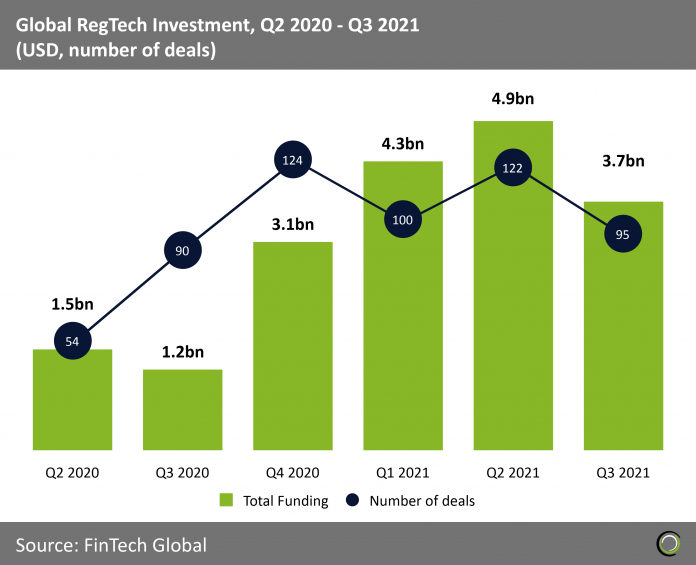

RegTech deal activity declined by 22% to 95 transactions from the highs reached in Q2

- RegTech funding saw sharp decline in 2020 amid the pandemic as the sector recorded consecutive drops in capital invested in the second and third quarter. In fact, RegTech companies globally raised just $1.2bn in Q3 2020, which is equal to little more than half of the capital raised in the opening quarter of the year and represented a five-quarter low.

- However, there were encouraging signs that investors were renewing their interest in the area during the second half of 2020 as deal activity recovered in Q3, after a poor second quarter where only 54 transactions were completed. This was followed by a blistering fourth quarter that saw $3.1bn worth of capital invested across 124 transaction, which was a five-quarter high for both funding and deal activity.

- While deal activity declined to 100 transaction in Q1 2021, total capital invested continued to climb and reach record $4.3bn. That trend continued in the second quarter as RegTech companies raised $4.9bn across 122 deals, a five-quarter high in terms of capital invested.

- However, RegTech investment cooled off in the third quarter as deal activity declined to 95 over the summer. As a result, only $3.7bn was invested in the sector during the period, a 25% drop compared to Q2. That being said the sector still recorded 16 transactions over $100m which, suggesting investor’s appetite for deals in the sector is still high and a quick bounce back can be expected during the final quarter of the year

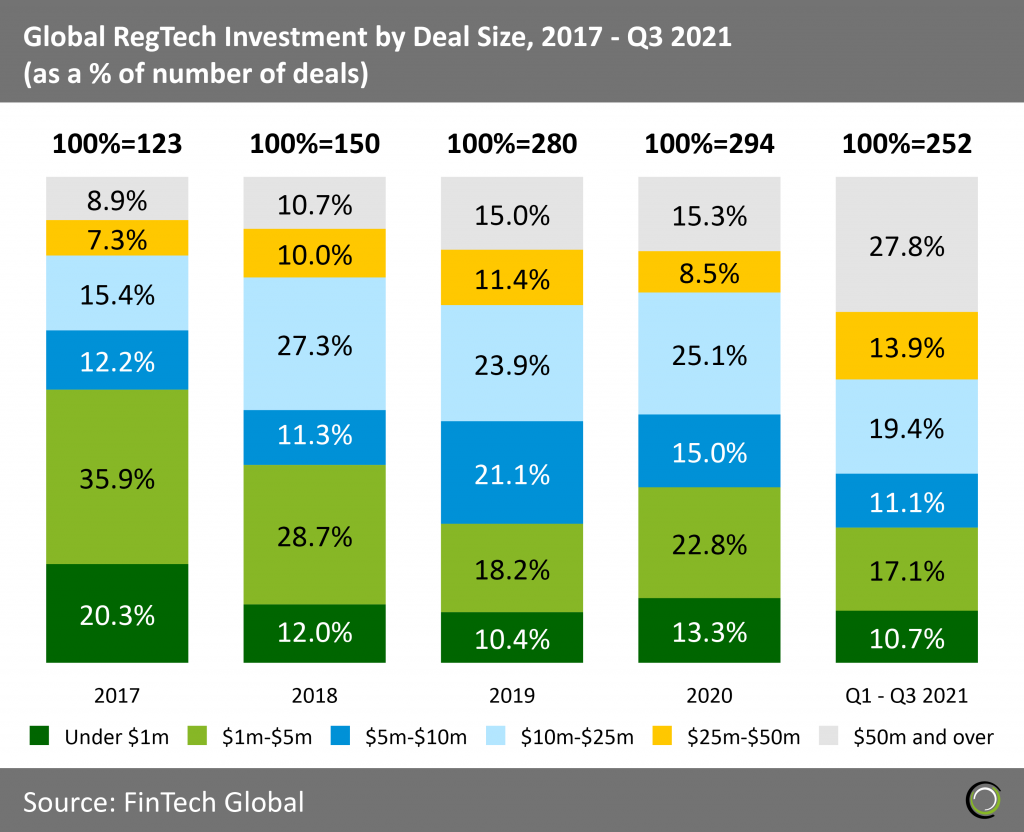

Investors’ appetite for large RegTech deals reached new highs in 2021

Investors’ appetite for large RegTech deals reached new highs in 2021

- As the global RegTech industry matured, the share for deals valued at $50m and over increased consistently from 8.9% in 2017 to 15.0% in 2019. That trend stalled last year and the share remained stable at 15.7%, when compared to previous years, as investors turned cautious while reassessing the long-term outlook for their portfolio companies and monitoring the economic impact of the pandemic.

