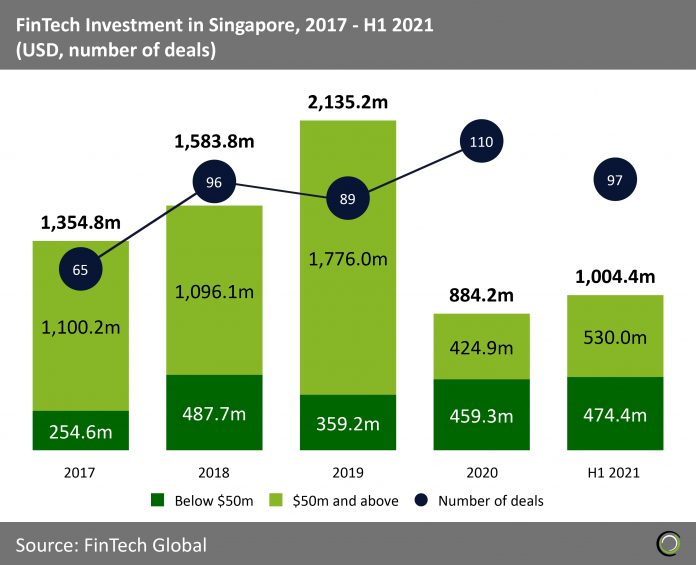

FinTech funding in the first half of 2021 has already surpassed the total capital invested in 2020

- FinTech Funding in Singapore already surpassed last year’s total by $120.2m, just six months into 2021. The growth in H1 2021, when compared to 2020, shows strong recovery in investor confidence. However, when comparing this year’s first half figures to 2018 and 2019, H1 2021 is merely recovering to its state prior to the pandemic. FinTech companies in Singapore raised just over $1bn in the first six months of 2021 across 97 deals and investment is on track to surpass the funding amount seen in before the pandemic.

