FinTech investors have completed almost 60 Payments & Remittances deals in Africa

- Payments & Remittances companies have captured the lion share of FinTech deals in Africa with 40.1%, followed by Marketplace Lending companies which have been involved in 15.5% of transactions since 2014.

- According to research from the IMF, mobile money accounts now surpass bank accounts in the region and greater financial inclusion has benefited large swathes of the population, which has attracted investors to the subsector.

- Additionally, Plug and Play has referred to the unbanked population of Africa as one of the biggest FinTech opportunities in history.

- Other subsectors that have been attractive to investors include WealthTech InsurTech and Real Estate. Naked Insurance, a Johannesburg-based provider of artificial intelligence-driven car insurance, raised $2.2m from Yellowwoods and Hollard Insurance in Q4 2018 to accelerate its growth and expand into new product lines. The InsurTech landscape in Africa is still in its infancy, and this investment in Naked is the largest InsurTech deal in the region to date.

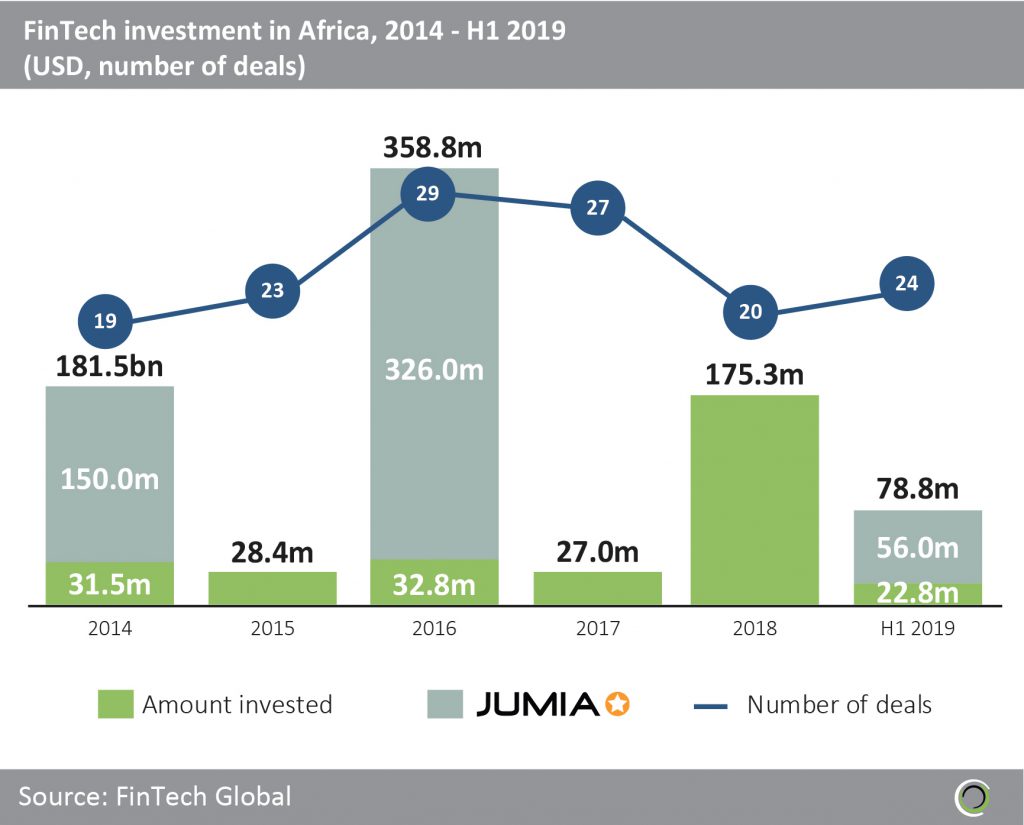

Deal activity in H1 2019 has already surpassed that of 2018

- FinTech companies in Africa raised $849.8m between 2014 and H1 2019, driven by investment in Payments & Remittances deals, with the IMF identifying mobile money as a real growth opportunity in Sub-Saharan Africa.

