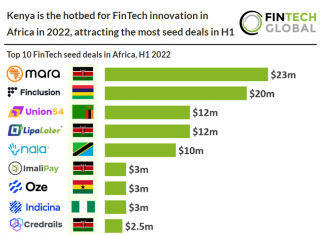

OZÉ, the FinTech startup which provides digital record-keeping tools with embedded finance products to MSMEs across West Africa, raised $3m in an oversubscribed pre-Series A round.

The round was led by major venture capital fund Speedinvest. Savannah Capital, Cathay AfricInvest Innovation Fund and several Angels experienced in operating and investing in global FinTech also participated.

OZÉ, which now has a client base of more than 125,000 business owners, will use the funds to expand the capabilities of its platform and increase access to affordable finance in Ghana and Nigeria through its partnerships with well-known commercial banks.

The OZÉ platform provides tools for business owners to understand and improve their performance as well as access to capital to fuel growth. Business owners use the platform to record transactions, stay on top of receivables, get paid by their customers, access business coaching, and can apply for a loan right in the app.

The platform also provides OZÉ with a proprietary data set of performance and behavioural data, which the company said gives it a competitive advantage in understanding and scoring a company’s credit risk. Financial institutions partner with OZÉ to provide small business loans.

The company said that the 100 million plus small businesses across West Africa have traditionally operated as brick-and-mortar enterprises running on pen and paper. Now, OZÉ said, as they look to build online presences demand for technology and financial products able to digitise business is increasing.

Copyright © 2022 FinTech Global