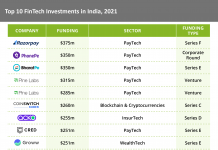

FinTech unicorn Pine Labs has received a $100m investment, which comes just hot off the heels of its $600m round.

The fresh $100m was supplied by Invesco Developing Markets Fund, a vehicle from US-based investment management firm Invesco.

Pine Labs previously secured $600m in July 2021, which had put its valuation at $3bn. The round was backed by Fidelity Management & Research Company, BlackRock and others.

Pine Labs has designed a selection of in-store and doorstep payment solutions, as well as buy now, pay later services. Its cloud-based platform helps businesses of all sizes access payment acceptance and merchant commerce solutions, with features including inventory management and customer relationship management.

Pine Labs CEO B. Amrish Rau said, “Over the last 18 months we have scaled our Prepaid Issuing stack, Online Payments, and also the Buy Now Pay Later (BNPL) offering. We continue to make progress in the larger Asian markets with our BNPL platform. Very excited to have a marquee investor like Invesco join us in the journey.”

It is unclear what the additional $100m will be used for. Following the close of the $600m round, Pine Labs said it was looking to scale its software commerce stack and provide its offline tech and payment capabilities to small merchants.

The company is also planning to launch into new geographies, with an eye on the Middle East.

Pine Labs hopes to list in the US stock market in the coming 18 months, with the ambition to be the first Indian FinTech to list offshore.

Copyright © 2021 FinTech Global