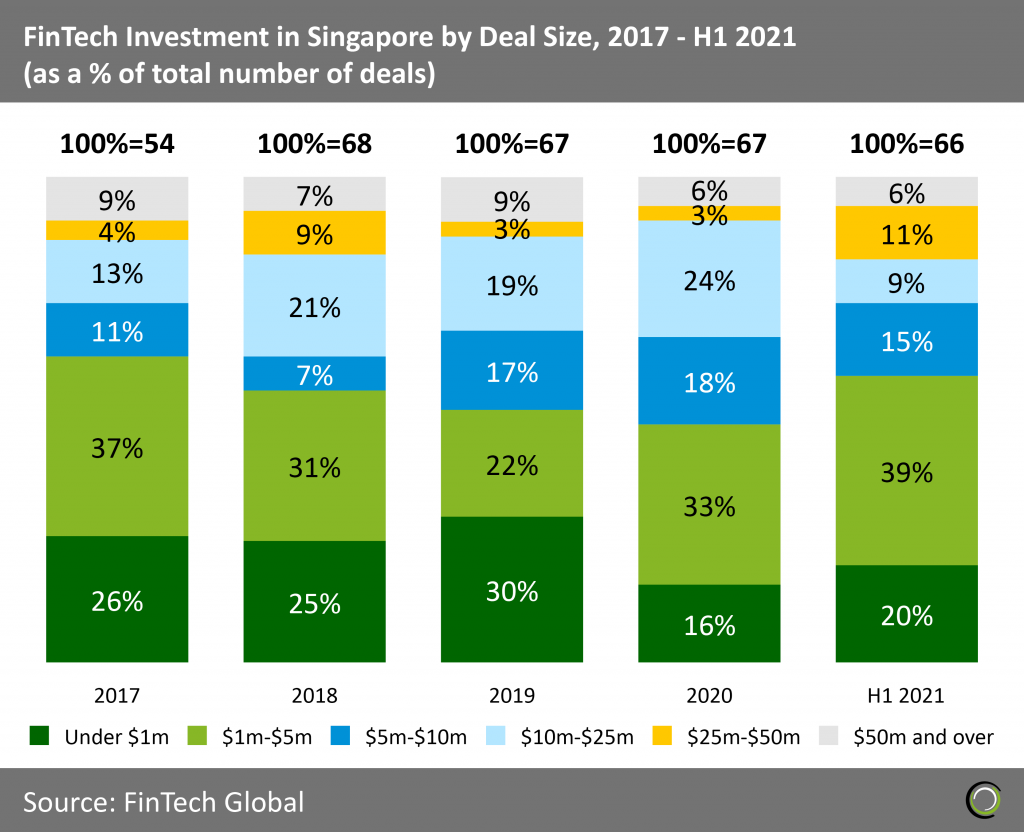

- For the first half of 2021, Singapore FinTech companies already acquired 97 deals, as opposed to the 89 deals that was raised for the entire year of 2019. Based on data from 2019, out of the 67 disclosed investments, 61 deals were below $50m. In 2021, out for the 66 deals with disclosed value, 62 were below $50m. Comparing the deals from 2019 and H1 2021, there is a noticeable trend that more investors this year are willing to invest lower levels of funding compared to the appetite for that type of transaction in 2019.

- With 2019 being the height of funding, it is important to understand what caused this outlier. In 2019, Sea Limited, a consumer internet company offering digital financial services, received the largest funding of $1.4bn from Tencent, with Tencent hoping to use Sea limited to expand its influence over Southeast Asia.

- FinTech funding in Singapore collapsed last year despite deal activity reaching a new record of 110 transactions. However, if we take out the Sea Limited’s $1.4bn investment from the funding figures in 2019, total capital invested actually increased YoY in 2020. Taking this into account the $1bn in funding raised in H1 2021 is even more impressive.

