Singapore-based Finbots.AI, which helps firms better handle credit risk, has collected $3m in its Series A funding round.

Accel served as the sole investor to the round, marking Its first Southeast Asian investment with its new $650m investment fund. The deal also marks Finbots.AI’s first external investment.

This capital injection will help Finbots.AI accelerate product enhancement, marketing and sales, and customer support. The company is also looking to hire senior talent and expand its tam across its offices.

Finbots.AI was founded in 2017 by Sanjay Uppal and Shripad Keni who leveraged their deep financial services understanding to create an AI-powered credit scorecard system. The ZScore is equipped with machine learning algorithms that utilise historical traditional and alternative data to automatically build, validate and deploy real-time, high-performing risk models.

By leveraging ZScore, financial institutions benefit from greater visibility over potential borrower’s credit capacity.

Speaking on the deal, Accel partner Mahendran Balachandran said, “The Finbots.AI team brings decades of collective experience in financial services and technology, and we see great potential and promise in their solution – ZScore – as it strives to remedy and bridge the limitations of legacy credit systems.

“We, at Accel, are delighted to be a part of Finbot.AI’s growth as they propel forward to enhance financial services by leveraging AI technology to serve the entire community – ranging from the large banks to the small lenders. We see massive potential in this region and FinTech as a vertical.”

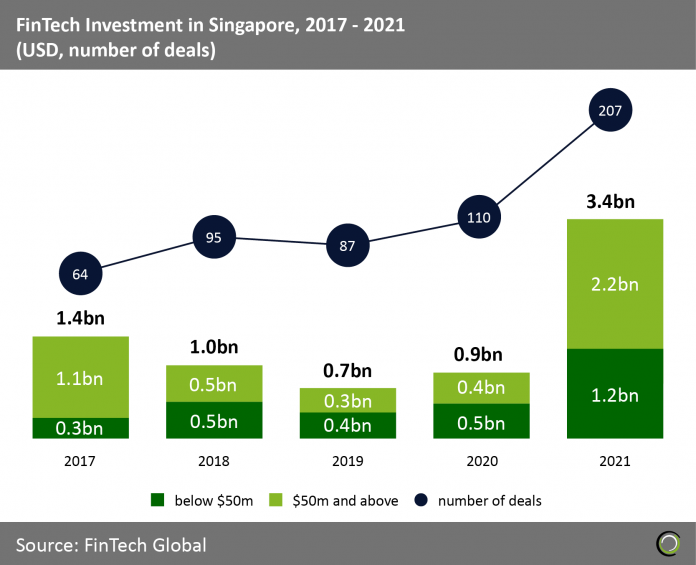

The Singapore FinTech sector had a record-breaking year for funding, with $3.4bn raised across 207 transactions, compared to $900m through 110 deals in 2020.

Copyright © 2022 FinTech Global

Copyright © 2022 FinTech Global