This week saw a modest 25 FinTech funding deals take place, with the PropTech sector performing well, and Israeli companies also faring well despite predictions of investment falling in the region.

A humble 25 deals saw a total of $0.8bn raised this week. Aside from a few high-value deals, this largely came from small to medium-sized raises in later stages.

The biggest deal of the week came from property management platform Guesty, which raised $170m in a Series E funding round. After the fourth largest deal, coming from another PropTech Stoa raising $100m, the deals dropped off to $30m and below.

PropTech is performing particularly well, with three companies in the sector making it into the top ten deals. They came from the aforementioned Guesty and Stoa, and also Curbio, a pay-at-closing home improvement product for real estate agents, brokerages and their listing clients, which closed a $25m credit facility.

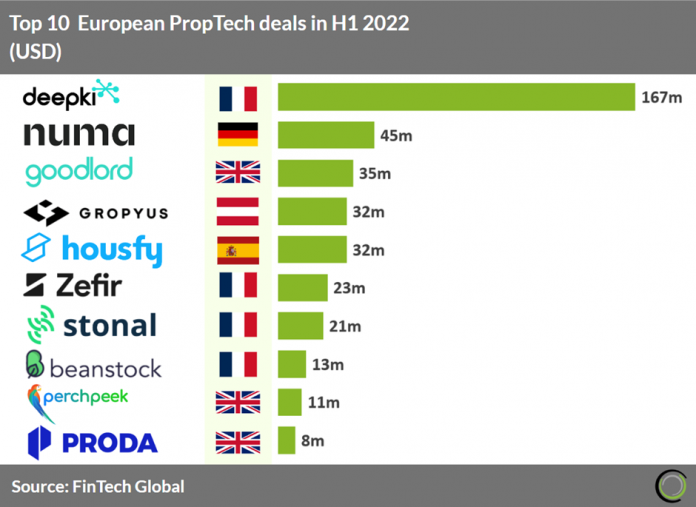

Within the PropTech sector, FinTech Global’s research recently revealed that France is a leading player, accounting for four of the top ten European PropTech deals in the first half of this year, as well as 45% of capital invested in the sector across nine deals for H1 2022.

The UK also performed well in the sector with the most deal activity with 23 deals in total, 28% of deals in the first half of 2022 although only accounted for 18% of funding raised. France’s large deals sizes and later stage funding rounds signal a maturing sector and will likely raise the most capital in Europe in the short term but the UK’s quantity of smaller deals signal more activity and innovation and will likely vie for the top spot in Europe.

This week also saw two Israeli companies in the top ten deals, Guesty, as previously mentioned, and Hibob.

Hibob is a tech-enabled HR platform, which $150m in Series D funding, bringing its total funding to $424m.The round was led by General Atlantic and Bessemer Venture Partners with participation from existing investors.

Founded in 2015, Hibob describes itself as “the modern HR platform for modern business.” Amid an uncertain economic backdrop and changing labour market, this could be a sector to keep an eye on within the FinTech industry. Indeed, Hibob itself said that the need for flexible HR platforms to manage people in times of uncertainty and change has become even more critical to business success than ever before. This has led to a boom in growth for the sector.