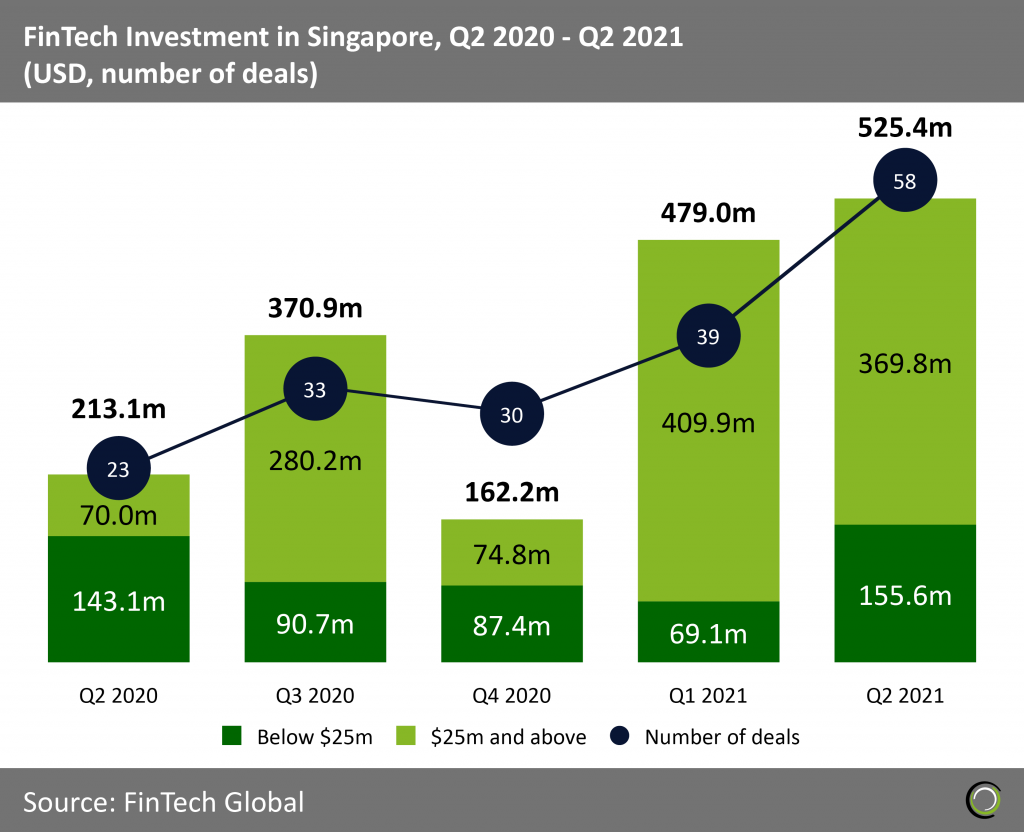

Singapore FinTech investment under $25m doubled in the second quarter

According to CNBC, Singapore’s Q4 2020 economy shrunk by 3.8%, after seeing a 9.5% GDP growth the previous quarter. With the introduction to the new variant of the virus, this hinder the rate of re-opening Singapore’s borders. The changes in GDP growth and the uncertainty of the industry would explain the huge drop in funding seen in Q4 2020.

According to CNBC, Singapore’s Q4 2020 economy shrunk by 3.8%, after seeing a 9.5% GDP growth the previous quarter. With the introduction to the new variant of the virus, this hinder the rate of re-opening Singapore’s borders. The changes in GDP growth and the uncertainty of the industry would explain the huge drop in funding seen in Q4 2020.- Additionally, Singapore’s FinTech funding for deals smaller than $25m, have increased 225% when comparing Q1 2021 to Q2 2021. The funding raised for smaller deals in Q2 2021 is the largest amount we have seen for the past three years. 40% of all the small deals in Q2 2021 were from the Blockchain & Cryptocurrencies sector. Seeing that Singapores experiences a tenfold crypto volume growth in Q1 2021, the growth would explain the large amount of small funding toward seed Blockchain companies.

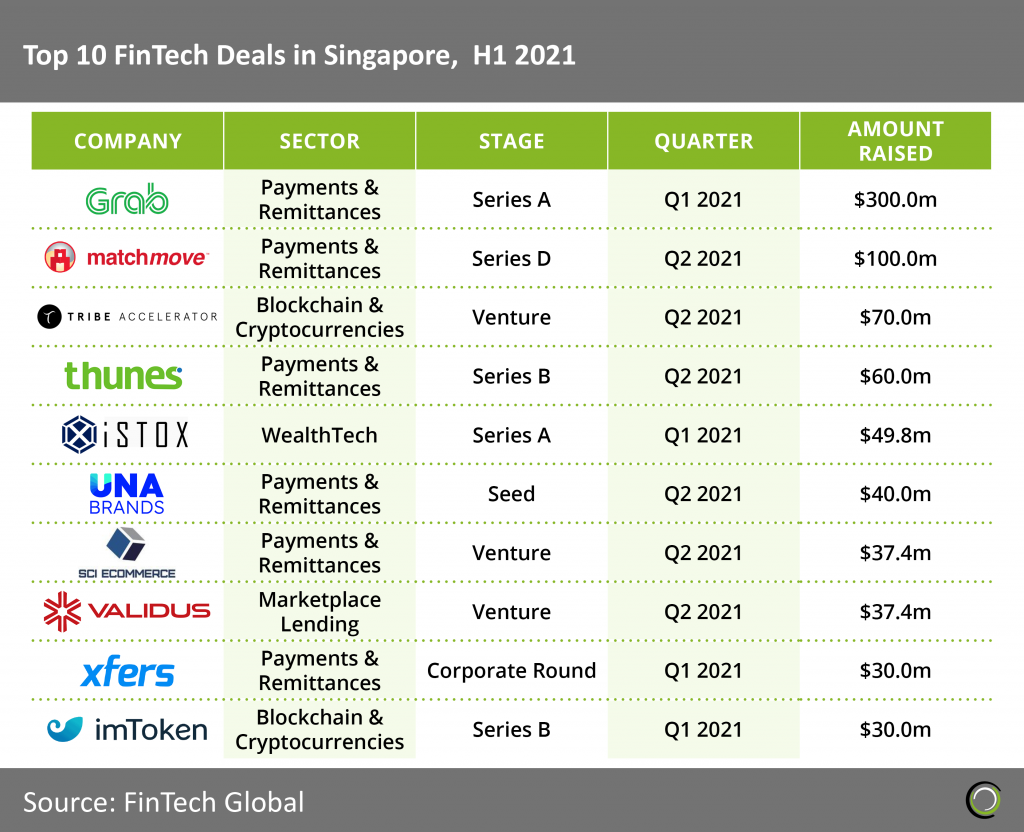

- It is worth mentioning that the main deals driving the strong figures in Q1 and Q2 2021 funding are from the Payments & Remittance and Blockchain & Cryptocurrencies Sectors, based on the top 10 FinTech deals made in H1 2021.

