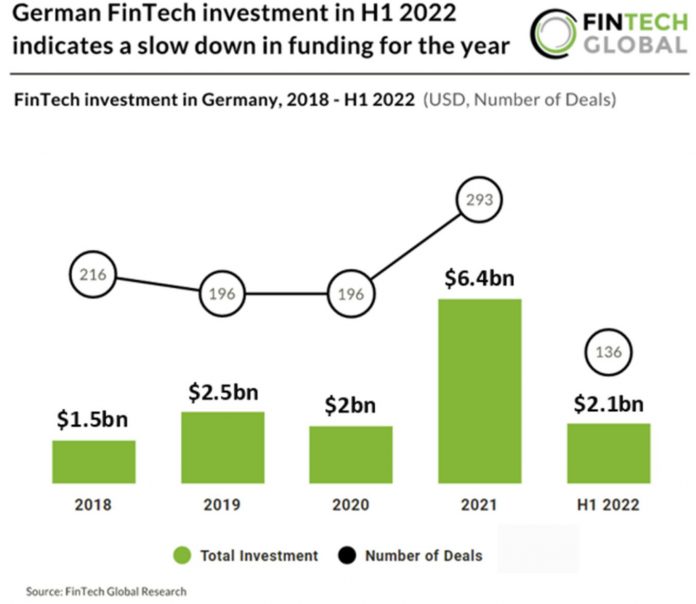

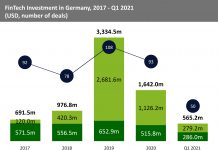

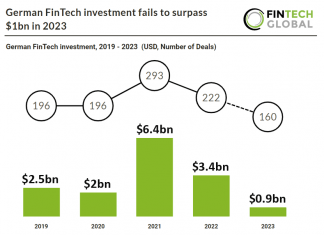

• German FinTech funding is projected to reach $4.2bn in 2022, a 34% drop from 2021 levels where investment peaked at a record-breaking $6.4bn. Deal activity in the country is also on track to fall although by a less significant 7% to 272 deals in total for 2022, this indicates that the drop in funding is driven by a correction in the size of deals deal rather than a serious slow down in the country’ FinTech sector.

• Trade Republic, a mobile-only trading platform, was the largest FinTech deal in Germany during the first half of 2022 raising a substantial $268m in their latest Series C funding round led by Ontario Teachers’ Pension Plan which brings their post-money valuation to $5bn. “The additional capital will primarily flow into product development to help even more people invest their money wisely with the help of innovative services and technology,” the company said.

• Berlin was the most active FinTech city and accounted for 51% of total deals announced in H1 2022. The next most active city was Munich with a 13% share of total deals.

• The most active FinTech sector in H1 2022 was Blockchain & Crypto with 23 deals, a 17% share of total deals. Seven other sectors had over ten deals showing Germany’s diverse FinTech ecosystem.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global