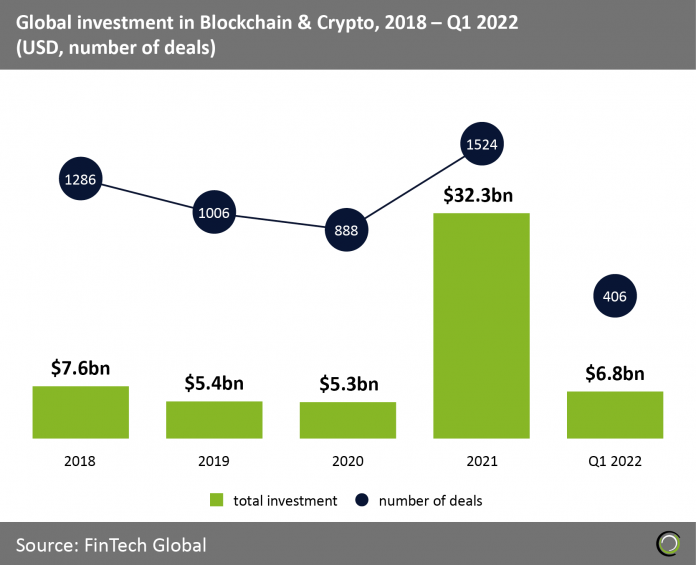

· The first quarter of 2022 saw the highest number of deals closed than any prior quarter in the Blockchain & Crypto sector. Current investment levels indicate that total investment will underperform 2021 by $5bn. This decrease is largely due to the sweeping drop in value across the digital asset market.

· The overall market cap of crypto assets has dropped to less than $1tn from its November 2021 peak of $3tn. Bitcoin, the most frequently traded cryptocurrency has largely contributed to the drop in market value, having shed nearly 52% of its value year to date.

· Other less frequently traded coins — better known as Altcoins — are experienc-ing similar rates of depreciation.The value of Avalanche and Waves, two of the most frequently traded Altcoins, has dropped 44% and 76% respectively.These extreme shifts exemplify the volatility of the market, and the influence environ-mental factors have on its’ success.

· China and Turkey banned cryptocurrency transactions in 2021, changing the in-dustry outlook for countless investors. Within just three days of China’s ban on cryptocurrency, an estimated $400bn in value was lost in the digital currency market. Until cryptocurrencies become more dependable and globally accepted, investors will remain hesitant to fully embrace the market.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global