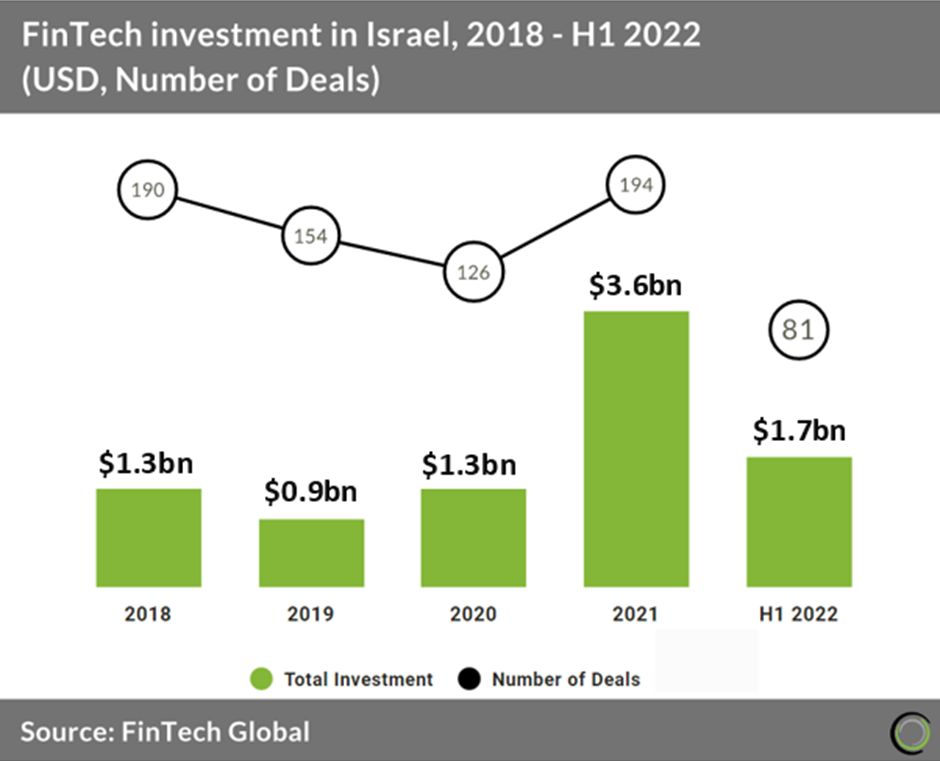

FinTech Global’s research recently reported that Israeli FinTech investment is on track to reach $3.4bn in 2022, based on the first half of 2022, which would yield a 5.5% drop from 2021 levels.

Israeli FinTech has thus far resisted the global 24% drop in FinTech investment from Q1 to Q2 2022 instead increasing by 7.6% due to its dominating CyberTech industry. However, deal activity in the country is expected to fall slightly in 2022 to 162 deals in total, a 17% drop from 2021.

Here are the 25 deals that took place.

Guesty lands $170m for short-term property management

Guesty, a property management platform for the short-term rental and hospitality industry, has raised $170m in a Series E funding round.

The round was led by the Apax Digital Funds, MSD Partners and Sixth Street Growth. Existing investors Viola Growth and Flashpoint also participated in the round.

Guesty’s platform automates and expedites guest communications, reviews, cleaning and other operational tasks, while also facilitating direct bookings, resource and revenue management, smooth payments systems, accounting and damage protection.

The company deploys open API capabilities and its marketplace of third party integration partners to adapt to specific business and operational requirements. This, Guesty said, provides “comprehensive and bespoke” solutions to cover all property management needs.

The Series E funding round comes at a time of growth, according to Guesty, which added that it has tripled its valuation and doubled its revenues since its last raised. Moreover, in 2021 and 2022, the company launched numerous new products, services and technology partnerships, including advanced accounting tools, protection offerings and payment solutions.

Guesty said the capital will be used to scale the company’ global operations to meet increasing demand, pioneer new solutions that support the growing and changing need of the hospitality industry, secure acquisitions and expand into new business verticals.

AToB raises $155m to transform finance in trucking

AToB, a FinTech which is revolutionising the trucking industry’s financial ecosystem, has closed its Series B funding round on $155m.

The round was a combination of equity to scale its services over the next 12 months, and debt and CAC financing to provide working capital to small fleet businesses.

Elad Gil and General Catalyst served as the lead investors, with commitments coming from existing backers Collaborative Fund, Contrary Capital, XYZ Venture Capital and Leadout Capital.

AToB claims to be the first FinTech payments platform that is modernising the $790bn trucking industry’s broken financial system.

Its platform supplies the fleet community with a suite of financial products, including no-fee fleet cards, instant direct-deposit payroll and access to bank accounts and savings tools.