- Lagos-based Jumia group, a Pan-African E-Commerce platform, has been a success story for FinTech in Africa, with over 700m visitors to the platform last year. The company raised $326m of growth capital from investors such as Rocket Internet and Goldman Sachs and is currently the only tech unicorn in Africa.

- If one excludes the capital raised by Jumia, total investment in the region is still almost $320m for the five-year period, of which more than half was raised in 2018 alone, with six deals valued above $10m last year. Cellulant, a Nairobi-based digital payments platform, raised $47.5m in a Series C round in May 2018. This is the largest FinTech deal in Kenya to date and was TPG Rise Fund’s first investment in Africa.

- Almost $80m was raised in the first half of 2019 which is just under half of 2018 investment total, however with 24 transactions completed already, deal activity is higher than 2018 setting strong expectations for the rest of the year.

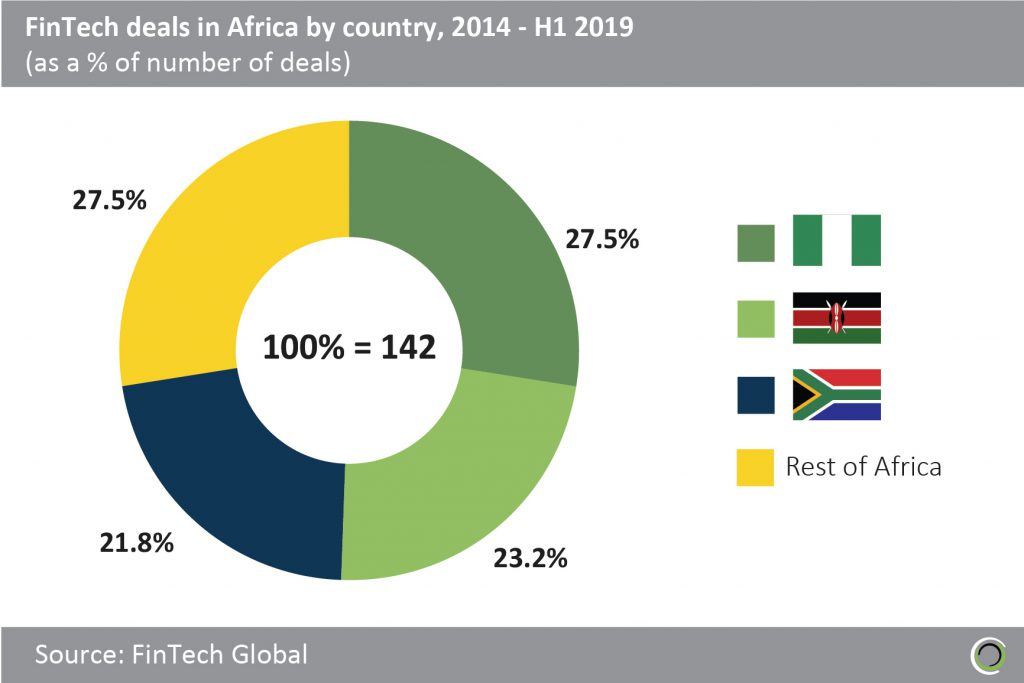

Nigeria has been the most active country on the continent for deal activity over the past five years

- There have been 142 FinTech deals completed in Africa since 2014, with FinTech companies in Nigeria capturing 27.5% of these transactions.

- Nigeria, Kenya and South Africa are dominant, having captured almost three quarters of all deal activity in the region over the past five years.

- This is to be expected given the size of the Nigerian unbanked population, the growth of Nairobi as a regional tech hub and the maturity of South Africa’s capital markets relative to other countries on the continent.

