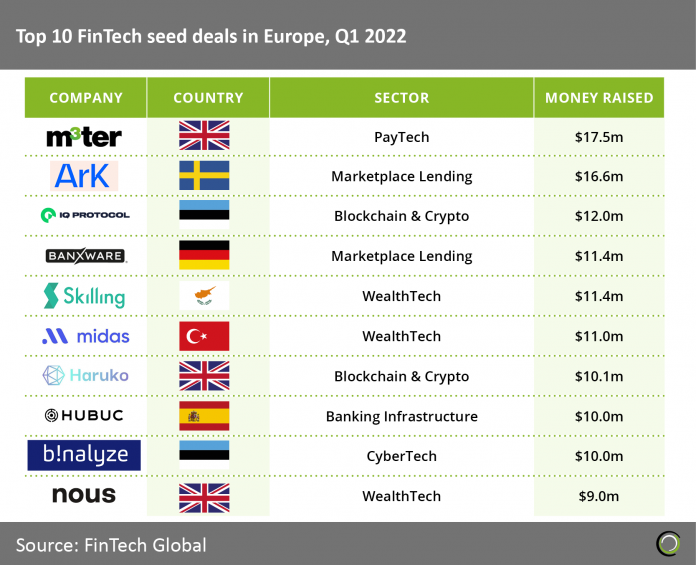

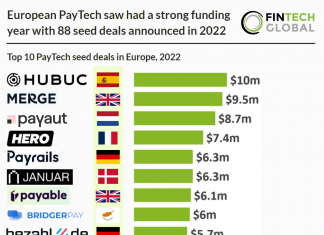

• WealthTech companies were the most active sector on the list with three of the top ten companies. Overall WealthTech companies accounted for 21 deals, 15% of the 143 European FinTech seed deals that occurred in the first quarter of 2022. Blockchain & Crypto was the most active sector overall with 27 deals, 19% of total European FinTech seed deals.

• m3ter, a metering & pricing engine for SaaS, was the largest seed deal in Europe for Q1 2022 raising a sizeable $17.5m from Insight Partners, Union Square Ventures and Kindred Capital. The company intends to use the funds to build on significant early traction to expand into new markets, grow its team, and extend its product. m3ter was founded in 2020 and has already attracted customers including Sift, Stedi and Redcentric, as well as signing a partnership with revenue delivery platform, Paddle.

• The UK was the most active country with a total of 39 deals and accounted for 27% of European FinTech seed deals in the first quarter of 2022. Germany was second with 20 deals, a 14% share and France was third with 15 deals, a 10% share of European FinTech seed deals in Q1 2022.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global