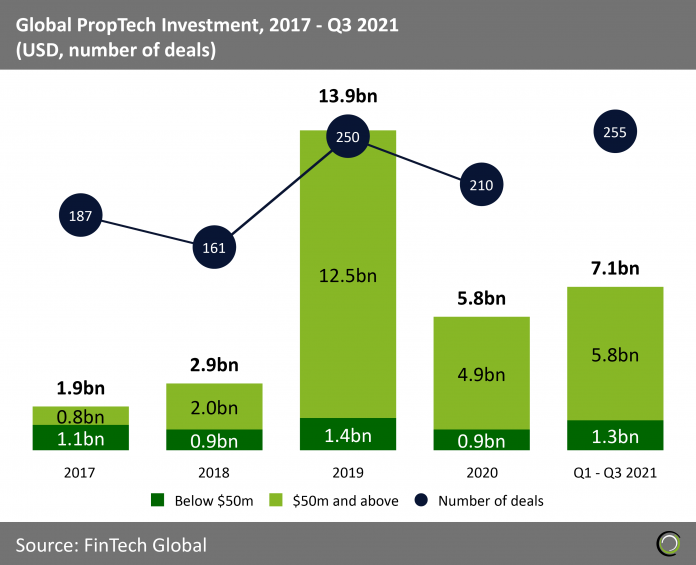

PropTech funding hit $7.1bn in the first nine months of 2021 after the sector saw total capital invested decline nearly 60% last year amid Covid restrictions

- In the first three quarters of the year, PropTech companies raised $7.1bn, already surpassing 2020’s levels. However, even with an increase of almost 23% in total funding compared to last year, 2021 is still far away from the level of funding recorded in 2019. That year, $13.9bn worth of funding was raised across 250 deals, with only 10% of capital coming from earlier stage deals (under $50m).

- PropTech companies raised $18.7bn across 598 deals between 2017 and 2019, with the number of PropTech transaction increasing by 33% from 187 in 2017 to 250 in 2019. During this period, 81% of capital was invested in deals of value equal or above $50m for big data and real estate technology improvements, and to optimise operations. Investors are relaying on the PropTech sector, and they expect high returns from their investments especially in the United States, where interest rates are historically low now.

- As of 2021, the Blackstone Group is one of the largest private owners and investors in the Real Estate tech market. Along with Adam Street Partners and others, in Q2 2021 Blackstone contributed, for example, to the Series B funding round of Dottid, an American Real Estate company that drives commercial real estate leasing transactions.

