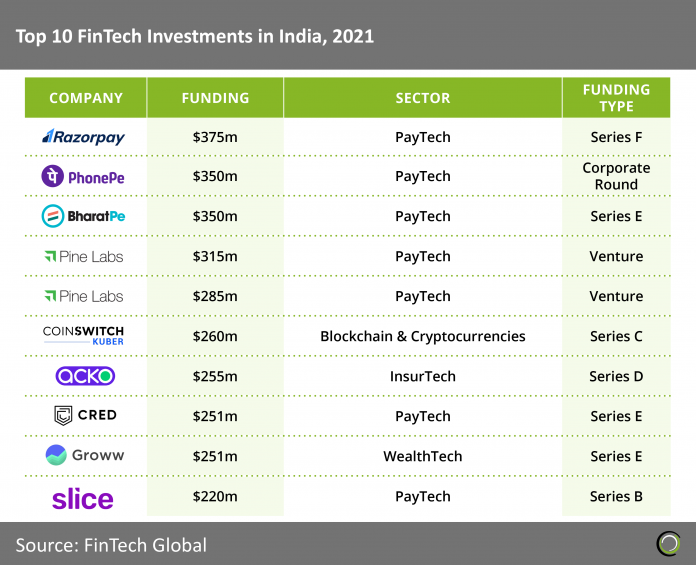

RazorPay, a point of sale platform, tops the list of the largest FinTech deals in India in 2021 with a huge $375m Series F financing which brought the company’s valuation to $7.5bn. The fresh funds will be used to scale RazorpayX, the firm’s neobanking platform, which already services 25,000 Indian businesses. PayTech companies have been attracting great investors’ interest given the value of digital payments in India has grown from $61bn in 2016 to $300bn in 2021, a nearly five-fold increase which is expected to grow further to $1tn by 2026. In addition, India’s FinTech adoption rate of 87% is substantially higher than the global average of 64%. Reasons for this are India’s cheap internet data and high smartphone penetration as well as a young population with 43% aged below 25. Indian PayTech companies also benefit from the country’s Unified Payments Interface (UPI), a mobile first payment platform, and the Aadhaar Enabled Payment System (AePS), a biometric first payment platform. “As of May 2021, India’s UPI has seen participation of 224 banks and recorded 2.6bn transactions worth over $68 billion, with more than 3.6bn transactions, in August 2021,” said Piyush Goyal, cabinet minister. Over 2 trillion transactions were processed using the AePS (Aadhar-enabled payment system) last year, he added.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global