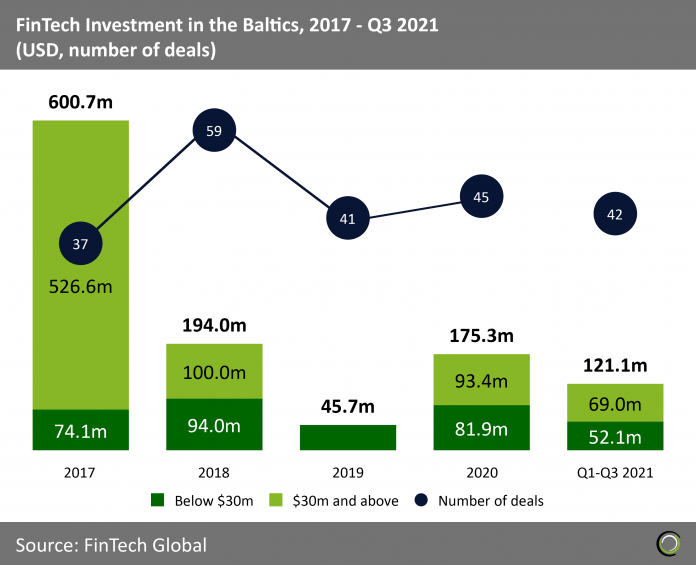

FinTech companies in the region raised $121m across 42 deals during the first nine months of 2021

- The FinTech industry in the Baltics recorded strong growth in deal activity between 2017 and 2018 as the number of transactions increased from 37 to a record high of 59. Funding peaked at just over $600m in 2017 driven by large transactions as Coinverco, a crypto investment management and trading platform, and 4finance, an online lending group, raised $120m and $325m, respectively.

- However, FinTech investment declined in 2019 with deal activity falling to 41 transaction and funding levels dropping 76.4% to $45.7m. Even if we exclude volatile over time large deals above $30m from the analysis total capital invested still declined by 51.4%.

- Despite being a small market, the countries in the region – Latvia, Lithuania and Estonia – possess a high level of technology penetration which has produced a disproportionally high number of tech hardware and software startups. As such the ecosystem showed resilience in the face of the pandemic last year with FinTech funding growing 3.8x to $175.3m. Deal activity also picked up from 41 deals in 2019 to 45 transactions in 2020.

- While the rate of funding growth stalled so far this year with only one deal over $30m recorded in the first three quarters, deal activity is set to increase again with current levels already at 93% of last year’s figure.

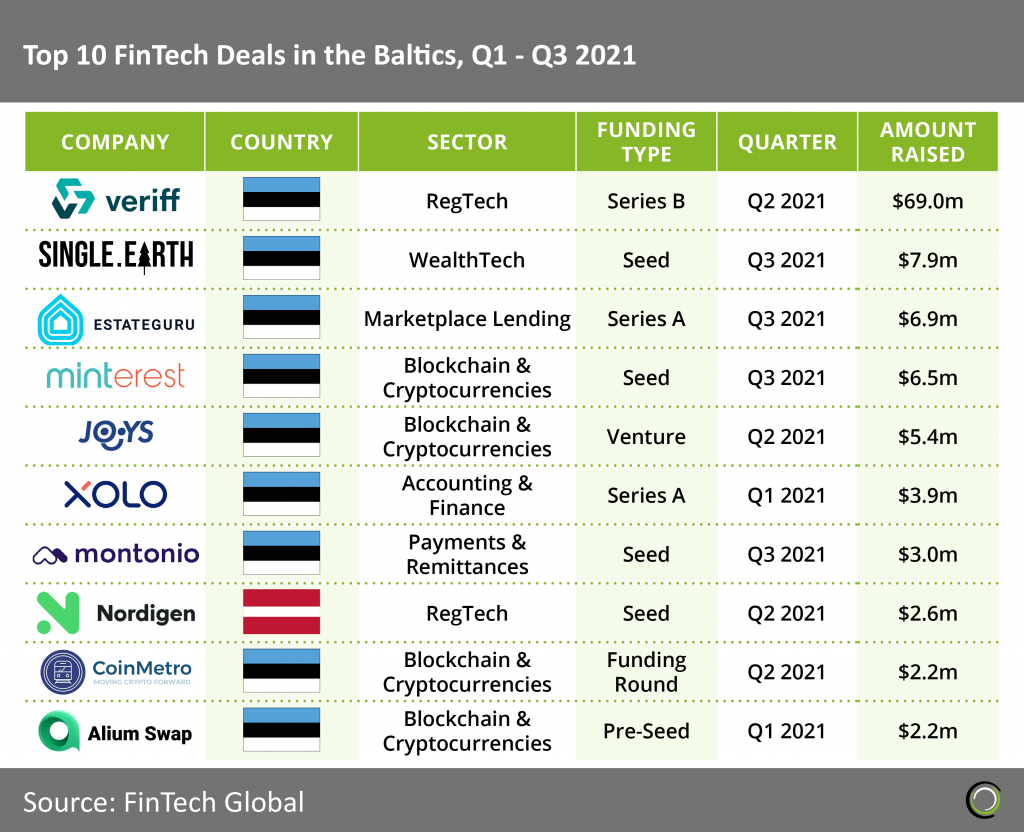

Estonian companies completed nine of the ten largest FinTech deals in the Baltics so far this year

- The top ten FinTech deals in the Baltics completed in the first three quarters of 2021 collectively raised $109.5m, making up 90.4% of the overall investment in the region during the period. The high levels of concentration of capital in large deals is normal given that the average deal size in the Baltics so far this is just $4.7m.

- Estonian companies took nine spots on the list with Veriff, a global identity verification service company, closing the largest deal in the country in 2021. The company raised $69m via a Series B round led by Institutional Venture Partners and Accel. Veriff will use the fresh capital to build on the ‘fast-growing’ market opportunity in the US as well as deliver on its promise of building a stronger source of identity online than government-issued IDs alone currently provide.

- The only company based outside of Estonia on the list is Nordigen, a Latvia-based free open banking API that provides PSD2 data connections to all major European banks, which raised a $2.6m Seed round. Unlike other industry leaders in the space such as Tink, the company offers its services for free and revenue comes from paid access to data analytics and insights. As a result, the company has quadruped the number of API users and onboarded more banks in six months than Tink managed in a year, according to Laurans Mesters, one of Nordigen’s founders.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global