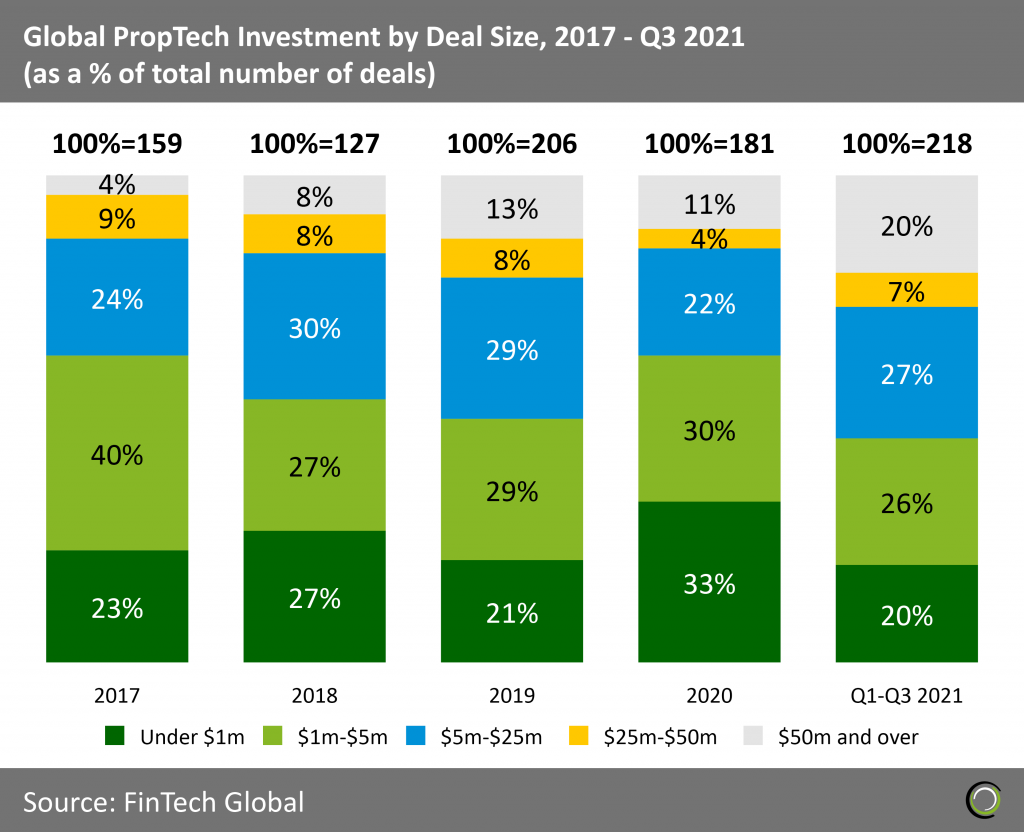

Increasing deal sizes highlight the increasing maturity in the PropTech sector

- As of Q3 2021, deals under $1m have decreased by 13 percentage points (pp) compared to 2020, underlining the increasing maturity in the PropTech sector. However, the portion of deals between $1m and $5m decreased only by 4 pp from 2020 to 2021 remaining a significant part of the PropTech funding landscape highlighting the solid levels of follow-on funding. Matching the overall decrease in small size deals in 2021, there was an increase in funding rounds over $25m. From 28 deals in 2020, PropTech companies recorded 59 deals between Q1 and Q3 2021.

- In 2020, the effects of the pandemic were strong in the PropTech sector. In Q1 and Q2 2020, the real estate market froze due to lockdowns all around the world. However, this woke up PropTech investors who increased their investments in real estate firms that provide virtual home tours, online tools for property assessment and reliable data analysis software for personalised advertising. Digital transformation shifted towards millennials, who became the new home buyers.

- The number of mega deals (deals over $50m) increased by 16 pp from only 4% in 2017 to 20% in Q1-Q3 2021. In 2017, only 7 mega deals were recorded mainly via venture capital funding rounds stressing still low reliability on tech solutions in the sector. At the same time, however, deal activity increased to record levels. In 2017, Millennials made up the 65% of first-home buyers and almost 100% looked at online websites for home search. The percentage of home buyers interested in smart devices and smart home technologies is increasing, making them important features to be incorporated in houses nowadays. In 2019, the proportion of deals valued at or above $50m increased by 9 pp from 2017 levels, to 13% of all deals in 2019. As the real estate market keeps soaring, investing in PropTech seems quite promising.

- Despite iBuying still holds only a small percentage of the total residential real estate market, the pandemic highlighted some of its benefits, like reducing in-person visits and physical interactions. Owner can sell homes quickly and with lower fees while home seekers are more willing to buy and rent unseen properties. RedfinNow, the Buying division of Redfin (a buying-selling platform specialised in mortgage lending), is bringing enormous profits to the company even if it still represents almost 2% of the total company’s sales.

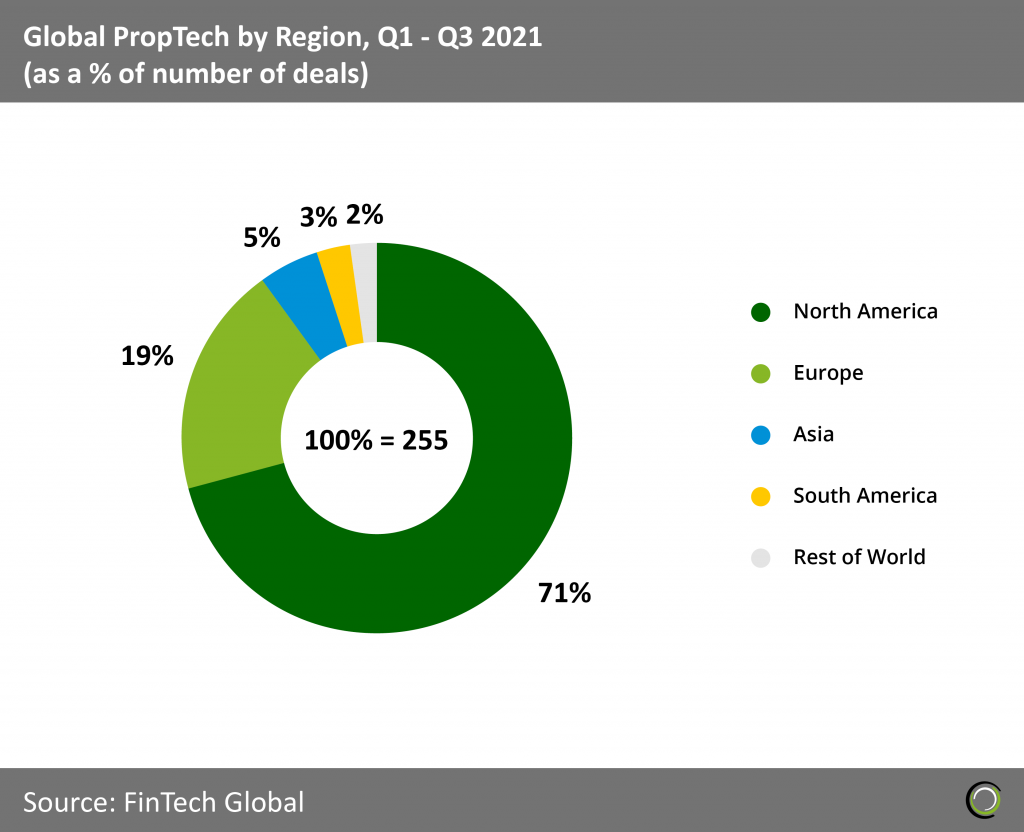

Between Q1 and Q3 2021, over 70% of the investment in PropTech have been raised by companies based in North America

- In 2021, North America has the lion share for PropTech investment by capturing 71% of total capital raised in the sector. As of Q3 2021, in North America the PropTech investment market raised $5.9bn of capital across 181 investments, aiming to become a record year for the region.