- However, the economies of commodity exporting countries like Nigeria and South Africa did contract between 2014 and 2015, as the strong USD created a bear market in oil and a tighter local monetary environment. This resulted in capital outflows from these countries in 2015, with the share of FinTech deals in other countries in Africa such as Rwanda, Egypt and Ghana increasing that year.

- MeQasa Ltd, an online property platform based in Ghana, raised a $500k seed round in Q4 2015, which was the largest FinTech deal in Africa that year outside of Nigeria, Kenya or South Africa.

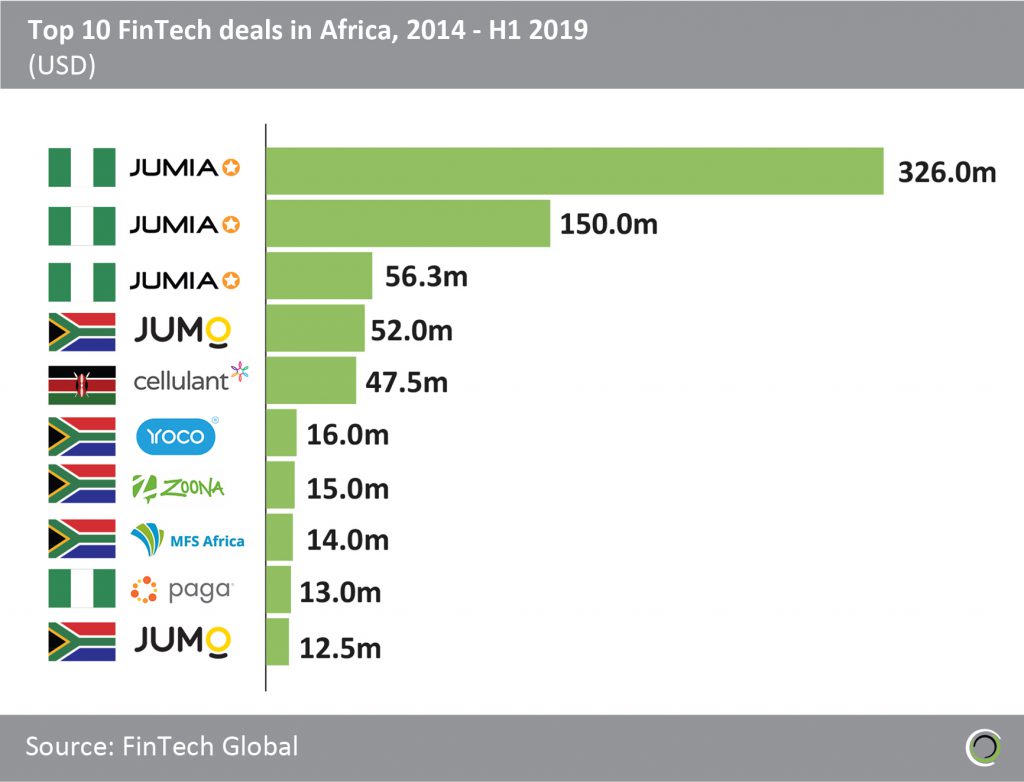

Payments & Remittances companies have been involved in all of the 10 largest FinTech deals in Africa since 2014

- Over $700m was raised in top 10 FinTech deals in Africa between 2014 and H1 2019, which is equal to 82% of total capital raised in the sector during the period, with all the top 10 deals involving Payments & Remittances companies.

- With $532m raised, Jumia Group has captured more investment than all other FinTech companies in Africa combined. The company most recently raised $56m from Mastercard before its IPO on the NYSE on 12th April 2019.

- Cape Town-based JUMO partners with banks, mobile network operators and other e-commerce players to deliver progressive financial choices to customers in emerging markets across Africa. JUMO raised $52m from Goldman Sachs, Vostok Emerging Finance, PROPARCO, LeapFrog Investments, GEMCORP and Finnfund in Q3 2018, and claims to have helped nine million consumers across its six markets in Africa.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global