Tag: asset managers

FCA sets new standards with anti-greenwashing rules

The Financial Conduct Authority (FCA) is enhancing its support for the FinTech industry by confirming new anti-greenwashing guidance ahead of its enforcement starting 31 May.

How the latest AML/CFT proposals will reshape investment advisory

The world of finance is on the brink of a significant transformation, especially for investment advisors in the United States. On February 15th, 2024, a pivotal announcement was made by the Financial Crimes Enforcement Network (FinCEN) that is set to redefine the landscape of anti-money laundering (AML) and counter-financing of terrorism (CFT) compliance.

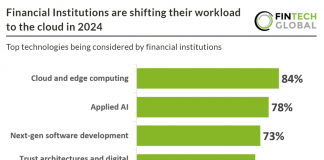

Financial Institutions are shifting their workload to the cloud in 2024

This research was derived from a 2023 survey conducted by McKinsey and The Institute of International Finance of 37 financial services companies around the...

Climate change and finance: The transition from TCFD to ISSB standards

After six years of pioneering work in climate-related financial disclosure, the Task Force on Climate-related Financial Disclosures (TCFD) has released its final status report. ESG-focused FinTech company Position Green recently explained what firms can learn from the new report.

Broadridge unveils new solution for high volume trading

Broadridge Financial Solutions, Inc. has unveiled the NYFIX Fill Matching platform, designed to address the pressing needs of asset managers dealing with high-volume and high-touch orders.

Fundpath bags £4m investment from Fuel Ventures

Fundpath, a company developing software to connect fund buyers with asset management companies, has landed a £4m investment.

Does reconciliation pose a big threat to asset and wealth managers?

A study conducted by AutoRek and Worldwide Business Research has found up to 60% of asset and wealth managers view reconciliations as the biggest challenge to their company.

Mandatory climate disclosures for financial institutions to be unveiled in New...

New Zealand has become the first country globally to pass laws requiring banks, insurers and investment managers to disclose the impact of climate change on their companies.

Risk of price bubble in ESG markets growing, BIS warns

The Bank of International Settlements (BIS) has warned of the escalating risk of a price bubble in environmentally-friendly-focused asset markets.

Banks and asset managers not yet prepared to meet climate risk...

A barometer measuring the climate risk preparedness of the global banks and asset managers has found a lot still needs to be done in terms of practical implementation.