- In second place, European PropTech transactions account for 19% of deal activity, counting 48 funding rounds in 2021. The marketplace for real estate in the European area is gaining momentum, but the deal activity is still heavily concentrated in the western area, especially in UK, France, Germany, and Spain. However, Switzerland and Italy’s PropTech markets are growing, counting eleven and six deals, respectively.

- Asia saw only 14 deals so far this year with all being completed in H1 2021. Deal activity in the continent is low due to high barriers to entry in the Asian market, which bring more invested capital but in less transactions.

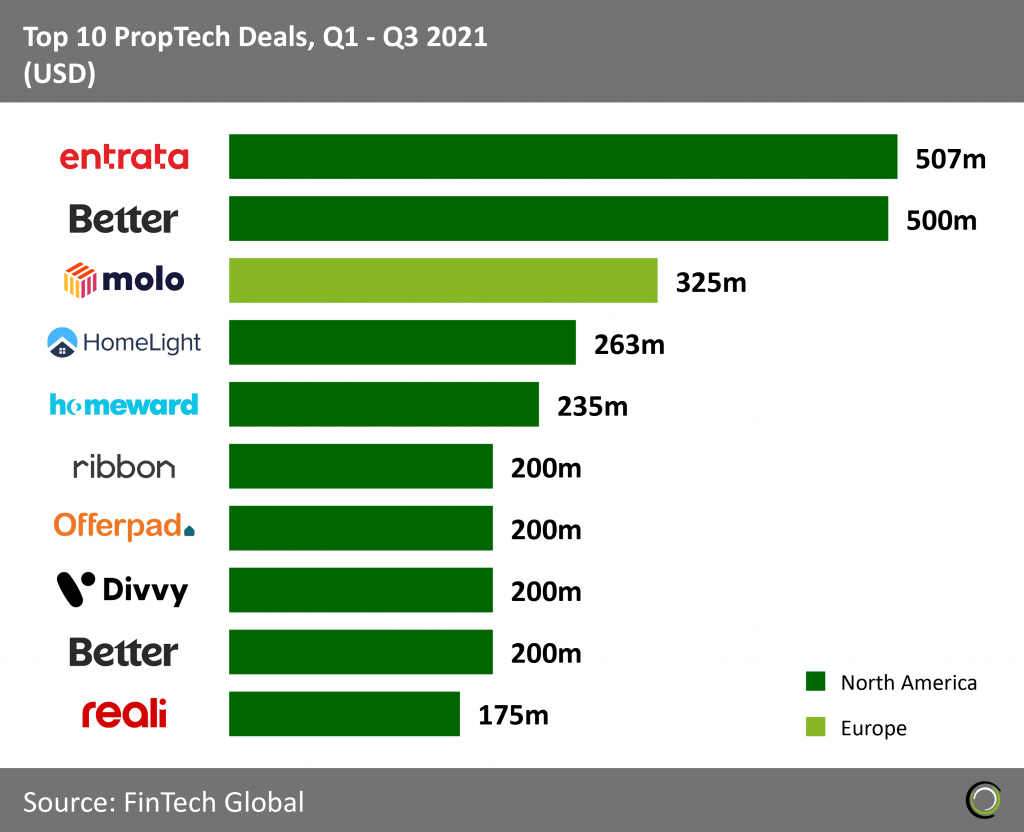

North American companies completed nine of top 10 PropTech deals in 2021

- Over $2.8bn have been raised by the Top 10 PropTech deals in the first nine months of 2021, of which $1.5bn came from six deals completed in Q3 2021. All of them, except for Molo (a British digital-only mortgage lender), were for companies based in the United States.

- Leading the Top 10 Deals in 2021 there is Entrata, a PropTech American company founded in 2003 that provides property management software to the multifamily housing industry. The company managed to raise $507m via private equity from Dragoneer Investment Group, Josh James, Ryan Smith, Silver Lake, and Todd Pedersen. Few months earlier, the American mortgage lender Better.com raised $500m in a secondary market round, selling shares to SoftBank. This mega deal helped the company signing a M&A with SPAC, aiming to go public in H2 2021.

- The only non-American company in Top 10 Deals is Molo. Molo is the UK’s first, fully-digital mortgage lender, founded in 2018. The company managed to raise $324.8m in January 2021 via a Series A by JIT Funds. Funding will be used for business development and product expansion since the company is planning to enter the residential mortgages market in early 2022.

- On September 2nd, HomeLight received $263m in debt financing. The company helps customers and owners thought the process of buying and selling, also connecting home sellers with real estate agents. With the fresh funding the company is aiming to triple its annual revenues in 2021 via platform investments and innovations.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global