The company claims America’s fleet financial system is broken. It stated that truck drivers and fleet owners rely on underregulated and exploitative fuel cards, which come with limited networks and prohibitively expensive fees, lack access to low-cost capital for maintenance and are paid through outdated systems, such as hard checks that cannot be deposited while on the road.

HR tech platform Hibob scores $150m

Hibob, a tech-enabled HR platform, has raised an additional $150m in Series D funding, bringing its total funding to $424m.

The round was led by General Atlantic and Bessemer Venture Partners with participation from existing investors.

Founded in 2015, Hibob describes itself as “the modern HR platform for modern business.” The company offers a HR platform that helps dynamic teams of in-office and remote workers. Its tools include payroll, onboarding, time and attendance, compensation, and more.

Founded by Ronni Zehavi and Israel David with the idea that the employee experience and role of HR needed to evolve, Hibob now boasts 2,500 customers and has recently opened an office in Berlin to serve the DACH region, successfully expanded into new office spaces in London and New York, and have plans to continue expanding our reach in the US and Europe before the end of the year.

Hibob said that the need for flexible HR platforms to manage people in times of uncertainty and change has become even more critical to business success than ever before. This has led to a boom in growth for the sector.

PropTech Stoa bags $100m to close US housing gap

Arizona-based property technology company Stoa has raised $100m less than a year after its previous $100m securitisation.

Stoa’s mission is to close the housing gap in America. Its iBuyer software platform, FlipOS, enables real estate investors to purchase, renovate, and sell homes faster and more efficiently than the traditional method.

The $100m funding was underwritten by Cantor Fitzgerald, a financial services firm that specialised in real estate investments.

This marks the second time that Cantor Fitzgerald has worked with Stoa on this type of fundraising. Stoa’s $100m securitization in November 2021 was also underwritten by Cantor Fitzgerald.

Stoa said that according to Bankrate.com, housing supply is far below demand levels. This is due to multiple factors including younger buyers looking for first-time homeownership and under-building after the 2007 recession.

The company’s software platform FlipOS aims to tackle this problem by focusing on the fix-and-flip market, where existing properties need upgrades or repairs before they become viable options for people looking for housing.

Stoa also supports investors with low-rate lending, detailed scopes of renovation work, and a guaranteed post-renovation purchase offer with a five-day close, to solve the painpoints in today’s US housing market.

With the additional securitization, Stoa said FlipOS will be able to work with more professional real estate investors to grow and scale their businesses, helping to close the housing gap in America by providing quality residential inventory to the market faster than homebuilders can.

ThreatX boosts API protection with Series B close

ThreatX, an API protection platform, has closed its Series B funding round on $30m, which was led by Harbert Growth Partners.

Contributions also came from Vistara Growth, and existing ThreatX backers .406 Ventures, Grotech Ventures and Access Venture Partners.

This capital will help ThreatX accelerate investments in platform development and scale their global sales and marketing initiatives as companies look to block complex attacks targeting APIs and web applications.

ThreatX claims to differentiate itself from other API security solutions by supplying organisations with the ability to discover and visualise their attack surface, block attacks in real-time and gain access to 24/7 managed services to support resource-constrained security teams.

Its API protection platform safeguards APIs from all threats, including DDoS attempts, bot attacks, API abuse, exploitations of known vulnerabilities, and zero-day attacks. The multi-layered detection capabilities identify malicious actors and initiate appropriate action.

Alongside the close of the round, the CyberTech company has named Harbert Growth

Curbio lands $25m credit facility

Curbio, a pay-at-closing home improvement product for real estate agents, brokerages and their listing clients, has closed a $25m credit facility.

According to FinSMEs, Maryland-based Curbio also secured a new banking relationship with Cambridge Facility. Following a $65m Series B back in February, the company has raised a total of $90m over 2022.

