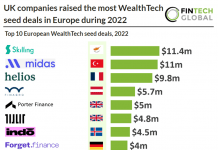

Icelandic FinTech company indó has launched from stealth after the close of its seed round on $4.5m.

This is the first challenger bank to emerge in Iceland. It also claims to be the first challenger bank aimed at acquiring customers’ primary salary-deposit account with a new-build and uniquely low-cost model while encapsulating existing financial infrastructure.

The genesis of Indó was the 2008 financial collapse, which saw the collapse of the country’s banking system. Indó was created to “restore faith in the banking system through ultimate transparency and no bullshit banking.”

Indó lives by three core principles. The first is the ease of creating an account that is designed for financial health. The second is a fair and transparent fee model that is aligned with customers. Finally, it is being open with customers so they know what is being done with their money.

The challenger bank claims it has better rates than any legacy bank and offers an easy-to-use mobile app.

indó CEO Haukur Skúlason said, “Over the centuries, banking has evolved from ‘a place to store money’ into a vast, complex financial services industry – one that is steeped in the mystique of money, privilege, power and exclusivity, thriving on opacity and getting away with shoddy customer service.

“The financial services industry is one of the lowest-ranked worldwide when it comes to trust and is driven by bank failures, ongoing scandals, revelations of corruption and participation in money laundering. indó is going back to the roots of banking to restore trust, regain transparency and return tradition to a field that sorely needs a new approach.”

Copyright © 2022 FinTech Global