A trio of FinTech companies have been selected to receive equity-free grants as part of Village Capital Finance Forward Latin America 2021, an investment-readiness programme.

The companies were peer-selected from the members of Village Capital latest accelerator, which is comprised of 12 participants.

Mexico-based Akiba, which offers payroll lending, salary on demand and saving funds for low-income employees in Latin America, received the largest grant. It was awarded $40,000 from MetLife Foundation.

Brazil-based HiSofi, which allows credit consumers to choose how they want to settle their debts, and Mexico-based ContaAyuda, which leverages machine learning to automate accounting, taxes and finance for small businesses, both received grants of $30,000.

Village Capital Latin America regional director Daniel Coss?o said, ?Financial health is a powerful force for economic stability and mobility in Latin America.

?The creativity and disruptive force that these entrepreneurs hold, along with the profound empathy that they feel for their communities, make out of this sector an unstoppable tool for our region. The pandemic, the economic crisis, and the sub-banked population start to visualize technological alternatives for a regional economic recovery.p>

Over 90 entrepreneurs, spanning 11 countries in Latin America, applied for a spot in the three-month virtual accelerator. The 12 companies selected for the cohort are building solutions around payroll financing, SMBs management, and P2P lending, as well as other areas in FinTech.

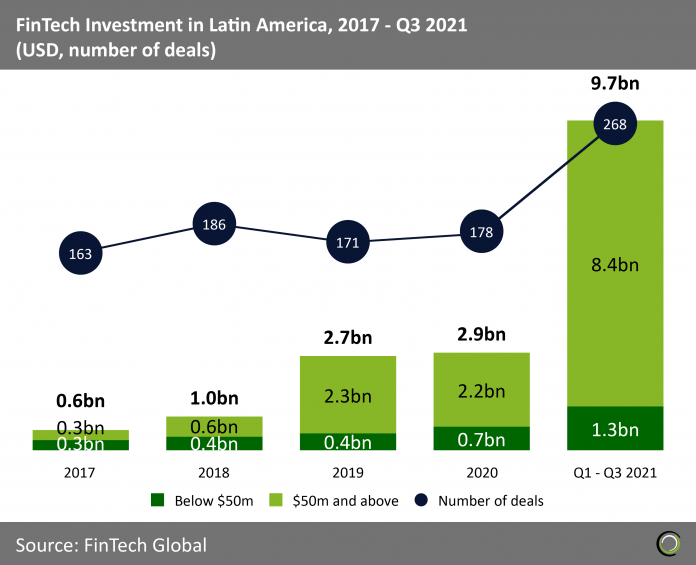

FinTech in Latin America has been booming in 2021. In just nine months a total of $9.7bn has been invested through 268 deals in the region. To put this in perspective, between 2017 and 2020 just $7.2bn has been invested into the region FinTech scene.

Copyright ? 2021 FinTech Global

Copyright ? 2021 FinTech Global