Curbio partners exclusively with real estate agents and their clients to get any home ready for the market, allowing it to sell faster and for as much money as possible.

Using its technology to power its service, Curbio completes pre-listing home improvements of any size quickly from start to finish, with zero payment due until the home sells.

Cambridge Trust will join Revolution Growth, Camber Creek, Comcast Ventures, Brick & Mortar Ventures, Kayne Partners, Masco Ventures and Second Century Ventures as investors.

Curbio intends to use the funds to expand into new markets, further develop its technology and support growth, which is anticipated to exceed $100m in 2023.

Automatic savings app Jar hits $300m valuation

Automatic savings FinTech app Jar has reportedly collected $22.6m in its Series B round, which values the company at $300m.

The investment round was led by Tiger Global, according to a report from The Economic Times.

Other backers to the Series B include Arkam Ventures, Eximius Ventures, Force Ventures, LetsVenture, Rocketship Venture Capital, WEH Ventures, 1Finance, Capier Investments, Cloud Capital, Folius Ventures, Panthera Capital, Prophetic Ventures and more.

Jar is reportedly speaking with other investors to potentially extend the Series B.

With the fresh funds, Jar plans to hire more staff and bolster its technology. It is also looking to release new investment products across mutual funds, insurance and lending.

Jar offers a platform to automate savings in digital gold. Based in India, the company lets users take spare change from their digital transactions and invest it into 24 karat gold.

The company is currently planning to be a credit distributor with the loans being underwritten by non-banking finance company partners. However, it might seek its own licence in the future.

PayPal Ventures backs payments processor Forage

Forage, a payments processor that makes it easier for grocers to accept SNAP EBT (formerly food stamps) payments online, has raised $22m from a Series A backed by PayPal.

The round was headed by Nyca and saw participation from EO Ventures and prominent angels including Instacart founder Apoorva Mehta.

Currently, one in eight Americans receive government assistance to buy groceries. While more than 250,000 brick & mortar locations accept SNAP benefits via EBT in-store, only a fraction have been approved for online EBT.

Many SNAP recipients are homebound, lack transportation, or live in a food desert without easy access to grocery stores; many others want to avoid in-person shopping due to concerns about COVID. While many Americans were able to shift to online grocery shopping during the pandemic, SNAP recipients were not afforded this safety and convenience because they are effectively unable to use their benefits online.

Forage has an in-house team of EBT and payments experts. The firm also developed and recently launched the first Shopify app that offers online EBT payment processing to Shopify’s ecosystem of merchants.

The company provides merchants with support through every step of the USDA approval process, from preparing the required documentation through system engineering and testing all the way to deployment.

Forage claims it will use the capital for product development and to accelerate hiring to meet high demand for the company’s solutions.

The Chainsmokers join funding of newly launched PayTech Pomelo

PayTech startup Pomelo, which aims to improve money transfers, has reportedly raised $20m in seed funding, alongside a $50m warehouse facility.

The founding round comes as the FinTech company launches out of stealth, according to a report from TechCrunch.

Founders Fund general partner Keith Rabois and A* co-founder and general partner Kevin Hartz led the $20m equity investment. Commitments also came from Afore Capital, Xfund, Josh Buckley and The Chainsmokers.

The $50m warehouse facility will help Pomelo give upfront cash to people that want to make transfers.

Pomelo is currently available in the Philippines, but is planning to launch in Mexico and India, among other geographies.

The FinTech company claims to reinvent money transfer through credit. Its credit card lets people send money or buy products and settle the bill at a later date. Usage of the platform helps the user build their credit score.

Pomelo also offers a physical card that can be used anywhere Mastercard is accepted. It offers a family account that can have up to four cards active. The main account holder can establish spending limits, pause any card and view how each user is spending.

The Chainsmokers have made several investments into the FinTech sector. Earlier in the year, the duo supported the $55m investment round of Indonesia-based Plaung. The company offers fractional investing, with access to micro-savings and micro-investments into gold, indexes, mutual funds and crypto assets.

