There were 151 FinTech companies among the 457 new unicorns across all industries this year

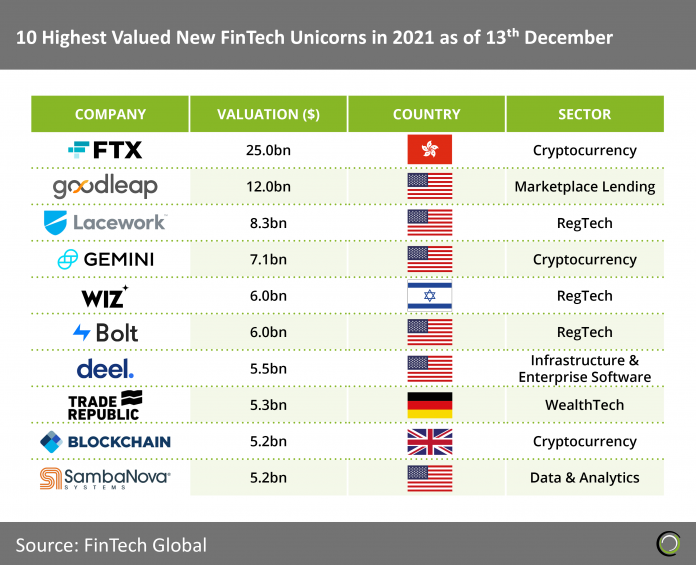

- FTX, a crypto currency exchange, is the largest FinTech unicorn of 2021 with a $25bn valuation and was founded by billionaire Sam Bankman-Fried in 2019. FTX raised $1.4bn during its Series B funding round in 2021 with the capital coming from 36 different investors. Lead investors of their series B funding round were Sequoia Capital and Ontario Teachers’ Pension Plan. “The additional capital and group of investors will let us provide the experience our users deserve and address other adjacent market opportunities including equities, prediction markets, NFTs and video-game partnerships,” said Ramnik Arora, head of product at FTX. FTX holds 16% of the market share for bitcoin futures as of August 2021, up from 9% in June 2021.

- Wiz, a cyber security platform designed to find security issues in cloud infrastructure, is valued at $6bn but what is interesting is that the company was founded in 2020, only one year ago. Wiz’s estimated revenue is $25m in 2021 and if we compare them to Lacework who provides similar services to Wiz and also features on the top unicorn ranking above, they have estimated revenues at $138m with a valuation of $8.3bn. Wiz’s hefty valuation is justified by their client base, which consist of Fortune 500 companies such as Blackstone and DocuSign. This gives Wiz an edge over their competitors as their clients have deeper pockets and will create potential growth to competitors that don’t want to be left behind with inferior security.

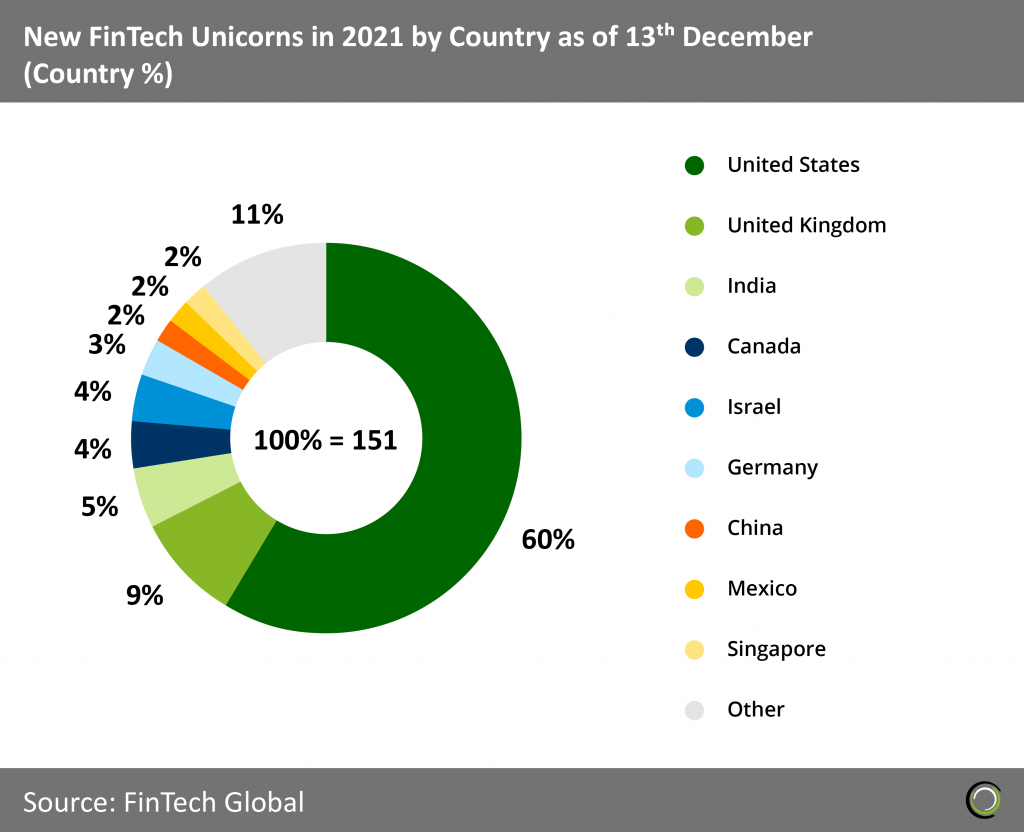

The US accounts for 60% of new FinTech unicorns in 2021

- New US-based FinTech unicorns in 2021 are valued at whopping $200bn in aggregate. The huge market share is due to the US financial services industry being the largest in the world and needs FinTech to keep up with competitors meaning there is a large existing customer base that wants FinTech services. The US also has regulation in place that makes it hard for foreign companies to enter the market. This means that they usually have to establish themselves under a US company. The UK also has a large established financial institutions that needs FinTech adoption to compete. Both the UK and US also benefit from existing tech hubs, the UK has the East London Tech City and the US has Silicon Valley, which contribute to regions successes.

