African FinTech Investment surpasses $2bn in 2021 for the first time

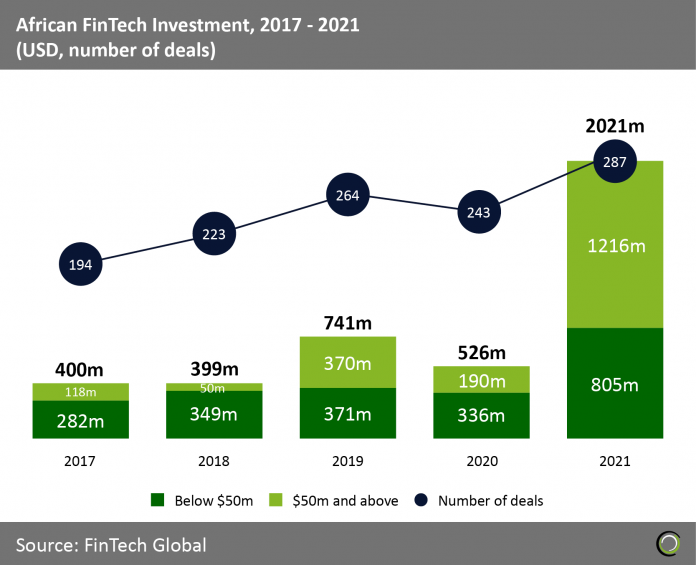

- Total capital invested in African FinTech companies grew by $1.49bn in 2021 compared to the previous year, setting Africa’s highest FinTech funding year to date at $2.02bn. The number of deals had a gradual increase of 18% YoY to a total of 287 deals. This shows that completed deals in 2021 are much larger in capital. The average deal was $10.7m in 2021 compared to $3.7m in 2020 which is due to keen interest from foreign investors.

- Africa is the continent with the youngest population worldwide. As of 2021, around 40% of the population is aged 15 years and younger, compared to a global average of 26%. FinTech adoption is more likely with a younger age group and may be a reason that investors bet big on the continent as the potential gains and new territory for established FinTech companies are astronomical. Examples of this are Wave, a Senegalese mobile payments company, which is backed by Stripe, an Irish-American payments company, and the 7th largest FinTech company by market valuation in the world.

- Africa also has a huge underbanked population. 42% of the adult population is estimated to not have a bank account in 2022, around 456 million people. FinTech companies are capitalising on this by providing alternative solutions via mobile. This is possible due to the large adoption of mobiles in Africa, currently there are 650 million mobile users in Africa. According to GSMA in 2020 Sub-Saharan Africa had the largest amount of mobile money transactions at $490bn, 374% higher than the second largest market, South Asia.

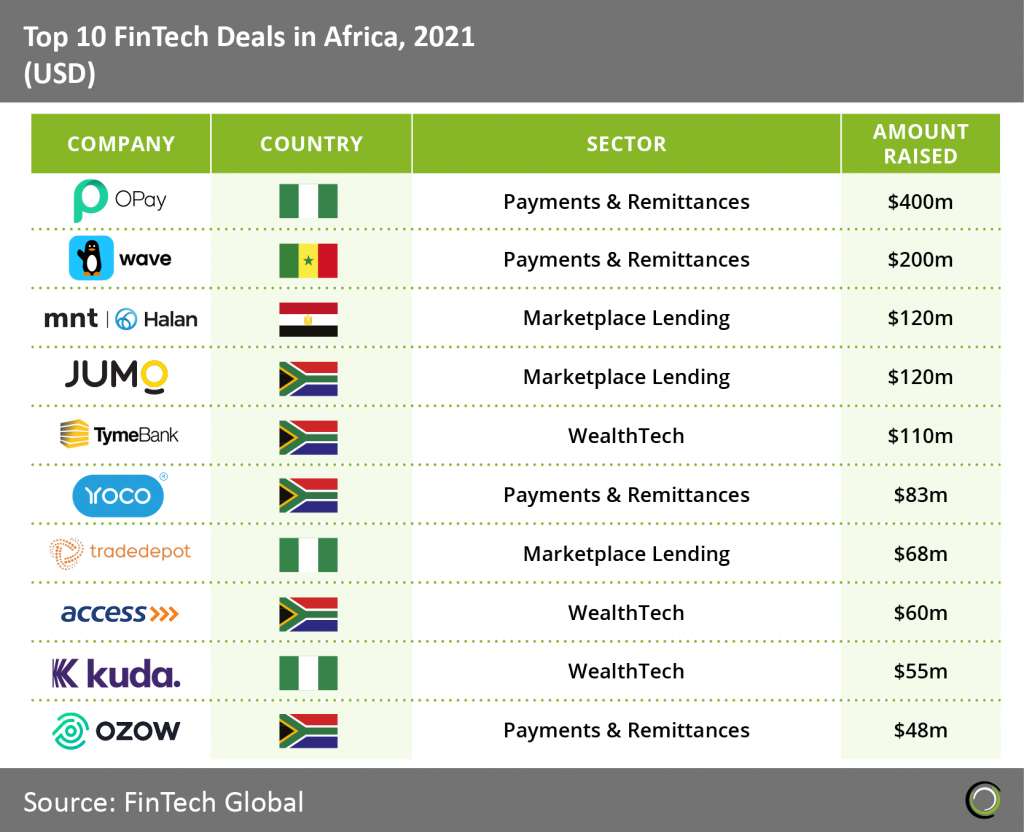

Top deals in Africa are dominated by PayTech and Lending companies in 2021

- PayTech and Lending companies account for 7 of the top 10 African deals in 2021 showing a large trend in the African FinTech investment. This trend also looks to continue as companies such as OPay and Tyme Bank intend to use this new capital to expand into new markets increasing usership, driving these sectors even further.