H1 2021 has seen the highest share of deals greater than $25m than any other year

The movement in the share of deals under $10m, from 2017 to H1 2021, indicates a W-shaped trend, with the high points being 2017, 2019, and H1 2021. At the end of 2016, Singapore launched its FinTech Regulatory Sandbox, which provides an environment for businesses to experiment in a controlled environment without the existing regulations. The sandbox was what resulted in the high point indicated in the 2017 data and later 2019 with the release of Sandbox Express. With the Sandbox Express providing faster and easier entry process, this enticed the needs of seed and lower level ventures.

The movement in the share of deals under $10m, from 2017 to H1 2021, indicates a W-shaped trend, with the high points being 2017, 2019, and H1 2021. At the end of 2016, Singapore launched its FinTech Regulatory Sandbox, which provides an environment for businesses to experiment in a controlled environment without the existing regulations. The sandbox was what resulted in the high point indicated in the 2017 data and later 2019 with the release of Sandbox Express. With the Sandbox Express providing faster and easier entry process, this enticed the needs of seed and lower level ventures.- During the height of the pandemic in 2020, the share of deals less than $25m were greater than any other year. This type of trend would indicate that investors were not as confident in investing large amounts for later venture series but were willing to invest in earlier seed and venture firms that were finding solutions for COVID-related problems, such as applications that allow easier contactless payments or solutions that help protect against online crime and fraud.

- In the first six month of 2021, the share of deals greater than $25m spiked, indicating that investors are more willing to invest bigger sums into FinTech that launched and showcased success, during the height of the pandemic. Lower-level fundings, on the other hand, also experienced all-time high since 2017. The lower-level funding indicates that many firms are creating new FinTech to combat the issues that resulted during COVID, and investors are willing to support Seed and Series A companies creating new products and services, such as the Payments & Remittance and Blockchain changes.

Payments & Remittances company, Grab Financial, took the number one position for the largest deal completed in the first half of 2021

Grab Financial Group, a financial empowerment program that provides payment credit and insurance for drivers, remains the largest deal completed so far this year with $300m. With the average Series A funding amount being $15m, it is surprising to see Grab Financial Group, a Series A, beat MatchMove Pay, a Series D, in the amount raised.

Grab Financial Group, a financial empowerment program that provides payment credit and insurance for drivers, remains the largest deal completed so far this year with $300m. With the average Series A funding amount being $15m, it is surprising to see Grab Financial Group, a Series A, beat MatchMove Pay, a Series D, in the amount raised.- Back in February 2020, Grab, Grab Financial Group’s holding company, announced a $850m raise in funding and advancement towards payment and financial services (TechCrunch). Additionally, in December 2020, Grab-Singtel and 3 other companies secured a digital banking licenses by the Monetary Authority of Singapore. With these two critical development, Grab Financial Group, as a subsidiary group of Grab, has captivated the attention of investors.

- Based on the top 10 companies that raised the most funding, the Payments & Remittance sector seemed to be the most prominent in H1 2021, as we slowly come out of the pandemic. As seen throughout the pandemic, most small businesses have implemented contactless payments, and companies are creating new ways to transfer money between consumers and vendors. This new way of life comes with numerous problems as well. In 2020, Singapore experienced a 65.1% increase in crime rates compared to 2019, due to online scams and e-commerce loans. This issue alone has strongly influenced and shifted the focus of Singapore towards RegTech.

- With the increase in illegal activities online e-commerce and loans as well as the shift in the attention we see with larger companies, it is reasonable to expect an upward trend in the RegTech industry in Singapore.