Alternative startup finance service Arc closes round

Arc, which stylises itself as the future of startup finance, has closed its Series A funding round on $20m.

Left Lane Capital served as the leader, with commitments also coming from NFX, Y Combinator, Clocktower Technology Ventures, Torch Capital, Atalaya, Bain Capital Ventures, Soma, Alumni Ventures and Dreamers VC.

The round was also supported by angel investors, including the founders of Wayflyer, Plaid, Column, Chargebee, Vouch and Jeeves.

With the funds, the company plans to accelerate its growth and expand the availability of its treasury and software products.

Arc was founded on the basis that premium startups deserve a premium non-dilutive and non-debt funding alternative, as well as financial tools to help them scale on their terms. The company programmatically underwrites credit risk, helping it deploy capital to founders within minutes.

Its offerings include Arc Advance, which allows founders to convert future revenue into upfront capital, and Arc Runway, which helps startups analyse their net cash burn.

The company launched out of stealth in January 2022 with $161m in funding from equity and credit investors. Since then, the company has experienced strong growth and supports 1,000 high-growth software startups on its platform.

India-based neobank Fi Money scores additional Series C funding

India-based neobank Fi Money has reportedly collected an additional $17m for its Series C funding round.

Singapore-based investment firm Temasek Holdings supplied $15m to Fi Money, and existing investor QCM Holdings deployed $2m, according to a report from Your Story.

Fi Money previously raised $45m in its Series C round, which was backed by existing investor Alpha Wave Global. The FinTech company has now raised a total of $137.2m in funding, to-date, and is backed by Ribbit Capital, Sequoia Capital and B Capital.

The FinTech company offers a financial app with a digital savings bank account and a suite of tools to help users track their money. Its money management app, which is aimed at working professionals, comes with a zero-balance savings account and access to commission-free mutual funds.

Users can connect through other bank accounts to Fi to see a combined balance and transaction history. Other benefits of the service include no minimum balance, withdrawal from any ATM, no hidden fees, money insured of up to INR 500,000 and more.

The app also boasts an assistant function that lets users receive insights into their spending, savings, bills and more.

Tiger Global backs Jodo’s vision for India’s education payments

Jodo, a Bangalore-based FinTech that helps families pay tuition fees, has raised $15m in Series A funding.

Jodo’s founders Atulya Bhat, Raghav Nagarajan, and Koustav Dey founded the company when they noticed that many households face difficulties paying tuition fees due to the lack of flexible payment options available.

According to a report by India Startup News, the round was led by Tiger Global, with participation from existing investors Elevation Capital and Matrix Partners India.

The FinTech offers a suite of payment and lending products with the aim of making fee payments more convenient and affordable for parents and students while making fee collection hassle-free for education institutions.

The founders said in a statement, “Education fee payments, one of the most important and high-value spend categories, has seen little innovation and is lagging in digitisation… At Jodo, we have built industry-first payment and lending products grounds-up, keeping the requirements of parents, students, and educational institutes in focus.”

With this Series A round, Jodo said it will accelerate product innovation and sales and scale its team. It also plans to scale up its education partnerships to 5,000 institutes in the next 18 months and help 1.5 million students with their fee payments.

At present, the FinTech said it has partnered with over 700 education institutes, facilitated over Rs 1,000 crore worth of fee payments and has catered to over 100,000 students on its platform.

Brazil-based FinTech Klavi scores $15m

SaaS-based data aggregation, analytics and API provider Klavi, which is based in Brazil, has scored $15m in its Series A funding round.

The capital injection was backed by GSR Ventures and Brazil-based Iporanga Ventures and Parallax Ventures. Commitments to the Series A also came from CIP SA and Vivo Ventures.

There is an additional 90 days to the financing, which could see more investors commit capital.

This capital will help Klavi bolster its position in the market by building new products.

