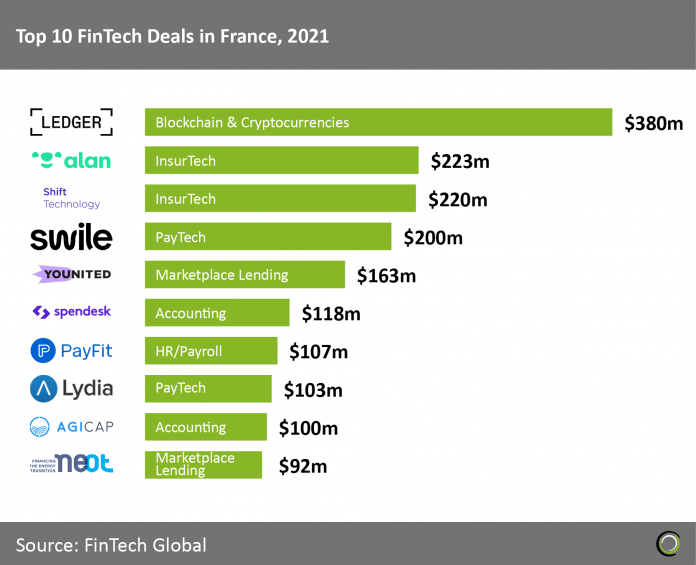

- Ledger, a physical crypto wallet, raised $380m in a Series C funding round led by 10T Holdings along with 32 other investors which set the company’s valuation into unicorn territory at $1.5bn. Ledger has sold over 3 million hardware wallets and claims to currently secure around 15% of all cryptocurrency assets globally.

- France overtook Sweden in terms of FinTech investment in 2021 taking third spot in Europe with $3.9bn in total investment. France has seen an impressive compound annual growth rate (CAGR) of 46.14% from 2017 to 2021 and deal activity in 2021 surpassed 2017’s peak of 194 to reach 209 transactions.

- Overall France’s FinTech ecosystem is growing rapidly across a variety of sectors despite lack of specific regulatory support. FinTech regulation in France is mostly directed by the EU and France has not implemented a regulatory sandbox as it treats sectors with an equal approach. Most incentives reside in R&D tax credits and start-ups are encouraged with €90,000 in equity-free funding, with 3,000 start-ups benefitting to date.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global