- However, last year made clear that the increased shift to digital operations and remote work is forcing financial institutions to redesign legacy compliance processes. As such prospects for RegTech companies in areas such as digital onboarding, information security and remote communications monitoring have never been better. Investors followed suit and poured $12.9bn in the sector during the first nine months of 2021, driven by 46 deals valued at $100m or more. Indeed, the share of deals over $50m reached an all-time high of 27.8%.

- In contrast, the number of deals under $5m returned to pre-pandemic levels as the share of such transactions shrank to 27.8% this year compared to 36.1% in 2020. Investors temporarily looked to back new opportunities in the sector last year around remote work and other disrupted areas of business that have been affected by the coronavirus.

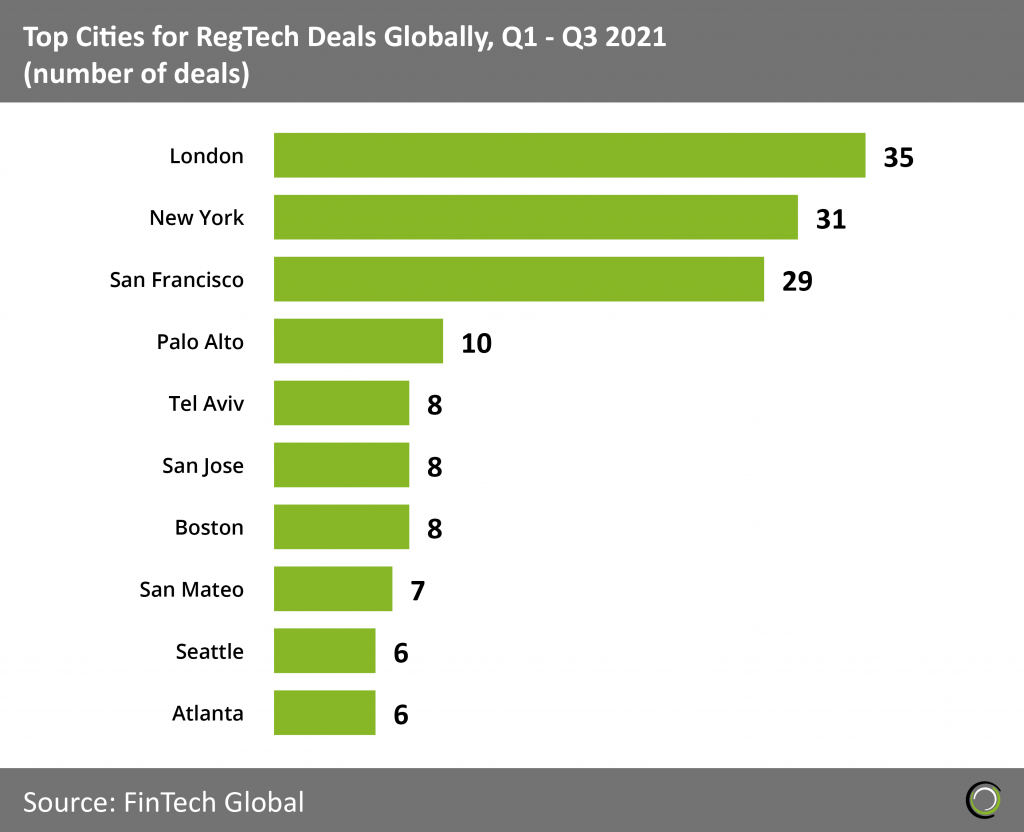

London wrestled top spot for RegTech deal activity from New York in the third quarter

- At the halfway mark through 2021, New York held the top spot for RegTech deal activity with 24 transactions completed in the city. London and San Francisco trailed with 22 and 21 deals, respectively. However, in the third quarter of the year London saw a flurry of deal activity and the city increased its number of transactions to 35 funding rounds taking the top spot so far in 2021. The largest investment recorded in the city was Snyk’s $300m Series E round completed in March. The company, which builds security into the application development process, saw its valuation climb to $4.7bn and was planning to use the fresh funds to scale up, recruit more talent worldwide and expand geographically.

- New York also saw healthy deal activity in Q3 to surpass the 30 transactions mark so far this year. With a strong financial services sector and natural first step to expand into the US for many European companies, the city is fostering a strong RegTech ecosystem. Dataminr, a real-time information discovery platform, closed the largest round in the city raising $475m in a Series F round which boosted the company’s valuation to $4.1bn.

- Interestingly, Tel Aviv was the only city outside of United States and United Kingdom to make the list. The city is home to leading RegTech companies Cappitech, a regulatory reporting company acquired in January by IHS Markit, and Cobwebs Technologies, an anti-money laundering intelligence solution, which were both recognised as RegTech100 companies previously. The largest deal this year was raised by Aqua Security, a cybersecurity platform, which completed a $135m Series E round in March.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global