Klavi is on a mission to be the leader in open finance. The company was founded in 2020 by Bruno Chan and Stone Zheng.

The FinTech offers companies the tools to customise financial products and services based on relevant and accurate data. It claims to have helped process over 450 million transactions and made over four million connections with financial institutions, bureaus, FinTechs and startups.

It hopes to grow its base by over 100 assets by the end of 2022 and reach 500 by December 2023. Its current clients include BV, Telefnica, Mepoupe, CIP S.A., Gorila, Jeitto, Supersim, Simplic, Portocred and Zippi, among others.

The FinTech company previously raised $1.25m in seed funding last year, with Iporanga Ventures and Parallax Ventures providing the capital.

Cybersecurity startup SynSaber nabs Series A

SynSaber, an early-stage ICS/OT cybersecurity and asset monitoring company, has nabbed $13m for its Series A round.

SYN Ventures led the round with participation coming from Rally Ventures and Cyber Mentor Fund.

With the close of the round, the company has raised $15.5m in total investment.

This fresh capital will support the innovation efforts, expand its global footprint, grow sales, marketing and development, and build customer momentum and industry research.

The CyberTech company was founded in 2021 by industry veterans Ron Fabela and Jori VanAntwerp. They released the first version of their operational technology (OT) visibility and detection solution in February 2022.

Its vendor-agnostic software allows critical infrastructure asset owners and operators to send OT edge data to empower their SIEM, SOAR or MSSP, it said.

The company offers asset and network monitoring that supplies continuous insight into the status, vulnerabilities and threats across every point in the ecosystem.

Singapore’s FOMO Pay bags $13m

FOMO Pay, a Singapore-headquartered major payment institution, has raised $13m in Series A funding.

The round was led by Jump Crypto. Other participating investors include HashKey Capital, Antalpha Ventures, Ab Initio Capital, and Republic Capital.

Founded in 2015, FOMO Pay’s mission is to be the leading global banking service provider for the fast-growing digital economy.

The Singapore-headquartered company helps institutional clients connect to e-wallets, credit cards, cryptocurrencies, and more with its global banking solutions.

Today, the FOMO Pay claims it is one of the largest digital payment and banking solution providers, servicing several thousands of clients across Web2 and Web3 industries. Over the past year, it has been involved in developing the innovation landscape within the Web3 ecosystem and has announced several strategic partnerships with firms such as Circle, Acentrik, Ripple, and others.

FOMO Pay said the capital will be used to accelerate its growth via investing in its people and infrastructure, strengthening research and development capability, and regulatory and geographic expansion across the FinTech industry.

COVU lands seed funding to empower insurance agents

COVU, an AI-enabled digital platform for insurance agencies, has raised $10m in seed funding to launch its product.

The round was led by ManchesterStory Group, with support from angel and VC investors across the insurance and technology industry.

COVU was founded by insurance industry veterans Ali Safavi and Tasos Chatzimichailidis with the goal of helping independent insurance agents and carriers better manage risk and make smarter insurance decisions through AI-driven policy recommendations, business services and sales support.

The COVU platform takes ownership of front and back-office tasks, which the company said gives insurance agents time to focus on strengthening customer relationships, grow their business and embrace digital operations.

A combination of technology and services help agents generate higher customer satisfaction rates, boost retention and cross selling and achieve higher profit margins, COVU added.

The majority of independent insurance agencies spend around 40% of total revenue and agents spend 70% of time on back-office and administrative tasks, according to COVU.

Yet, these efforts have not translated into faster or easier journeys for customer insurance transactions. To retain customers and reduce wasted effort, COVU is advocate of improving the journey.

Biza.io closes $7.5m Series A

Australia-based Biza.io, which offers Consumer Data Right (CDR) solutions, has reportedly raised $7.5m in its Series A funding round.

OIF Ventures and Jelix Ventures led the round, which is the first external capital raised by biza.io, according to a report from Digital Nation.