- OPay, a point of sale platform and mobile payment service based in Nigeria, more than doubled its funding last year with a $400m Series C round led by Softbank, the investor’s first bet in Africa. This was along with six other investors, valuing the company at $2bn. OPay, which has accumulated 160 million active users in Africa since its launch in 2018, said it will use the capital to invest in African markets including Nigeria and Egypt, as well as Middle Eastern markets.

- MNT-Halan, Egypt’s largest and fastest growing non-bank lender and payments platform, has propelled themselves into Egypt’s FinTech wave with $120m in funding as they look to expand to countries with large unbanked populations. In 2020, the Central Bank of Egypt allocated E£1bn for a FinTech Innovation Fund as well as new regulation to improve the market. The approved draft provides the Central Bank of Egypt to directly license and regulate payment systems and payment service providers, as well as regulate different aspects of financial technology. MNT-Halan have capitalised on this as regulators have granted the company licenses for micro and consumer finance, and it holds the first independent electronic wallet license for the Raseedy wallet from the country’s central bank.

- Tyme Bank, which offers a transactional bank account with zero or low monthly fees and a savings product, have grown rapidly and now has about 2.8 million customers. Their latest round of funding saw $110m invested in a private equity round from JG Summit Holdings and Apis Partners. Tyme plans to expand its digital bank for the underserved into Asia and Southeast Asia, starting with the Philippines.

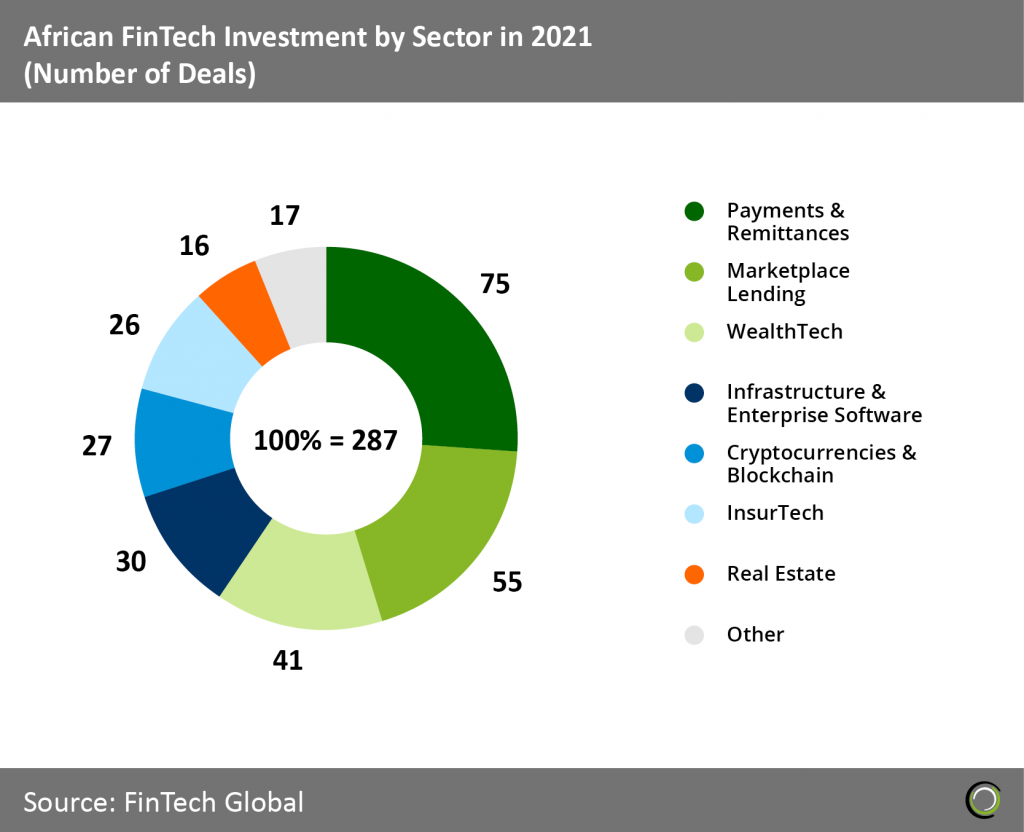

Cryptocurrencies & Blockchain companies have highest deal growth in 2021

- Cryptocurrencies & Blockchain companies had the most funding growth in 2021 with a 59% increase in deals from 17 in 2020 to 27 in 2021. This is due to Africa’s crypto market growing by $105.6 billion in 2021. Octopus Network, a cryptonetwork for launching and running Web3.0 application specific blockchains, aka appchains, was the largest funding round for the sector at $5m. Cryptocurrencies & Blockchain companies are growing in popularity and this is because it has disrupted traditional financial processes and systems. Higher usage driven by a desire for decentralisation and more transparent transactions are features that traditional banks cannot offer which has resulted in greater investment in the sector.

- Payments & Remittances was the largest sector at 75 deals in 2021 and saw a 32% increase from 57 deals completed in 2020. Marketplace Lending, the second largest sector had 55 deals and this was an increase of 34% YoY. Both these sectors have seen massive growth in capital invested as FinTech companies look to serve the underbanked in Africa. Both sectors are highly popular due to the access they provide and give users greater opportunities to handle their finances. These platforms are also highly competitive which results in constant innovation and incentives to use their services which benefits customers.

- WealthTech, the third largest sector in Africa had 41 in 2021 saw a 16% decrease from 49 deals in 2020. This is not a surprise though as other markets such as the UK experienced a decline in WealthTech deals of 45%. This shows that WealthTech is trending negatively and that the competitive industry is less attractive to new start-ups and funding.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global