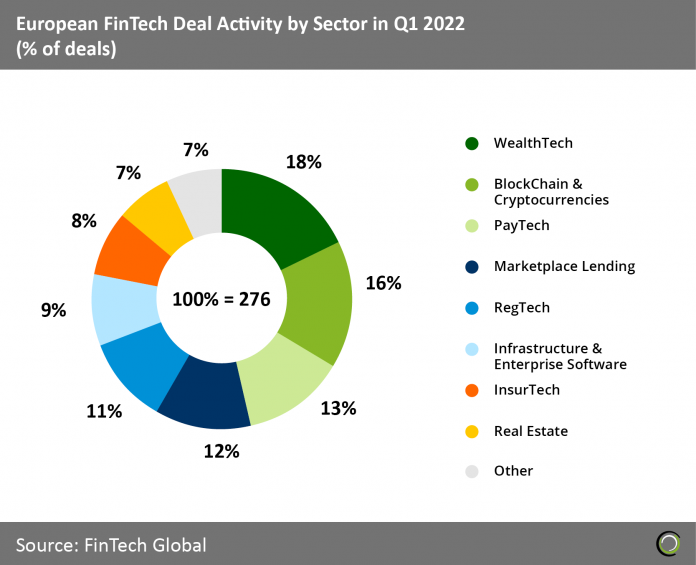

- WealthTech has been the most dominant FinTech sector in Europe during the first quarter with a total of 49 deals and capital invested hitting $982m. Blockchain & Crypto was the second most dominant sector by deal activity with a total of 43 deals and raised a total of $440m. The sector which raised the most capital was Marketplace Lending which raised a total of $1.8bn across 33 deals.

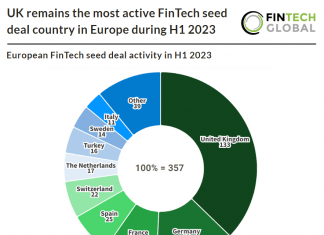

- European FinTech funding is projected to rise 17% in 2022 based on Q1 2022 results. Deal activity in Europe accounted for 20% of global FinTech deals in the first quarter with a total of 276 transactions. Investment in the region reached $6.8bn and accounted for 24% of global FinTech investment, slightly down from 2021 levels which had 26%.

- The largest deals in Europe during Q1 2022 have come from Checkout.com ($1bn), a global payments solution provider, Qonto ($552m), a neo bank for small and medium-sized businesses, and Lendable ($275m), a peer-to-peer lending platform.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global