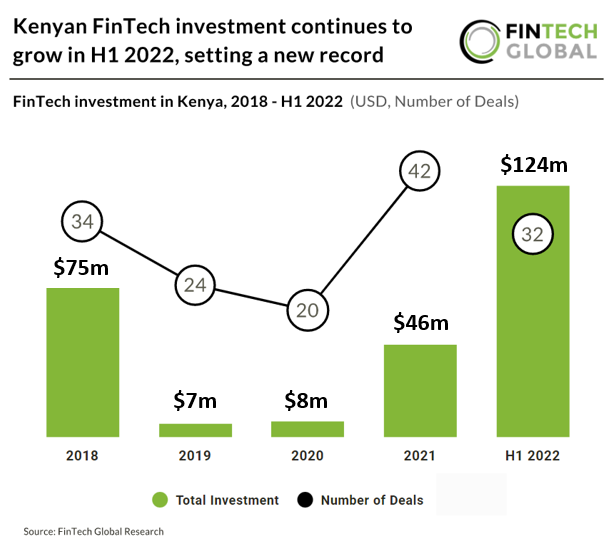

• FinTech investment in Kenya is expected to set a new annual funding record of $248m in 2022 based on investment in the first half of 2022. That’s a five-fold increase from 2021 levels and a more than three-fold increase from the Kenyan FinTech investment peak of $75m in 2018. Deal activity in the country is also expected to rise to 64 deals, a 52% rise from 2021 levels. Kenya’s capital Nairobi is the FinTech hub in the country accounting for 84% of deals in H1 2022.

• M-KOPA, an asset financing platform, was the largest Kenyan FinTech deal in H1 2022, raising a sizeable $75m in their latest Venture Round led by Generation Investment Management. M-KOPA plans to use the funding to expand into additional countries, adding to its hubs in Kenya, Uganda, Nigeria and recently launched Ghana. Since launching in Nigeria, M-KOPA has acquired over 50,000 customers, its executives said. For Ghana, its newest market, they say it “has grown two times as fast as any of its previous markets.”

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global