Founded in 2017, Biza.io provides companies with the tools to meet compliance with CDR. It boasts full CDR API implementation, product reference data, consent management, consumer consent dashboards, enterprise integration, and service metrics and admin APIs.

Its conformance testing service covers over 200 ACCC tests, FAPI conformance suite validation with CDR profile and collects test evidence to meet ACC requirements.

Alongside the close of the investment, Biza.io has established a board of directors.

BankiFi lands $4.8m to scale in North America

BankiFi, a provider of embedded banking solutions for SMEs, has raised $4.8m for global expansion in North America.

The funding round was led by Praetura Ventures, who claim their mission is to help firms reach their potential with both monetary and operational support.

According to BankiFi, this strategic growth investments gives it the capital to provide its industry-leading embedded banking platform to more than two million SMBs across four continents by 2024.

BankiFi provides an open cash management platform and architecture that financial institutions embed into their current digital banking infrastructure to address the specific issues of their SMB portfolio.

Indonesia-based document manager Momofin closes funding

Indonesia-based Momofin, which offers document and contract lifecycle management, has raised an undisclosed amount in funding.

The capital injection was backed by Rorian Pratyaksa, the co-founder of local social commerce platform Woobiz, and Firlie Ganinduto, the president director of credit-scoring startup Digiscore.

This capital will help the company bolster its product line.

The company was established earlier this year by Pranowo Putro, Saga Iqranegara, and Yoga Pratama and has already served over 10,000 users and 100 enterprise clients.

Momofin currently has two products, MomofinGo, which is a cloud-based document and contract lifecycle management system for businesses, and eMET, an electronic seal app for individual customers.

Its services are used by financial services, education, healthcare, retail, legal, manufacturing and shipping businesses.

Financial services use the technology to improve customer experiences with streamlined document workflows and offer electronic signatures.

MGA InsurTech Ledgebrook secures seed fund

Ledgebrook, a Boston-based MGA InsurTech, has raised $4.2m in seed funding to provide a “best-in-class” quoting experience to wholesale brokers.

The InsurTech was founded in March with the goal of providing the fastest, easiest quoting experience to wholesale brokers while delivering a high standard of pricing and risk selection via its tech stack.

The seed round was led by Brand Foundry Ventures with participation from American Family Ventures and 15 angel investors.

According to Ledgebrook, the funding will allow it to build out the team, technology, and operational infrastructure to launch its first product.

The MGA InsurTech is composed of industry veterans who understand how the lack of automation, limited pricing sophistication and outdated technology platforms can be improved to create better quoting experiences for brokers and better rates for insureds.

Following on from this funding round, Ledgebrook said its plans to launch an Excess & Surplus (E&S) general liability product to establish its value proposition to wholesale brokers, before expanding via multiple additional product launches in 2023.

Bookkeeper360 to improve business accounting through seed funding

US-based Bookkeeper360, which claims to be transforming traditional business accounting through technology, has closed its seed round on $3.5m.

Among the backers was National Business Capital. The FinTech company did not reveal the other investors, but stated it was filled by new strategic partners, customers and previous investors. It also received backing from angel investors of Etsy.com.

Bookkeeper360 has experienced strong growth over the past 14 months. It has expanded its team by 120% and now supports nearly 1,000 customers nationwide. The company has also named three new directors.

The bookkeeping company, which celebrates its 10th anniversary later this year, offers business accounting technology and services to streamline and integrate back-office, management reporting, advisory, payroll and tax solutions.

It currently has integrations with Xero, Quickbooks Online and Gusto Payroll. Bookkeeper360 is looking to expand its existing integrations with additional marketplaces and operational platforms. It also wishes to integrate capital and lending products for customers.

All-in-one cybersecurity platform Defendify nets $3.35m

All-in-one cybersecurity platform Defendify has raised $3.35m in a fresh funding round.

