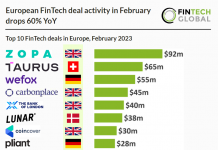

Zopa, a UK-based digital bank, is reportedly in talks to raise another $100m before it goes public.

A report by Sky News revealed that Zopa is in detailed negotiations with new and existing shareholders about raising approximately $100m to fund its continued expansion.

Sources said a number of blue-chip financial institutions were involved in the discussions.

The fundraising is expected to value Zopa slightly in excess of the roughly £750m price tag it attracted nearly a year ago, according to one investor. The round would also be the last capital injection into the business before the company seeks a public listing.

While the firm was launched in 2005, initially as a peer-to-peer lending service, it pivoted to more mainstream banking and launched its digital bank in 2020.

Just nine months after gaining its full bank license in June 2020, the neobank launched a host of features such as fixed-term savings accounts, credit cards, unsecured loans and auto-finance for its UK customers.

In August this year, Zopa Bank hit the £2bn deposit mark, only two years after the company launched its challenger bank.

In March last year, Zopa raised £20m round led by IAG Silverstripe to help the firm further expand its footprint. The round saw participation from Augmentum, Waterfall managed Alternative Credit Investments and Venture Founders.

Commenting on the importance of digital bank services at the time of the raise, Zopa CEO Jaidev Janardana said, “Less than a year since launching our bank, we have exceeded our plan for growth, both in terms of customers and balance sheet. This capital injection will enable us to continue on this accelerated path.

“Our strong entry to the UK savings and credit card markets shows the organic appeal of our products and we are happy to have investors who share our excitement at the opportunity to serve more customers across more product categories.â€

Copyright © 2022 FinTech Global