Tag: Banks

How the world’s top banks and insurers are adopting GenAI tools

In recent years, the integration of generative artificial intelligence (GenAI) tools within the financial sector has seen remarkable growth. A study conducted by ORX, a leading operational risk association, reveals that 75% of the world’s major banks and insurers are now utilizing external GenAI applications in their operations.

Swedish FinTech apps see more downloads than incumbents from 2017-Feb 2024

Swedish FinTech apps saw a combined 21.0m downloads from 2017-Feb 2024. This means on average Swedes have downloaded two FinTech apps each (population 10.5m)....

Banks identify data as the biggest ESG challenge in 2024

As part of KPMG research, 111 banks from more than 20 countries have answered questions on their progress on and challenges with taking new...

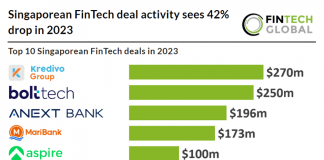

Singaporean FinTech deal activity sees 42% drop in 2023

Key Singaporean FinTech investment stats in 2023:

• Singaporean FinTech deal activity totalled at 135 transactions in 2023, a 42% reduction from 2022

• Singaporean FinTech...

91% of banks are endorsing Generative AI at board level

91% of banks now endorse Generative AI at a board level, according to a new global study by NTT Data.

Enhancing onboarding: The strategic edge in bank customer due diligence

In the competitive landscape of banking, customer onboarding emerges as a pivotal phase, with customer due diligence standing at its core. When managed poorly, the onboarding process can deter potential clients, causing banks to miss out on new revenue streams. Conversely, hasty or inaccurate due diligence could lead to the acquisition of customers who pose commercial and reputational risks, potentially incurring hefty regulatory fines.

Radian backs FinLocker with a fresh investment

Radian Group, a leading company in mortgage and real estate services, announced a strategic investment in FinLocker, a revolutionary app designed to assist in personal financial fitness and homeownership.

Kinecta partners with FusionIQ to revolutionise digital investing

FusionIQ, a leading provider of cloud-based wealth management solutions, joins forces with Kinecta Federal Credit Union in a strategic partnership aimed at enhancing digital investing services for financial institutions.

The rise of money mules in UK fraud: Prevention and detection

Fraud in the UK has become a significant concern, with 40% of crimes being fraudulent. Money muling is at the forefront, where fraudsters utilise synthetic or real mule accounts for financial gain. The UK government, recognizing the seriousness, plans to publish an action plan to combat this issue.

US banks to face tighter online lending scrutiny under updated regulations

Regulators in the US are set to tighten the screws on banks regarding which communities they serve through online lending.