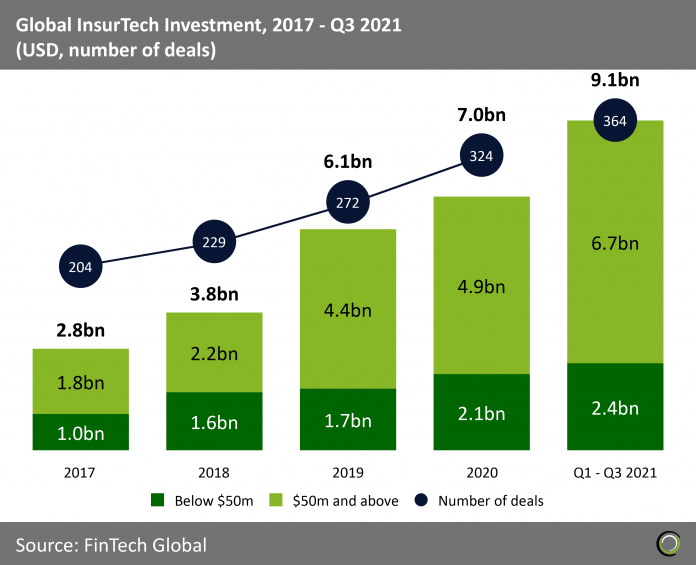

InsurTech companies raised $9.1bn across 364 deals in the first three quarters of the year driven by large transactions over $100m

- The global InsurTech industry saw tremendous growth in investment between 2017 and 2020 as investors sought to take advantage of the increased demand for digital services from traditional insurance companies and financial institutions. Total funding reached a record $7.0bn levels last year despite the coronavirus-caused economic uncertainty.

- The coronavirus pandemic only increased investors’ appetite for deals in the sector as the huge increase in the use of digital channels and the level of customer expectations due to COVID-19 restrictions has accelerated the need for innovation among insurers. Funding hit $9.1bn in the first nine months of 2021, already surpassing the total capital invested in the whole of last year. The massive investment growth was mainly driven by 25 deals valued at $100m or more, compared to just 10 such transactions recorded in the first three quarters of 2020.

- If we look beyond the eye-watering funding figures, the InsurTech sector also surpassed the previous annual deal activity record with companies in the sector completing 364 transactions so far this year. Further, the strong investment figures are not just driven by huge deals and the sector also saw 255 deals under $50 completed in the first three quarters of 2021 compared to 169 transactions of that size during the same period last year.

US companies raised seven of the top ten InsurTech deals globally in the third quarter of 2021

- The top ten InsurTech deals in the third quarter of the year collectively raised $1.78bn, making up 58.5% of the overall investment in the sector during the period. The ratio is much lower than the levels recorded in Q3 2020 when the ten largest transactions made up 79.7% of the total capital invested during the third quarter. This suggests investors are looking to back a wider array of solution providers offering solutions across the insurance value chain.

- Notably US companies still attract the most capital given the size of the insurance and healthcare markets in the country. As a result, American companies completed seven of the top deals in Q3 with Digit Insurance, an India-based tech-enabled general insurance company, bolttech, a Singapore-based insurance software developer, and Marshmallow, a UK-based digital-only insurer, rounding off the list.

- The largest deal of the period was raised by Hippo Insurance, a tech-powered home insurance provider, which raised $550m in a PIPE led by current investors (including Dragoneer, Lennar and Ribbit), top tier mutual funds and Reinvent Capital. The transactions was part of a merger with Reinvent Technology Partners Z, a special purpose acquisition company (SPAC), which allowed Hippo to go public on the NYSE.

If you want to see which are the leading companies in the InsurTech space, check out the newly announced InsurTech100 list for 2021.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global