Egypt-based Hollydesk has collected $325,000 in pre-seed funding, which makes it the first FinTech in the country aimed at managing SME expenses and accounts to raise capital.

The round was led by angel investor Faisal Abdel Salam, with contributions also coming from unnamed investors.

With the fresh equity, the company plans to expand its services and solutions into neighbouring countries.

Founded in 2021, the company lets small and medium-sized businesses monitor and control their company’s daily expenses in real-time. Employees can also request petty cash.

Employees can access their money through banks, digital wallets and POS machines and they can register suppliers, attach invoices, get approvals and pay suppliers from within the application.

The system connects all members into a single system, including stores, financial management, human resources and managers.

Hollydesk CEO Mahmoud Moussa said, “We seek to use the new funding to develop technologies for our solutions, assign new competencies within the team, and launch other services that will be announced soon with major Egyptian banks, which is in line with the Egyptian government’s plans to achieve financial inclusion, especially for workers within small and medium companies.”

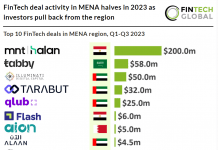

A handful of Egypt-based FinTech companies have raised capital this year. MNT-Halan, a digital banking platform aimed at the underserved consumers, collected $120m in funding to support its international growth.

Another local FinTech to raise funds this year was Telda. The digital bank raised $5m in its pre-seed funding round.

Copyright © 2021 FinTech Global