Tag: crypto assets

Mintos expands its reach to France and the Netherlands

Mintos, renowned for its unique combination of alternative and traditional investment options, has announced its official entrance into the French and Dutch markets.

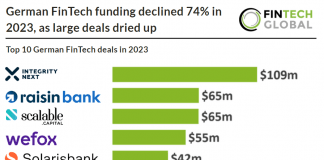

German FinTech funding declined 74% in 2023, as large deals dried...

Key German FinTech investment stats in 2023:

• German FinTech investment totalled at $911m in 2023, a 74% drop YoY

• German FinTech deal activity totalled...

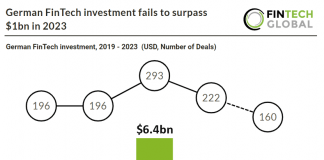

German FinTech investment fails to surpass $1bn in 2023

Key German FinTech investment stats in 2023:

• German FinTech investment totalled at $911m in 2023, a 74% drop YoY

• German FinTech deal activity totalled...

Navigating through MiCA: Unpacking the EU’s new crypto-asset regulations

The Markets in Crypto-Assets Regulation (MiCA) is setting a precedent, crafting a well-structured framework for regulating crypto-assets throughout the European Union (EU) which are not yet encased by current financial services legislations.

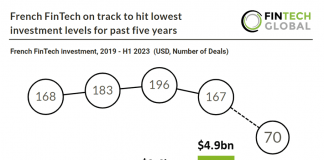

French FinTech on track to hit lowest investment levels for past...

French FinTech investment stats in H1 2023:

• French FinTech companies raised a combined $521m in H1 2023, an 84% drop YoY

• French FinTech companies...

Canada’s OSFI eyes risk management with proposed Crypto-asset guidelines

The Office of the Superintendent of Financial Institutions (OSFI) is taking strides to adapt to the rapidly changing digital asset landscape. Reflecting the shifting risk environment and emerging global patterns, OSFI is introducing modifications to its capital and liquidity guidelines for crypto-assets.

The Impact of MiCA on the EU’s Crypto Landscape

The forthcoming Markets in Crypto-Assets Regulation (MiCA) aims to standardise the regulatory landscape for crypto-assets within the European Union (EU). This is particularly significant...

EBA outlines updated measures to tackle ML and TF risks

The EBA has issued its fourth biennial Opinion on the threats of ML/TF affecting the EU's financial sector.

Traditional finance metrics prioritised over crypto-specific ones, Broadridge survey finds

A ground-breaking study by Broadridge Financial Solutions, a global FinTech leader, has uncovered that key metrics essential for comprehensive crypto asset evaluation are not the primary focus for a majority of investors. This is despite a burgeoning interest in the realm of crypto assets.

MiCA: The new regulatory benchmark for crypto assets in the European...

The world of digital currencies and assets has seen an explosive growth, prompting both opportunities and challenges for regulatory authorities. Eventus, a multi-asset class trade surveillance, market risk and transaction monitoring solutions provider, recently explained what firms need to know about MiCA.