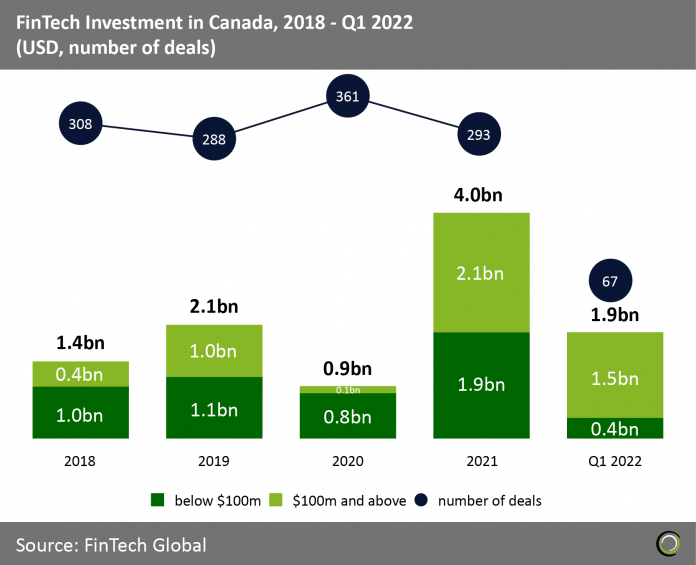

- FinTech investment in Canada has grown at a staggering compound annual growth rate (CAGR) of 30% from 2018 to 2021 demonstrating the strength of the FinTech ecosystem in the country. However, deal activity has remained stable from 2018 to 2021 and 2022 is expected to decrease by 9% based on Q1 2022 levels.

- So far this year investment has been bolstered by huge deals over $100m which accounted for 79% of total capital invested. These deals come from 1Password ($620m), a password management platform, Assent Compliance ($350m) a compliance management solution for supply chains, and eSentire ($325m) who specialise in managed detection and response, aiming to protect critical data and applications. Overall, these three funding rounds alone accounted for 68% of all Canadian FinTech investment in the first quarter of 2022.

- FinTech adoption in Canada stood at 50% in 2019, placing them 23rd in the world. Canadian age demographics are slightly unfavourable for FinTech adoption with 45% of their population over the age of 45. Canadian internet usage (5%) and mobile usage (86.1%) are both very high which benefits FinTech adoption.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global