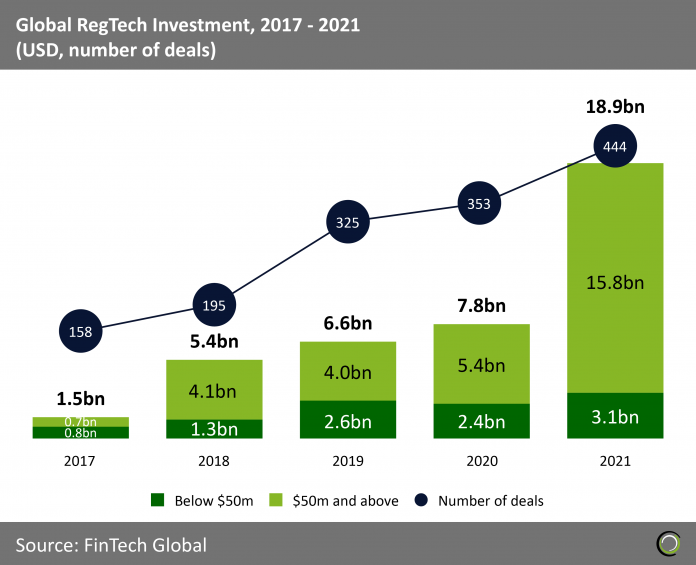

RegTech companies raised $18.9bn across 444 deals in 2021, beating the previous high of $7.8bn set in 2020

- Total investment in the RegTech sector rocketed from 2017 to 2020, growing at a compound annual growth rate (CAGR) of 73.2%, as investors increasingly backed companies looking to solve and bring efficiency to outdated compliance processes as well as take advantage of the new complex regulations coming into effect such as MiFID II and GDPR.

- The coronavirus pandemic only increased investors’ appetite for deals in the sector as the social distancing measures and flexible working arrangements forced financial services firms to employ surveillance software and digital solutions to monitor online risks and remote staff’s conduct. As a result, funding more than doubled in 2021 to hit $18.9bn, more than double the previous record recorded in 2020.

- The massive investment growth was driven by 61 deals valued at $100m or more, compared to just 24 such transactions recorded in 2020. However, if we look beyond the huge funding numbers, the RegTech sector still saw strong levels of deal activity at the early-stage segment of the market with 348 deals under $50m recorded last year, a growth of 12.9% YoY.

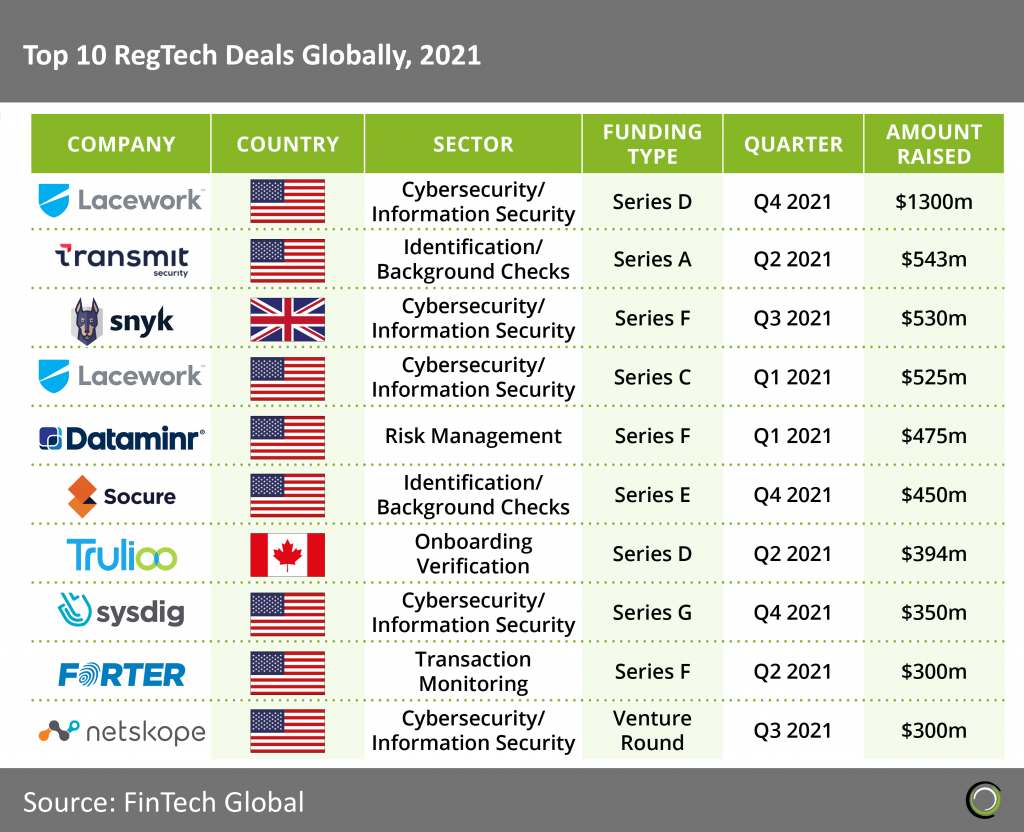

The RegTech sector recorded its first $1bn+ deal in 2021

- The top ten RegTech deals in 2021 raised in aggregate $5.16bn, more than double the figure recorded last year. Cybersecurity companies occupied half of the spots on the list as safeguarding digital operations has become the top challenge globally. Cybercrime is a major risk for the finance industry with companies like J.P Morgan Chase investing $600m per year to strengthen its cyber defences. The pandemic has increased the activity of fraudsters trying to take advantage of compromised systems. With financial service providers being entrusted with personally identifiable information and the rise in use of digital channels, the demand for cybersecurity will continue to grow.

- The biggest deal so far this year was completed by Lacework, a threat/anomaly detection and compliance platform across multicloud environments, which raised $1.3bn in a Series D round, making it the first 1bn+ transaction in the sector. The funding will support Lacework’s product development efforts as the company expands its engineering and R&D initiatives.

- The largest deal outside of North America was completed by Snyk, a UK-based cybersecurity platform that helps businesses to integrate security into their existing workflows, which raised $530m Series F valuing the company at $8.5bn. The fresh funds would further the development of its products, with new features to be announced. Funds will also be used to enhance its Developer Security Platform, build more workflow integrations and develop new features.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global