Existing investor Maine Venture Fund led the round, with commitments also coming from 3dot6 Ventures, York IE, Maine Technology Institute, FreshTracks Capital and Wasabi Ventures. Also joining the round were first-time backers Coastal Ventures and Opus Ventures.

This fresh capital will help the company accelerate its go-to-market strategies, bolster product development and expand its team.

Defendify offers a simple, affordable, flexible and scalable cybersecurity platform that aligns with regulatory, compliance, and cyber insurance needs. It claims to be a unique solution that offers a single pane of class and multiple layers of ongoing protection to continuously improve security posture across people, process and technology.

Over the course of the pandemic, Defendify added thousands of customers, expanded to over 60 countries and doubled the size of its team.

It also made multiple strategic additions to its team, including former Oracle CIO Mark Sunday as senior advisor, digital transformation and marketing leader Emily Carville as CMO, and SaaS business development expert John Mayfield as director of sales.

Cybersecurity platform Aceiss unveils product after seed close

Cybersecurity platform Aceiss has closed its seed round on $3.25m, as it reveals its flagship solution.

The round was backed by Canaan, Insight Partners, Connecticut Innovations and others.

Aceiss offers a cybersecurity platform that solves the problem of access observability and mitigates the risk of unauthorised user access. Built on zero-trust fundamentals, Aceiss claims to offer unprecedented visibility and insights into user access.

The company claims that layered defences, compensating controls and risk-based policy assessments lessen the risk of compromise. However, they do not solve issues around observability and scaling.

Aceiss is a non-invasive solution that can immediately discover hidden access, contextualise activity and surface least privilege insights across all data sources. This includes on-premises systems, cloud platforms, and devices, without requiring duplication or additional infrastructure.

Its technology is used by companies within financial services and healthcare industries.

Indian InsurTech MetaMorphoSys secures $3m

MetaMorphoSys, a business-to-business (B2B) SaaS InsurTech, has raised $3m in funding to help insurance companies tackle industry challenges.

According to a report by The Economic Times, the round was led by Info Edge-backed technology fund Capital2B. The round also saw participation from angel investors Pavitar Singh and Dhruv Dhanraj Bahl.

Founded in 2016 by Amit Naik and Kewal Vargante, MetaMorphoSys Technologies is an Indian InsurTech focused on creating innovative software products to address the challenges of the global insurance industry.

The India-based company said it is leveraging its “domain expertise, regulatory knowledge and technology experience” to architect innovative products and disrupt the insurance value chain from Customer Acquisition to Engagement.

MetaMorphoSys’ SaaS-based low code platform aims to help insurance companies launch innovative products across categories such as motor, travel, property, life, and health. Its services are being leveraged by insurance entities across India, Singapore, Indonesia and Vietnam.

The startup said it will use the capital to expand and invest in innovative solutions.

Agri-InsurTech IBISA secures funding

IBISA, an Agri-InsurTech on a mission to provide innovative weather protection insurance, has raised seed funding.

A report by Entrepreneur revealed that the capital was raised from Ankur Capital, an early-stage venture capital fund focused on transformative technologies in deeptech and climate tech.

Founded in 2019, IBISA began operations in India to provide parametric insurance against drought coverage in Tamil Nadu.

Now, the company is scaling its operations in India with operations in Odisha, Karnataka, and Telangana for coverage against excess rainfall and wind speed and drought.

IBISA builds, distributes and operates climate insurance solutions for agriculture in a cost-efficient, scalable and innovative way. Configurable Weather Parametric insurance with affordable premiums and rapid payouts sit in a digitalised, transparent platform.

According to some reports, 70% of the global food supply comes from smallholder farmers and more than 50% of the Indian workforce is into agriculture and allied sectors that contribute to just 20% of India’s GDP.

With climate-change related extreme weather events occurring more frequently and more unpredictably, smallholder farmers are more vulnerable than ever. Although insurance solutions are available, it is often argued that these are not adequate because they are not affordable or sufficient to the farmers’ needs.

Copyright © 2022 FinTech Global