Allianz Commercial reveals new Head of Portfolio Solutions to shape global strategy

Allianz Commercial has made a significant addition to its leadership team by appointing Claudia Valencia as the Global Head of Portfolio Solutions, effective from January 8, 2024.

Shiftboard selects Eric Amblard as its new Chief Financial Officer

Shiftboard, a renowned provider of enterprise workforce scheduling software tailored for organisations operating around the clock, has announced that Eric Amblard has joined the company's executive leadership team in the capacity of Chief Financial Officer (CFO).

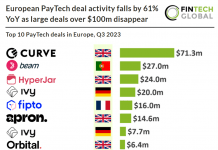

European PayTech deal activity falls by 61% YoY as large deals over $100m disappear

Key European PayTech investment stats in Q3 2023:

• PayTech deal activity reached 17 transactions in Q3 2023, a decline of 61% from last year’s...

Glia’s Digital Interaction Solutions now available within Lumin’s Digital Banking Platform via new partnership

Glia is set to integrate its DCS capabilities into Lumin's digital banking offering as part of a new partnership.

India’s InsurTech sensation InsuranceDekho clinches $60m

India's InsurTech startup InsuranceDekho, which emerged from the automobile marketplace group CarDekho, has successfully secured $60m in its latest fundraising effort.

UK FinTech sees no deals over $100m in Q3 2023, last occurring in Q2...

Key UK FinTech investment stats in Q3 2023:

• UK FinTech deal activity reached 85 deals in Q3 2023, 43% decline compared to the same...

Accelerate card service roll-out with Star’s CardPro Accelerator

Star, a leading global technology consulting firm, links strategy, design, and engineering to assist businesses in propelling their growth and maximising value.

Leading WealthTech d1g1t secures funding for US expansion led by MissionOG

d1g1t, the institutional-grade wealth management platform catering to Financial Advisors, RIAs, and Multi-Family Offices, has successfully concluded a combined equity and venture debt financing round.

Visa and Lloyds Bank team up to unveil next-gen virtual card solution

Visa, a global pioneer in digital payments, and Lloyds Bank, a key player in the UK banking sector, have joined forces.

Reseda Group fuels Goalsetter’s innovative FinTech journey with $1m investment

Reseda Group, a credit union service organisation fully owned by MSU Federal Credit Union (MSUFCU), has announced a partnership with the FinTech star, Goalsetter. Their collaboration aims to sculpt the upcoming generation of savers, investors, and credit union enthusiasts by infusing advanced financial tools and educational resources.