- Senegal joins the list of countries with unicorns as Wave, an online bank that provides cash deposits, withdrawal, and peer-to-peer and business payments, is valued at $1.7bn. Wave benefits greatly by the large uptake of mobile money accounts in Sub-Saharan Africa. According to GSMA in 2020 Sub-Saharan Africa had $490bn in transactions, 548m registered users and 159m active users. Comparing this to the next biggest uptake of mobile money accounts, South Asia had $131bn in transactions, 305m registered users and 66m active users. This truly shows how large mobile banking is in Sub-Saharan Africa and how Wave are positioned perfectly to benefit.

- India’s is home to the third most new FinTech unicorns this year with seven companies. Venture capital companies have been very positive of the country. Reasons include a high mobile adoption with 550-600m users putting it second in the world, it also has the second highest internet usage 795m+ internet users as on Dec 2020. Over 65% of the Indian population is below 35 years as well which are more likely to adopt new technology especially in financial services where inclusion levels are still comparatively low.

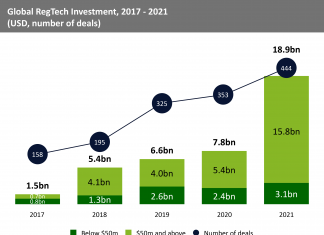

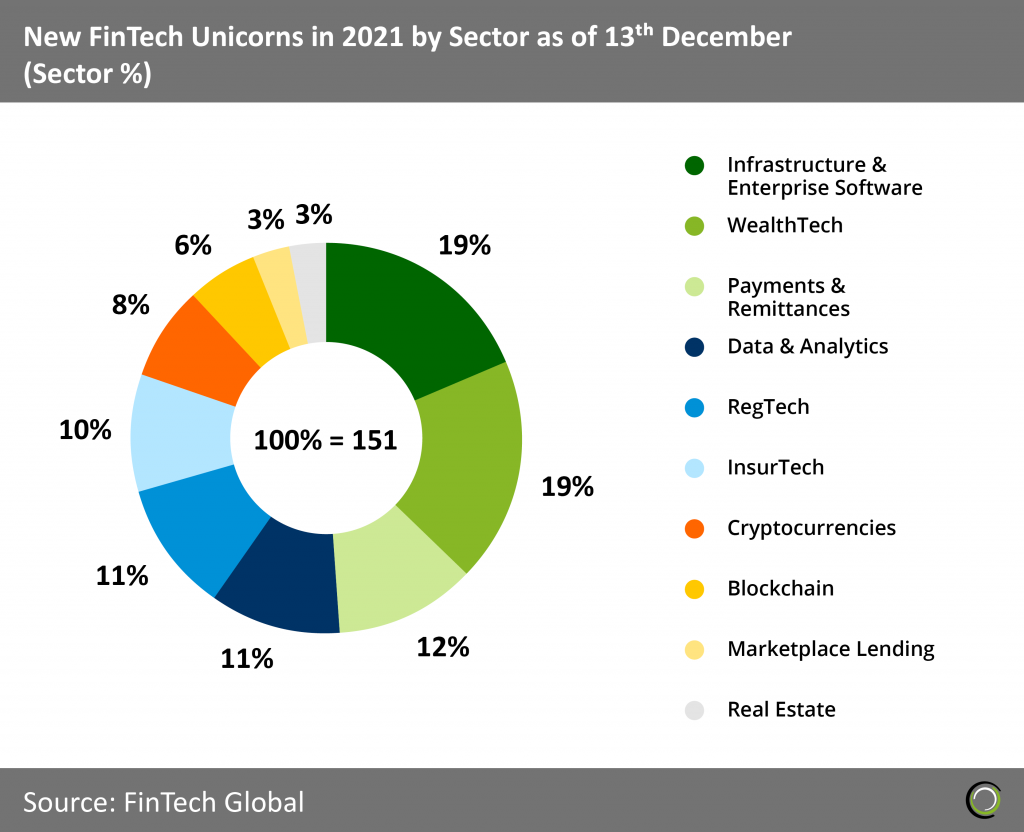

New Fintech unicorns are well distributed between sectors in 2021 with a small trend towards Infrastructure & Enterprise and WealthTech companies

- Infrastructure & Enterprise Software and WealthTech account for the most new unicorns in 2021, with 19% each and 38% combined of total FinTech unicorns. Both sectors have been accelerated due to Covid-19 with financial services organisations transitioning to offer more products online via partnership with tech companies. Younger people have also adopted core banking and investment technology quickly driving the sectors even further.

- Payment & Remittances accounted for 18 out of 151 total FinTech unicorns and 61% of Payment & Remittances unicorns were Point of Sale companies showing a large trend for this sub sector. Data & Analytics accounted for 17 out of 151 total FinTech unicorns and 59% of Data & Analytics unicorns were Big Data companies.

- Data & Analytics companies are becoming increasingly needed as financial institutions such as banks go online during Covid-19. This is because the amount of data to be processed increases, which gives a lot of opportunities to personalise services for customers and capture new segments by using AI and automated capabilities.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global