next stages of growth. Investors showed a renewed appetite for early-stage deals in 2020 as new compliance and digital transformation problems sprung up, while so far this year they are focused on backing those investments with follow-on funding and investing into larger companies to support their expansion.

North American companies account for eight of the top ten RegTech transactions globally in H1 2021

- Eight out of ten deals were closed in North America in H1 2021, making North America the dominant region for RegTech financing. North America accounts for 65% of deals in H1 2021. Looking beyond North America, Europe accounts for 23% of deals during the period.

- Five out of the top ten RegTech companies in H1 2021 were in the cybersecurity sub sector. Cybercrime is a major risk for the finance industry with companies like J.P Morgan Chase investing $600m per year to strengthen its cyber defense. The pandemic has increased the activity of fraudsters trying to take advantage of compromised systems. With financial service providers bring entrusted with personally identifiable information, the demand for cybersecurity will continue to evolve.

- The top RegTech deal for H1 2021 went to Boston based Transmit Security, a company creating frictionless identity for both workforce and customers across channels. Transmit Security raised a $543m Series A funding led by Insight Partners and General Atlantic in Q2 2021. The Company is said to use the funding towards expanding its reach and investing in key global areas to grow the organization.

- The top European deal went to Snyk, a cloud native application security empowering fast and secure development. Snyk raised $300m at a $4.7bn valuation at a late-stage funding that included Accel Tiger Global Management in Q1 2021. With this late-stage investment, Snyk is predicted to go public in the next couple of years.

New York is the hottest city for RegTech Investment in H1 2021 closely followed by London and San Fransico

London held the top spot for RegTech investment with 33 transactions completed in 2020. New York and San Francisco trailed behind with 30 and 25 deals respectively. A breakdown for top cities at the halfway mark through 2021 reveals that New York has surpassed London as the top city for RegTech activity.

London held the top spot for RegTech investment with 33 transactions completed in 2020. New York and San Francisco trailed behind with 30 and 25 deals respectively. A breakdown for top cities at the halfway mark through 2021 reveals that New York has surpassed London as the top city for RegTech activity. - New York accounts for 24 out of 174 RegTech deals. New York’s symbiotic relationship with the financial community has given NYC the distinction of being the world’s financial center. NYC comprises the largest Tech Talent in the US with the most computer-science graduates. Additionally, NYC’s tech industry is the fastest growing area of the US market. Also, NYDFS’s cybersecurity regulation and AML final rule on transaction monitoring and filtering have increased compliance workloads for financial services. All these factors contribute toward the city’s RegTech community.

- London came in second with 22 deals in the first half of 2021. Despite the circumstances caused by the Covid-19 pandemic, the UK saw larger later stage funding rounds indicative of a maturing industry. The FCA is a regulatory authority in London known for its propensity to embrace and innovate RegTech with Project Innovate and through the promotion of innovation sandboxes. The regulatory laws enforced by FCA have pressured financial services with heavy regulation and fines for non-compliance. This regulatory pressure has kept the finance industry in search of ideal RegTech services driving demand.

- Five of the top ten Cities including San Franscico, Palo Alto, San Mateo, San Jose, and Sunnyvale belong to the US state of California. The Silicon Valley enclosed area is a prime location for CyberTech development compared to NY and London due to the state’s prohibition of non-compete clauses, cybersecurity laws, vibrant community, professional networks, and top-notch universities rendering highly skilled tech talent.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global

London held the top spot for RegTech investment with 33 transactions completed in 2020. New York and San Francisco trailed behind with 30 and 25 deals respectively. A breakdown for top cities at the halfway mark through 2021 reveals that New York has surpassed London as the top city for RegTech activity.

London held the top spot for RegTech investment with 33 transactions completed in 2020. New York and San Francisco trailed behind with 30 and 25 deals respectively. A breakdown for top cities at the halfway mark through 2021 reveals that New York has surpassed London as the top city for RegTech activity.