Blockchain & Cryptocurrencies and Payment & Remittance companies completed half of the FinTech Investment deals made in H1 2021

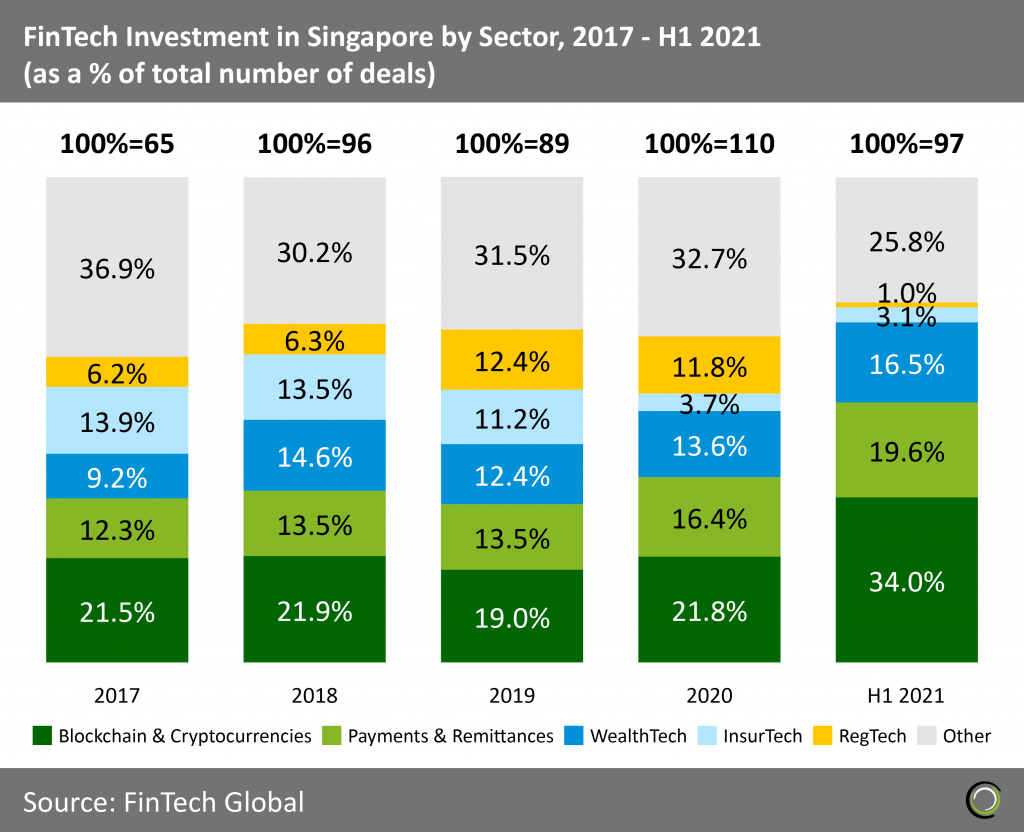

Looking at the number of deals in Singapore by sectors from 2017 to H1 2021, the largest changes occur in RegTech, Blockchain & Cryptocurrencies and Payment & Remittance. From 2019 to H1 2021, RegTech is on a downward trend from 12.4% to 1.0%. Meanwhile, Blockchain and Payments Sectors are growing, with Payments & Remittance taking up 19.6% and Blockchain at 34.0% of the FinTech industry in H1 2021.

Looking at the number of deals in Singapore by sectors from 2017 to H1 2021, the largest changes occur in RegTech, Blockchain & Cryptocurrencies and Payment & Remittance. From 2019 to H1 2021, RegTech is on a downward trend from 12.4% to 1.0%. Meanwhile, Blockchain and Payments Sectors are growing, with Payments & Remittance taking up 19.6% and Blockchain at 34.0% of the FinTech industry in H1 2021.- The Blockchain & Cryptocurrencies and Payments & Remittance sector occupy 53.6% of the FinTech industry in H1 2021. This is due to the new regulatory consent Singapore granted for cryptocurrency exchange. Monetary Authority of Singapore’s (MAS) five-year project to explore the benefits of the Blockchain & Cryptocurrencies sector and to expand technology for the Payments & Remittance sector would explain the increasing number of deals percentage for Payments & Remittance and Blockchain & Cryptocurrencies Sectors that was analyzed earlier.

- Along with the upward trend of Blockchain & Cryptocurrencies and Payments & Remittance, it is important to recognize the downward trend that RegTech is experiencing. With the need for RegTech improvements, the MAS had issued a $31.6m grant to expand the development of RegTech and FinTech. As mentioned before, with the advancement of Payments & Remittance and the Blockchain sectors, it is forecasted that the RegTech Sector will advance to keep up with the demands seen in other FinTech sectors.

- A chief development that is keeping our eyes glued to Grab-Singtel, Greenland Financial Holdings, Ant Group Co. Ltd and Sea Limited is the new issued digital banking license Singapore released at the end of 2020. During Q2 2021, the four main digital banking companies had little to no movement. The Green Finance Industry has been moving towards green finance, such as helping banks assess eligible green trade. Seeing that one of the four digital banking is focusing its attention towards RegTech.With the new license, we expect to see these companies have a larger influence on the overall trend.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global

According to CNBC, Singapore’s Q4 2020 economy shrunk by 3.8%, after seeing a 9.5% GDP growth the previous quarter. With the introduction to the new variant of the virus, this hinder the rate of re-opening Singapore’s borders. The changes in GDP growth and the uncertainty of the industry would explain the huge drop in funding seen in Q4 2020.

According to CNBC, Singapore’s Q4 2020 economy shrunk by 3.8%, after seeing a 9.5% GDP growth the previous quarter. With the introduction to the new variant of the virus, this hinder the rate of re-opening Singapore’s borders. The changes in GDP growth and the uncertainty of the industry would explain the huge drop in funding seen in Q4 2020. The movement in the share of deals under $10m, from 2017 to H1 2021, indicates a W-shaped trend, with the high points being 2017, 2019, and H1 2021. At the end of 2016, Singapore launched its FinTech Regulatory Sandbox, which provides an environment for businesses to experiment in a controlled environment without the existing regulations. The sandbox was what resulted in the high point indicated in the 2017 data and later 2019 with the release of Sandbox Express. With the Sandbox Express providing faster and easier entry process, this enticed the needs of seed and lower level ventures.

The movement in the share of deals under $10m, from 2017 to H1 2021, indicates a W-shaped trend, with the high points being 2017, 2019, and H1 2021. At the end of 2016, Singapore launched its FinTech Regulatory Sandbox, which provides an environment for businesses to experiment in a controlled environment without the existing regulations. The sandbox was what resulted in the high point indicated in the 2017 data and later 2019 with the release of Sandbox Express. With the Sandbox Express providing faster and easier entry process, this enticed the needs of seed and lower level ventures. Grab Financial Group, a financial empowerment program that provides payment credit and insurance for drivers, remains the largest deal completed so far this year with $300m. With the average Series A funding amount being $15m, it is surprising to see Grab Financial Group, a Series A, beat MatchMove Pay, a Series D, in the amount raised.

Grab Financial Group, a financial empowerment program that provides payment credit and insurance for drivers, remains the largest deal completed so far this year with $300m. With the average Series A funding amount being $15m, it is surprising to see Grab Financial Group, a Series A, beat MatchMove Pay, a Series D, in the amount raised. Looking at the number of deals in Singapore by sectors from 2017 to H1 2021, the largest changes occur in RegTech, Blockchain & Cryptocurrencies and Payment & Remittance. From 2019 to H1 2021, RegTech is on a downward trend from 12.4% to 1.0%. Meanwhile, Blockchain and Payments Sectors are growing, with Payments & Remittance taking up 19.6% and Blockchain at 34.0% of the FinTech industry in H1 2021.

Looking at the number of deals in Singapore by sectors from 2017 to H1 2021, the largest changes occur in RegTech, Blockchain & Cryptocurrencies and Payment & Remittance. From 2019 to H1 2021, RegTech is on a downward trend from 12.4% to 1.0%. Meanwhile, Blockchain and Payments Sectors are growing, with Payments & Remittance taking up 19.6% and Blockchain at 34.0% of the FinTech industry in H1 2021.